Hello Steemians

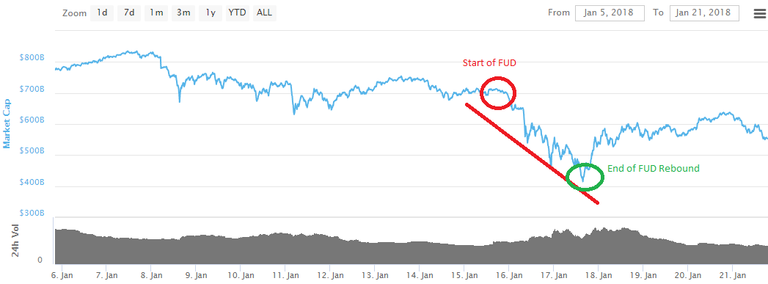

Another week comes to an end, which we can say was not too good in general. Fortunately there was an end to the big correction which started last Monday 15th and took the market capitalization to dip from ATH at USD 700 Bn to USD 429 Bn to days later on Wednesday 16th, a dip which eroded more than 200 Bn in a matter of hours.

As you may already know some unconfirmed rumors from China Central Bank sparked a huge FUD (please see my other article) which seemed not to stop right away, many media outlets claimed this to be finally the long awaited and prophetised doom of the crypto Markets, even some at reputable outlets like Financial Times even came with the cheap phrase, "I told you so".

But here we are, still breathing, with probably some 10-20% less in our portfolio if we did not jump out of the wagon when Ripple was above 3 USD each, but still on the green if we are on this before December.

Bitcoin

Though the Market recovered to be above the 500 Bn mark, we are still on uncertain levels, Bitcoin, the still to be claimed Crypto King have staggered in the 11-12K Band after rebounding from the low of 9.5K in the charts. As seen on the Chart below the steep decline was much speedy than the not as fast recover which is now taking 5 days. there is uncertainty in the markets, we suppose people is watching sidelines to see a confirmation on one of the two possible trends, either Bearish or Bullish, but this Band around 11K is not a clear signal for anybody. Volumes have decreased, though the Market participation of Bitcoin had settled in the 30% line.

It is to be seen the next week development of BTC, many doubts lie on the Crypto giant due to his expensive fees and lack of speed facing the huge amount of rising transactions.

Ethereum

Though with a large lost since the 15th to the 17th, ETH went from a close to the ATH of USD 1300 per coin to below 800, still managed to recover in a few days to above the USD 1100 mark. At the time of press was hanging above the 1000 support, same as with BTC there is no clear trend at the moment. It is to be seen if it breaks the 1150 resistance to confirm a bearish trend which could call other waiting capitals to push the train to new highs. On the market many analyst are claiming that this will be the ETH consolidation year, reaching as per some predictions 3 to 4K each.

Personally I have more faith if you want to call it that way than in BTC, there is much more consense in the Ethreum network, which can be seen by simply looking at the low amount of Forks which happened last year compared to his big Brother BTC. Still many other small cap cryptos are waiting to take the throne of the most efficient.

Ripple

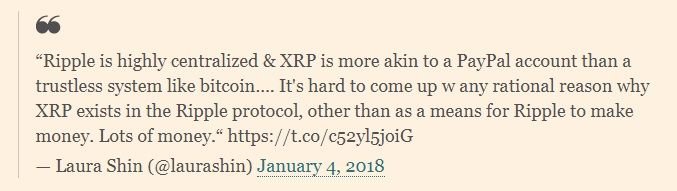

After reaching huge gains by beginning of year XRP has disappointed many investors which though that buying at USD 2 per coin was a good entry level, after touching above 3 levels, a huge jump that was not expected back in November when the sidelines price of .20ies ended abruptly to send the coin into the heaven of the cryptos. Truth is XRP is not that popular among those companies which the consortium targets, Banks and remittance companies, but is more about the technology that the company offers to those.

Though I have an small investment in Ripple I can not more than agree with the tweet that was catch by the Financial Times on the article related to the Ripple phenomenon. I agree that the valuation even at 1ish prices is insane considering how many coins are pre-minted.

If by the next weeks Moneygram or other big partner does not announce a huge step on the implementation of XRP (and not the technology sold by Ripple Inc.) as a coin I do not foresee a new crazy Bullish Market which will sell Ripple CEO and biggest XRP holder to be again the list of the richest persons in the world.

A new sideways trading in the 1.0-0.8 is more likely in the short term, until fundamentals come into play as mentioned above.

General Crypto Market

To end this quick review (though it took me a couple hours write :v ) of the crypto market for the past week, we will check how the rest of the Market is doing at the end of this Sunday.

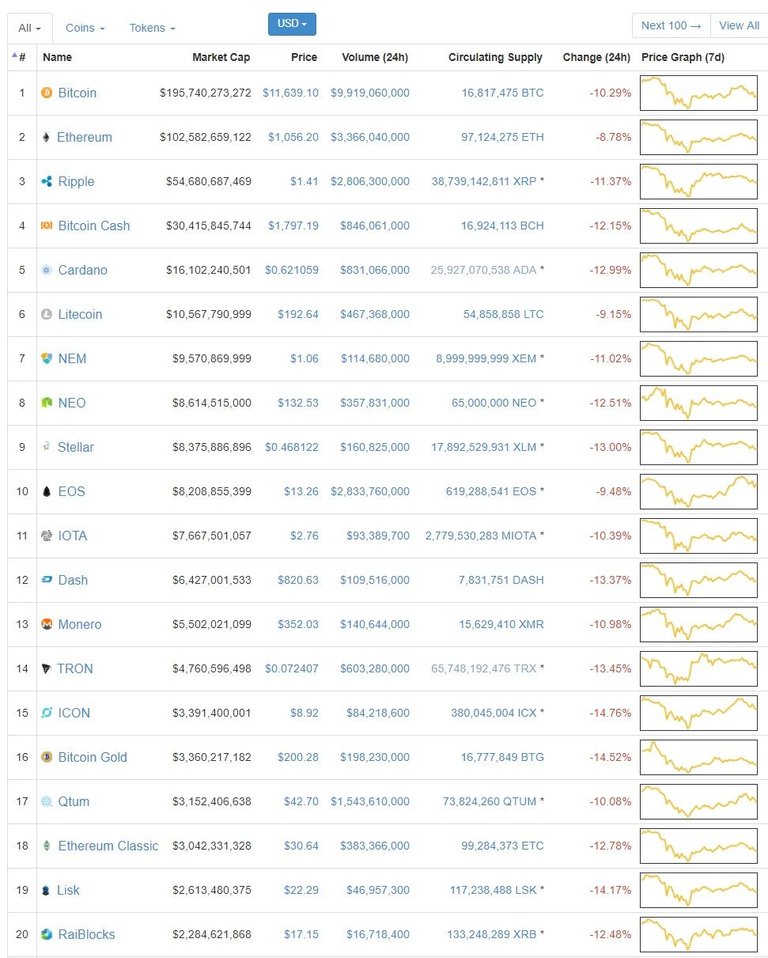

According to CoinmarketCap the Crypto Market is somehow recovered in the market cap side with some 563 Bn dollars in value, though still far from the previously mentioned above 700 Bn mark from the beginning of the week.

The top 20 shows at this time a little correction in the red of around 8 to 15% among those coins. As mentioned before there is no clear trend in the Market and it looks like the pegging of the alt coins is being confirmed over and over again, they go all up or down, like if there were no differences among them... a sign that the market is long of being mature. Probably it has a lot to do with the fact that many people is trying to make a fortune with this, but lacking the minimal knowledge on Trading, TA or Fundamental analysis, without even mentioning Psychological factors playing on the minds of the new traders.

In other related news, the ECB led by Draghi is about to hold a round of questions received from normal people which was asked to ask their questions on "Criptocurrencies and Blockchain" according to the Central Bank announcement.

After a red week, let see what awaits us on the next week, hopefully some sky rocketing profits for everybody, anyhow stay alert and informed. Wish you a great start of the week fellow Steemians

I also believe there is a close relationship between the Chinese new year and the current corrections in the market...

Indeed plucoinz, as previously mention in one of my posts there is a strong correlation between that and the general crypto price.

You got a 2.37% upvote from @minnowvotes courtesy of @santana33!

Hopefully we see some green across the board in the coming weeks...

You got a 2.16% upvote from @postpromoter courtesy of @santana33! Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

6.90% @pushup from @santana33

You got a 38.48% upvote from @votebuster courtesy of @santana33!