Don't get trapped where there is no liquidity

Volume is a total measure of transactions in a given time period of a specific equity or asset. Direction is almost irrelevant, as when we look at it from a transactional perspective, buying or selling pressure represents, one thing, volatility. The ideal is to not get caught where the transactions are forcing downward momentum, but the most important aspect is liquidity.

Low volume - low transactions - creates a situation where it may be near impossible to exit a position with out taking a significant loss, leaving some on the table or entering a position where you may pay a premium for your balance. The worst case scenario in low liquidity environments would be that your sell orders causes the equity or asset to crash or sink lower, in which case you can't get out without taking more losses. In fact a large order may scare off the potential buyers. It is absolutely imperative to remember for every seller, there must be a buyer.

Liquidity of an asset as defined by Investopedia

Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset's price.

Market liquidity refers to the extent to which a market, such as a country's stock market or a city's real estate market, allows assets to be bought and sold at stable prices. Cash is the most liquid asset, while real estate, fine art and collectibles are all relatively illiquid.

To give you an example of liquidity risk: on August 1st bitcoin underwent a hardfork and leading up to the event, individual investors were pulling their funds off of exchanges en masse to put them in cold storage. Going into that event I had a bearish lean simply for this reason as the asset became illiquid from the chicken little mentality. I was still greatly exposed to BTC and willing to weather any storms and then buy the dip - fortunately for everybody there was no real storm, just a price peg, but one large sell order could havej just as easily crashed the price.

A practical example

An individual I know was trying to liquidate crypto holdings through a relatively new service. They needed the money to live and so it was time to sell their long term holding. Their initial order only got a partial fill as the sheer volume crashed the price because the asset was to some degree already illiquid.

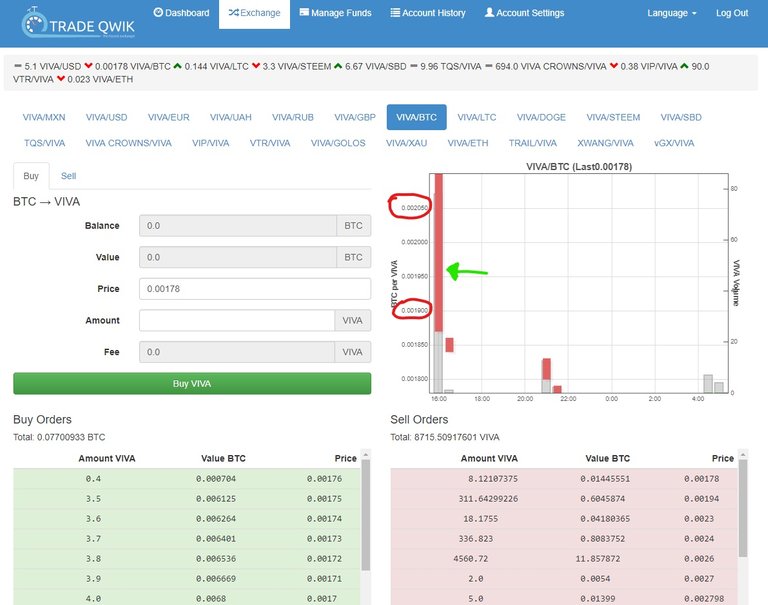

Demonstrated in the volume chart, that giant red candle, was them. Their order dropped the value of the asset by 7% from 0.002050 BTC to 0.0019000. Aside from the fact that this would have scared off potential buyers, to continue selling, would have drive the price down further, they would have been taking considerable losses.

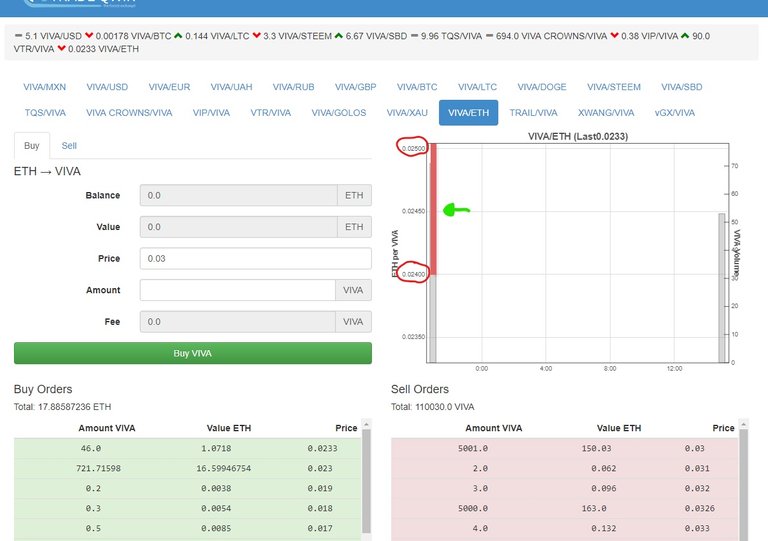

...So in order to help them liquidate the remaining holding without taking anymore losses that were significant we scanned through the potential options and landed on selling into Ethereum.

Just selling half of the remaining holdings dropped the price by 4% - wow. We still had half to go and so this is where it was essential that we intelligently scan the order book to meet the scale of this individuals sell order, we needed to ensure a full fill on the next sell.

We could have nickled and dimed, and perhaps because of the low liquidity gone as far as manipulated the price - manipulation is unethical and in normal asset and equity trading it is illegal - the goal was just to get out as unscathed as possible.

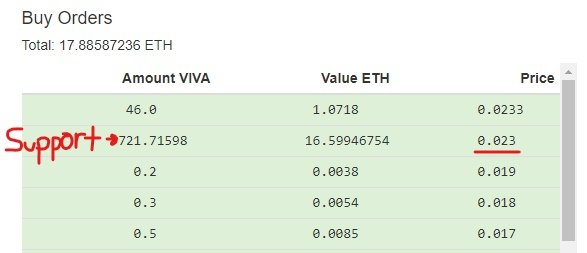

In reviewing the order book we noticed a large buy order, second to the top, an area of support. We used this to enter our sell order and in doing so we also captured the above price point. The individual still took a loss, but the risk of not selling below bid was that that support could disappear and then there is no predicting what that would do to the price.

Long story short we managed to get them out of the position without taking further losses. I was glad to be able to help the individual out of a tricky spot, but this is a clear, real world example of why novice investors and traders should only buy where there is volume as volume is liquidity. Don't chase shit coins, buy the stalwarts and the same rings true in traditional equities and asset trading in the stock market.

Nice write up @satchmo .

I'm happy you finally decided to write something about the Fappening and the importance of buying and selling at the appropriate times.

You also brought light to a very important factor in which we have talked about before in chat, the ramifications on the market from large buy/sell orders and predictable human nature in crypto trading.

Up-Yunked.

thanks much! This is why i only trade where the volume is

Gotta have volume and gotta have transactions happening... slow money don't make money 😉

Super useful info, wish I'd known this back in 2014... :O

Great post! Really gets you to understand a key factor in trading!

Thanks!

quite welcome Ace!

Hey @satchmo I like your formatting. I looked at steemd and I learned you can use more than one quoting level. I also opened the images in a new window or tab to see it better and I was surprised that it resizes automatically. Neat.

Great story, personal and good technical background, simple to understand! Thumbs up! :-)

Thanks! My Goal its to help shed light on intricacies and nuances of trading! A little bit of experience shared can help save someone a lot of stress and in this case money! Much appreciate your comment.

Hey thank you, I sort of knew this but I didn't know the details. that part with the candle was quite eye opening. Connecting the dots one dot at a time.

click here!This post received a 2.8% upvote from @randowhale thanks to @siragrays! For more information,