China Loves FUD

image rights Cointelegraph

Hi guys, after some days off the Markets blogging I come back to update you on some insights on the current situation of the Market. Another week started today to let the Bears run across the Board. Numbers are deep in the red zone with the Top 20 coins on an average loss of 15% or more.

A hint of fresh air was felt last Saturday, but thanks again to PBOC's FUD and rumors we are now back in the red zone.

China goes further into the Witch Hunt

According to an article released by the South China Morning Post, see article here, PBOC announced that they would extend the ban to foreign Exchanges and ICOs which up to know where able to gather Chinese investors from abroad. After last September announcement, many players moved offshore to continue with the operations, being Hong Kong one of the chosen off-mainland destinations.

"To prevent financial risks, China will step up measures to remove any onshore or offshore platforms related to virtual currency trading or ICOs,”

Though this time the rumors seem to have a more trustable source, we can not fully confirm the claims.

What we can confirm is that Asia reacted quite negatively to the rumors, assuming China's investors will have a hard time to be participants in the market.

What lies ahead?

The whole Crypto markets look like a guy beaten down, and who as soon wants to step up and fight again, receives a harder hit from a Gang of Banksters. I am quite sure that all these were concerted from the dark rooms of Davos, well dark symbolically talking since as shown on one of my previous posts it was done at daylight, or should I call it "Camera light?

I am a Bull on Blockchain and Cryptos, but I have to admit that I am looking for this bloodbath to leave an 80-90% of the sh*coins out of the market. At the end is a good thing, you should not expect that the only one you invested (now in last December) to be the chosen one. This is not Matrix, guys, so there is no Neo, most likely 1500 coins which are like Agent Smith. A few truly valuable will come out of the mist, as shining warriors. Which ones? Well take your bet, and maybe now that all are at a discount, diversify your portfolio and hope for the best (this means = HODL) and also be patient.

The biggest bleeder?

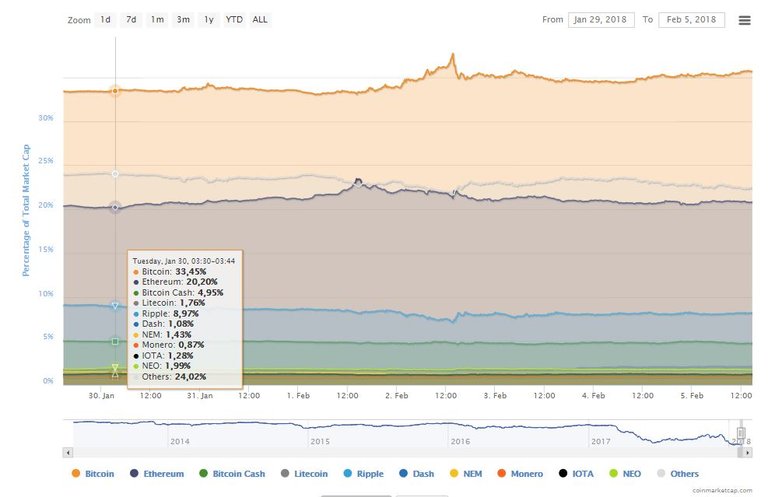

The above mentioned could also indicate that people are not yet making decisions on the next winner.

Some BTC TA

As per the graphic below on 1-hour candle, we can see that a bearish short-term trend has been confirmed again, with a new lower low of at the time of press, USD 7351 per BTC. The purple color in the back is the mid-term channel started in January, for a break up on the upside a great Market move until 9.5K should be reached. Below, with all the FUD we are not in a position to say when this will finish.

Though from a TA point of view, this should be an intraday bottom, fundamental news are keeping the market on fire. RSI still indicates an overbought both in 1 hours as in 1-day candles.

Steem lose track

As mentioned above Steem has lost all the attention and a few positions while trying to make it to the Top 20. In the day it has come from USD 4.2 to now (at press time) USD 3.28. We see a good support level in this area; if the China new FUD news is priced in, a good rebound could be seen. In case there is a further down penetration, the low of January 17th of USD 2.8 could be visited again.

On the positive side, we need to consider this is good for those new users who are looking to Steem up their Power, since the STU calculation takes into account the USD price for Steem to calculate the SP for rewards for each post. for further calculations I recommend you to use this great calculation tool from @dragosroua.

Traditional markets also on fire

Call it a coincidence, the red moon, or a so long awaited correction. Thing is the traditional markets are all on red, with numbers going from -1% to -5%. Saving the distance, we could say that 1% in the traditional markets is relatively close to a 5% in the Cryptos, so we see significant numbers eroded here. What is the impact on the Cryptos is hard to tell, unless the risk aversion sentiment impacts the same kind of traders, there should not be a correlation. From now on, we should keep an eye on it.

Haha "oh btw, traditional markets are crashing too". I noticed many traditional investors that came into the space in the past few months running back to traditional markets yesterday because there was a "sale". 60% sale > 4% sale, quick maths... Nice read, followed!

Thanks a lot for your comment. We saw today a short bull run in both markets, traditional and cryptos. Well, newbies forget they got late into the game, so now there is no place to hide. Either re-buy cheaper, close your red and change the average price, or just HODL.

Agree completely. People in it for the quick buck got rekt when it hit mainstream meadia, and those that didn't get out already have a forced hand. People with skin in the game longer than even 6 months were expecting some type of pullback long before the 20k high was reached.

Indeed, I was expecting a nice pullback, unfortunately was on holidays on the peak, when I saw 20K I knew it was going doooowwwwn for real, but could not close my positions. Anyway I got the chance to re-buy some coins at a huge discount. The rebounce will take longer I believe, but is coming, we are here for the long term.

Resteemed by @xtdevelopment! Good Luck!

This resteem was paid by @nanocheeze

Curious? Then read our introduction post

Get more with the #NanoCheeZe initiative

Very good post... You are mostly correct I think and it all leads back the banksters.... This is a planned collapse. Very carefull executed... I just posted an article about it. I don't normally spam my own comments in others, but I felt hey are connected so I will share it....

https://steemit.com/bitcoin/@nanocheeze/the-bitcoin-selloff-it-s-a-trick-by-the-big-bankers-don-t-be-deceived-price-is-about-to-dip-below-usd7000-usd-don-t-get-played

I do disagree with the shitcoin comment though, but only depending on which altcoins you consider shitcoins, because sidechaining and atomic swaps will make all chains equally valuable to a certain degree.... versus what they are now anyways... point being, altcoins will JUMP in price once sidechaining is out.. Look up rootstock

Thanks for the comment, do not worry I agree that is good to lead common readers to quality related material, it also makes the point on same or different views easier for those looking for perspectives. My believe is that 90% are sh*tcoins, since many have no prototype, no proper team, a bunch of rookies who went millionaires overnight and lost track. I really hope them to fail, since it will make the ecosystem more reliable for proper investment, just take as an example Tezos, Bitconnect, and many ponzi schemes. I do believe altcoins will be more valuable than BTC in the future from a utilization perspective.