In my last post, I described the properties of a consensus algorithm and how Bitcoin implements Proof of Work. If you're new to Cryptocurrency and want to know more, I'd recommend to check out my last blog post:

In this post, I'd like to write about the economics of Bitcoin mining. I'll do so by explaining the different factors that influence the profitability as well as how these factors depend on each other. All statements are based on actual data retrieved from the Bitcoin blockchain as well as from https://blockchain.info.

Image by LauraTara - Source: Pixabay.com

Introduction

The concept of Bitcoin mining seems rather simple on first sight and lot of its complexity is only revealed by a closer look. It is a continuous balance of Price, Hash Rate, and Difficulty. Each of which changes under different conditions, influencing the other. Making mining a very uncertain venture, that is extremely hard to predict. And yet, mining seems to be profitable for a lot of miners. Leading to some fundamental questions that I'd like to answer in this post:

- How is the profitability of mining calculated?

- What is an efficient mining setup, and why is it important?

- What is the influence of Price, Hash Rate, and Difficulty?

- What happens if the Price of Bitcoin changes significantly?

- What happens if the Hash Rate changes significantly?

- How is the Difficulty determined?

One thing all these questions have in common is the fact that they define the profitability of any mining operation. Like with many other things, the easiest way to put this is: If the reward is bigger than the effort, mining is considered profitable. And: The effort always strives towards the reward.

The anatomy of a Mining Setup

Before talking about the reward, I'd like to start with the effort that needs to be taken. The effort can be considered to be anything related to the setup and operation of your mining equipment and consists of:

- Mining Hardware

- Housing

- Rackspace

- Electricity (For Mining Hardware & Cooling)

- Labor costs (Installation & Maintenance)

- Pool Fees

The total of these expenses must not exceed the reward, thus making efficiency crucial. Minimizing costs for Mining Hardware, Housing and Labour Costs maximises the margin and provides a competitive mining setup in the long term.

Effort in $

Let's assume we have a setup of one Antminer S9 from Bitmain. This provides specific numbers and makes the matter more tangible. The Antminer S9 has a list price of $ 1'450.- and offers a hashing power of 14TH/s with a power efficiency of 0.098 W/Gh.

Mining Hardware

The first thing that needs to be taken into account is the price of the mining hardware. The price depends on supplier, country and quantity and takes a high influence on the number of days needed to break even. Besides the hardware itself, it's power efficiency is another aspect to be taken into consideration. The most efficient mining hardware usually has its price. Requiring a tradeoff between the costs of electricity (Operational Expenditure) and the costs of Mining Hardware (Capital Expenditure).

Image by Reisefreiheit_eu - Source: Pixabay.com

Mining Operation

Mining operation considers all expenses for housing (Rackspace, Electricity (Mining & Cooling)) as well as labour costs. In our example, we assume electricity costs of 0.1$/kWh and neglect labour costs as well as costs for rack space and cooling. The power consumption of 1372 Watts, results in daily power costs of $3.29. Since "solo-mining" isn't possible anymore, we're required to join a mining pool. A mining pool is a collective of miners, working together and sharing the block reward relative to the hash power each miner provides. The expenses of the mining pool are paid in the form of a fee, which we assume to be 2% in our case.

Reward in BTC / $

After we had a look at the effort side of the equation, let's have a look at the reward. The reward for processing transactions and securing the network (mining) consists of two components. The first component is the so-called Block Reward (Created Bitcoins - currently 12.5 Bitcoins/Block). The second component is the transaction fee for all transactions processed in that block. Having 14TH/s of hashing power, the Antminer S9 would be rewarded with 0.00100266 Bitcoin/Day or $6.83/Day at the current exchange rate.

Reward Summary

The setup described above as well as the current Bitcoin price of $6'542.-/Bitcoin result in a break even after approximately 432 days and the estimated reward listed in the table below:

| BTC/Day | USD/Day | Power Costs/Day | Pool Fees/Day | Profit |

|---|---|---|---|---|

| 0.00100266 | $6.79 | $3.29 | $0.14 | $3.36 |

The numbers indicate a profit of $3.36/day. This represents the margin that can be achieved under current conditions. It is a very simple but also rather unreliable way of calculating mining profitability and can be done, using a calculator like to ones listed below:

The reason these calculators are unreliable is that they don't account for the change of Price, Hash Rate and Difficulty over time.

Accounting for Change over Time

Things tend to become very uncertain if we try to account for the change over time of either Price, Hash Rate or Difficulty. Each is influencing the calculation, pushing inefficient setups out of the competition.

Price over Time

If we take our example, Bitcoin's Price is one of three factors. It is highly volatile and has a huge impact on the reward but also on the incentive of new miners to join the playground.

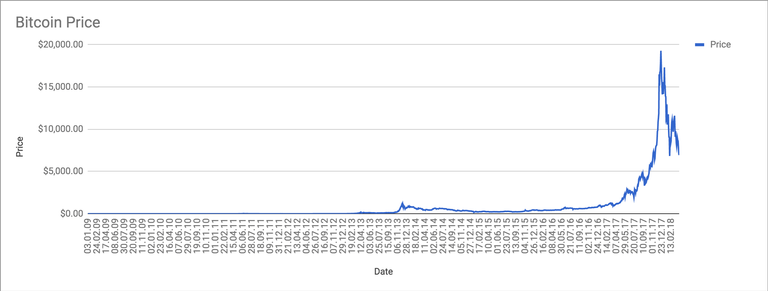

blockchain.info.All-Time Price Chart - Bitcoin. Created by @sblue, based on information from

If we take the same calculation but assume the price to be $14'000.-/BTC, the number of Bitcoins mined per day doesn't increase, but the reward in $ is significantly higher:

| BTC/Day | USD/Day | Power Costs/Day | Pool Fees/Day | Profit |

|---|---|---|---|---|

| 0.00100266 | $14.04 | $3.29 | $0.28 | $10.46 |

A high reward regarding the $ value incentivises new miners to join the operation and explains why we often see increasing hash rate correlating with increasing price.

Hashrate and Difficulty over Time

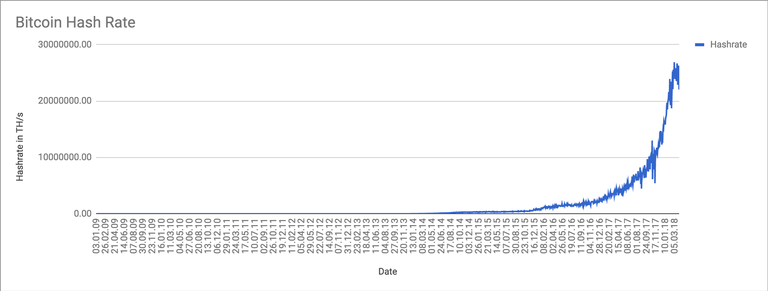

Whenever the price of Bitcoin incentivises new miners to join the playground, it increases the Hash Rate and decreases the time between blocks.

blockchain.info.All Time Hashing Power - Bitcoin. Chart created by @sblue, based on information from

Although the increased Hash Rate has a negative impact on the relative amount of hash power our Antminer S9 can provide, it also decreases the block time. This is why the change of the Hash Rate only has marginal effects on the profit. Unfortunately, effects are only marginal until the difficulty is adjusted to meet a block time of 10 Minutes again. This happens every 2016 blocks, approximately every two weeks. Meaning that increased price leads to increased hashing power which will lead to increased difficulty after a maximum of 2016 blocks.

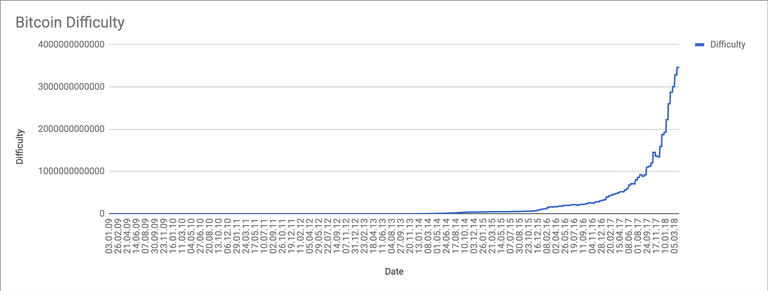

blockchain.info.All Time Difficulty - Bitcoin. Chart created by @sblue, based on information from

The increased Difficulty caused by increased Hash Rate the profitability significantly. The table below shows the impact to profit for the current Bitcoin price of $6542.-/BTC and a difficulty adjustment of +5%, compared to the value used before.

| BTC/Day | USD/Day | Power Costs/Day | Pool Fees/Day | Profit |

|---|---|---|---|---|

| 0.00095491 | $6.25 | $3.29 | $0.12 | $2.83 |

The profit of our mining setup just fell to $2.83. Under stable conditions of hashing power and difficulty, the mining operation described in this post would become unprofitable if the price of Bitcoin would fall below $3500.-/BTC.

Survival of the fittest

Now that we know how Price, Hash Rate and Difficulty can affect the profitability of our mining setup it is time to talk about efficiency and why it is important. Since price is subject to volatility and influences the total Hash Rate which influences the Difficulty, every miner is participating in an ever-changing ecosystem.

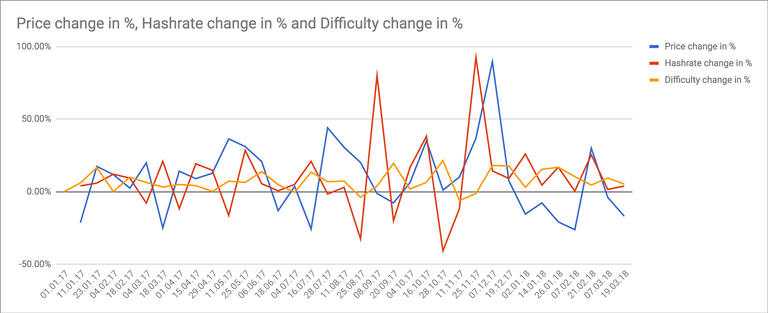

blockchain.info. The chart shows the correlation of Price, Hash Rate, and Difficulty. The change in price is followed by the change of Hash Rate, while the change of Difficulty follows inertially.Bitcoin Price, Hash Rate, and Difficulty since 01.01.2017. Chart created by @sblue, based on information from

If the price either falls or rises, the Hash Rate will follow and so will the Difficulty, which is adjusted every 2016 blocks to sustain a block time of 10 Minutes.

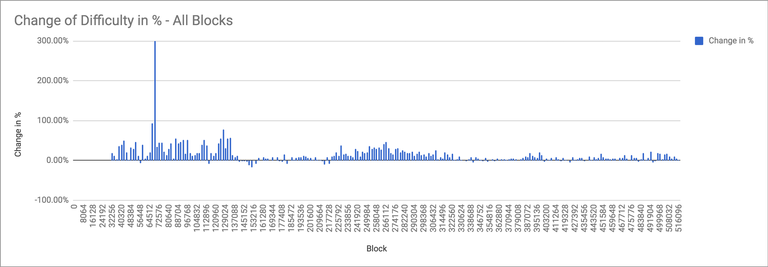

blockchain.info. The chart shows the difficulty adjustment in %, compared to the previous block. It lists every 2016th block, thus shows every adjustment to difficulty ever made. In most cases, Difficulty is adjusted up, but the chart also shows the rare cases, where difficulty had to be adjusted down.All Time Difficulty Adjustment - Bitcoin. Chart created by @sblue, based on information from

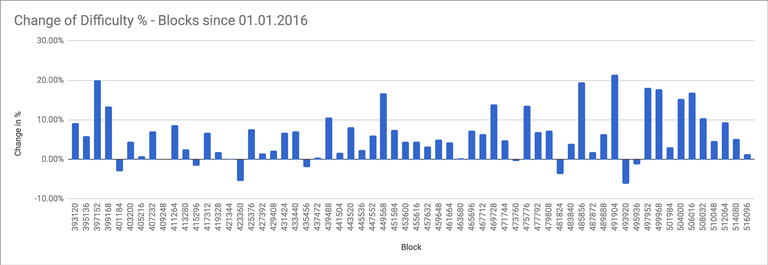

blockchain.info. The chart shows the difficulty adjustment in %, compared to the previous block.All Time Difficulty Adjustment since 01.01.2016 - Bitcoin. Chart created by @sblue, based on information from

Under the conditions of a declining Price or increasing Hash Rate / Difficulty, inefficient setups (with the lowest profit) will render unprofitable first. Since there's no incentive to run an unprofitable mining operation, it will be the inefficient setups that are pushed out of the market first. Leading to an adjustment of Hash Rate/Difficulty and ensures profitability for the most efficient setups. Therefore we can assume, that even without the block reward and miners only earning profits from fees (approx 1% of today's total profit), the most efficient mining setups will remain in operation and continue to be profitable. Although it is almost impossible to determine the reward that only consists of fees, history shows that the numbers always follow and adjust according to their environment. We can be certain that there will always be a profit for the most efficient setups. Furthermore, the reduction of the Block Reward that happens every 210'000 Blocks will gradually shift the rewards from Block Reward & Fees to Fees only.

Conclusion

Independent of the reward calculated under current conditions, you should always be aware of the fact that only the most efficient setups will remain profitable in the long run. In times of a falling price or increasing hash rate, you're competing against all other miners in the world. Unfortunately, efficiency is mostly dependent on local conditions and size of the setup. Local conditions define the costs of electricity or rent, but also influence the amount of power you need for cooling. Substantial mining farms are often either located in cold areas or close to cheap sources of electricity. Ideally both. The size of the setup refers to the fact that it will always be cheaper to buy vast quantities of hardware than short ones. These factors facilitated the creation of significant mining farms in favourable locations, making it very hard for a one-man mining show to remain competitive. At least you can neglect labour costs as well as the costs for cooling and housing when only running a setup with a single Antminer. Leaving some chances to run a small, profitable mining operation. The only thing you shouldn't forget is that these things are pretty noisy, so having one in your living room might not be the best idea.

I hope I was able to give you an overview of how mining profitability can be determined and could provide an insight into the different aspects that influence the equation. Furthermore, I hope you can now decide yourself, whether having your own mining setup would be profitable or not. If you have any questions, feedback or input, please leave a comment below.

Thanks for reading and have a great day!

Sources and Additional Information

- Bitcoin.org - Bitcoin Whitepaper

- Bitcoin.org - Open source P2P money

- GitHub.com - bitcoin/bitcoin: Bitcoin Core integration/staging tree

- Bitcoin Wiki

- Bitcoin Wiki - Controlled supply

- Bitcoin Wiki - Comparison of mining pools

- Books – Andreas M. Antonopoulos

- Blockchain.info - Bitcoin Block Explorer

- Bitmain.com - Asic Bitcoin Mining Hardware From Bitmain

- CoinWarz.com - Cryptocurrency Mining Calculators and Profit Calculators

- Cryptocompare.com - Mining Calculator Bitcoin, Ethereum, Litecoin, Dash and Monero

- Bitmain.com - Antminer S9

- Bitcoinmining.com - Bitmain Antminer S9 Review All You Need to Know

- CoinMarketCap.com - Cryptocurrency Market Capitalizations

- Pixabay.com - Stunning Free Images

- Steemit.com/@sblue - Proof of Work - Sudoku on a planetary scale!

- Steemit.com/@sblue - WTF is Money? And why Bitcoin is more than just a currency.

- Steemit.com/@sblue - What is Bitcoin? - When Money becomes a content type!

- Steemit.com/@sblue - What is Git / Github? - The 3 minute journey through Bitcoins GitHub history

- Steemit.com/@sblue - Introducing Crypto-Puzzles

Congratulations! This post has been chosen as one of the daily Whistle Stops for The STEEM Engine!

You can see your post's place along the track here: The Daily Whistle Stops, Issue #95 (4/5/18)

The STEEM Engine is an initiative dedicated to promoting meaningful engagement across Steemit. Find out more about us and join us today.

Thank you very much @thesteemengine! Again, it is an honour to be chosen as one of the daily Whistle Stops!

Great post! Profitability of Bitcoin mining is definitely not an easy topic to cover. I'm running three Antminer S9s, and one Aintminer L3+. The monthly profit when compared to the energy costs and mining pool fees always looks great, but the ROI on the actual hardware, is where things get fuzzy. Difficulty aside, the volatility of the market, makes it hard to predict when you will break even! Only reason I justified the hardware costs of the ASICs, was because I paid for them using some major cryptocurrency profits made in 2017. It was my way of diversifying from day trading, to day trading and mining.

Hey @syntacticsugar! Thanks for your reply, I'm happy to hear that you liked my post. Indeed, ROI is very tricky to predict. Having so many moving parts and variables doesn't help the ROI calculation. I think you chose a very interesting way to diversify. I'd have done the same if I had some place where I can put the miners. But living in a flat, the noise is a real problem 😅. I hope your monthly profits keep looking great and that you eventually break even. I wish you success with your mining venture. May it fund another trip to Disney World 😎👍

I admit I don't know as many things about bitcoin as I would like to.

I am still hoping that the Proof of Stake will take over as it will be better for the planet overall and the security is still pretty good.

Great post again! Thanks for contributing!

Hey @alexdory! Thanks for your reply, I‘m happy to hear that you liked my post! If you‘d like to read more about Bitcoin and how it works, you came to the right place! 😎 I guess I‘ll stick to Bitcoin for my next posts, before moving on to other projects like Ethereum (Smart Contracts) or Steem (Delegated Proof of Stake). Next stop the 51% attack! 🤓 I like the idea of proof of stake/alternative consensus algorithms and also see environmental advantages. Although, from an economic point of view, the situation stays the same: Effort strives towards the reward. I‘m very curious to see what people will come up with in order to maximize their share of the reward. Steemit/Steem serves as a good example of how this can play out, with all the good and bad side-effects. I‘m definitely going to have a closer look and will share my insights once I covered all the aspects of bitcoin that are still on my to-do list :)

Thank you for taking the time to research and write about this. Too often, many people look at mining as an extremely lucrative way of making additional income. Even I was under the impression that you could make a lot money from mining. However there is so much more to understand and look at, though I guess if you are tech person it is a lot easier to understand. Learning more about crypto and blockchain everyday.

Hey @khimgoh! Thanks for your reply. I‘m happy to hear that you liked my post. Indeed, mining is more complex and less profitable than most people think. I believe that a lot of shady cloud mining services took advantage of the fact that people consider mining super profitable and promoted that idea even further since it serves their business. I absolutely agree that it helps to have a background in tech/computer science when getting into crypto. I think another advantage would be if you’re already familiar with trading and finances. I’m lucky enough to have a degree in computer science and it helped me quite a lot and sort of gave me a head start. I can only imagine how people with no background in computer science or finance/trading must feel when getting into crypto.

Your post was mentioned in the Steemit Hit Parade for newcomers in the following category:Congratulations @sblue!

I also upvoted your post to increase its reward

If you like my work to promote newcomers and give them more visibility on Steemit, feel free to vote for my witness! You can do it here or use SteemConnect

Hey @arcange! Thank you very much for your reply and the mention in the Steemit Hit Parade for newcomers! I like the idea and appreciate your work and support for newcomers on Steemit, thank you! 👍Since I have some spare slots on my witness list, you got my vote! Keep it up!

Thanks a lot for your support. Steem On!

Great research!!

Thanks!

G'day @sblue! Nice post, i really like this one. I will also resteem this. Thank you for posting.

Hey @natasha98! Glad you liked it and thanks for resteeming! 👍

Resteemed to over 17100 followers and 100% upvoted. Thank you for using my service!

Send 0.200 Steem or 0.200 Steem Dollars and the URL in the memo to use the bot.

Read here how the bot from Berlin works.

We are happy to be part of the APPICS bounty program.

APPICS is a new social community based on Steem.

The presale was sold in 26 minutes. The ICO is open now for 4 rounds in 4 weeks.

Read here more: https://steemit.com/steemit/@resteem.bot/what-is-appics

@resteem.bot

Coins mentioned in post:

Congratulations @sblue! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last announcement from @steemitboard!

Thanks for your beautiful comprehensive analysis of the evolution of this beautiful animal @sblue. I guess next thing will be colorful 3D expressions depicting change over time of all the different variables!

Your work certainly is a great contribution toward us lesser beings in this realm gaining insight under the hood. Thanks again. Your mention that conditions can be such that negative adjustment of difficulty is induced also deepens my respect for the overall design...

This post was resteemed and upvoted by @anupbose and @apukb for Upvote and Resteem to 1,753+and 1012+ Followers Send 0.100 SBD or STEEM to @anupbose with URL in the Memo thanks to @sblue for using my service.

This post is resteemed and upvoted by @bestboom

Very nice post, here is an article that may add more basic understanding for people wondering about the price movement https://bitcoinbuyersguide.com/supply-demand-how-the-price-of-bitcoin-moves/

Criteria To Consider Before Choosing The Best Crypto Exchange.

Read the full Article here: https://bit.ly/2NrYAyp