With all the news of adoption and mass appeal, people need to remember that despite Bitcoin price breaking $10,000, less than one percent of the world’s population actively uses it. There is a lot of noise around the digital currency, but it is still a small fish in the global economy.

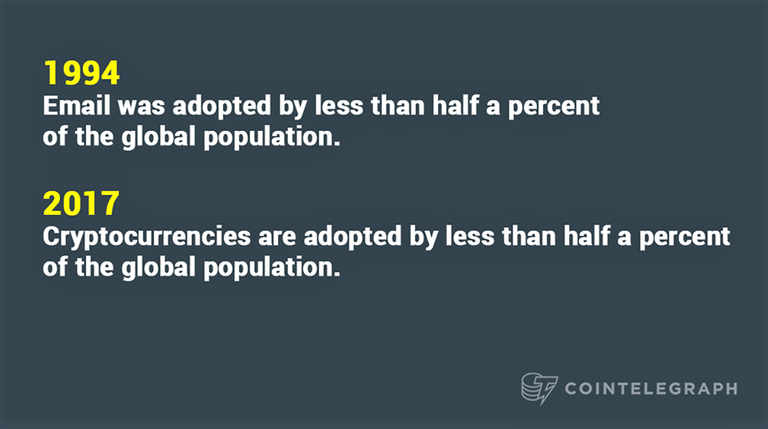

Many have likened Bitcoin to the dotcom bubble, waiting to burst as people throw money at it like the companies back in the emergence of the Internet. But Bitcoin is not a company, it is a technology, and it sits on the precipice like email did in 1994.

The Killer App

Back in 1994 email was globally adopted by around 0.25 percent of the population. However, it was invented in 1972 by Arpanet engineer Ray Tomlinson. It was, for a very long time, the only ‘killer application’ for the Internet.

It all sounds quite familiar. Bitcoin, invented in 2008, was mostly a toy for tech geeks and anarchists who saw a revolution in money as the global economy collapsed. But it was just a hobby, nothing else.

Then, as it gained momentum, it became the only ‘killer app’ for the Blockchain, and dominated that space for some while by itself.

Making the jump

In order for email to move from being more than just a toy for techno geeks into the space of mainstream commercial and retail use, it needed to tick three boxes.

The technology itself had to develop so far that it was standard and stable and of course useful to users. It had to be made approachable and the User Interface had to shift to be accessible to the every-man. And, finally, the user base needed to grow as that in itself gave email its value in a virtuous cycle.

Bitcoin’s path

The early similarities between email and Bitcoin are there. But it is when you start to plot its adoption graph that you note more similarities. 2013 had signs of adoption as Coinbase did a lot to open the market up with easy access and a good interface for any user to understand and use Bitcoin.

But, there was still a lot of technological issues that needed to be solved. Problems like an unintentional hard fork, few user-friendly interfaces, and a minimal network effects, all dogged Bitcoin’s growth and adoption.

That has changed now, in 2017, as even the so-called ‘civil war’ is over and the protocol has proved steady in the face of most technological gremlins.

User interface and ease of use is so through the roof that elderly mothers and grandmothers can use wallets and access their Bitcoin, and even more so with the announcement of ETFs, Futures, and even ATMs.

And finally, Bitcoin, of course, provides value, it is literally a store of value, but it is also a disruptive technology that is challenging the hegemony of the banking system and freeing many people from their chains of debt.

Bitcoin entrepreneur Erik Voorhees said, back in 2014: “We still have a very long way to go in absolute terms," in response to the idea that Bitcoin was already breaking into the mainstream back then. It was worth $340 to $530 in April of that year.

Voorhees added: “Both the Internet and PayPal had a long period where people heard of it and sort of knew what it was before they really tried it out."

Previous Bitcoin Foundation Executive Director Patrick Murck said back in 2014 as well:

"Blockchain-based products are starting to emerge that solve real problems for people, that will drive adoption and grow the pie for the whole Bitcoin community."

Really, there has been a jump from 2014 to 2017, and relatively it is large. But in terms of globally, it is not even noticeable.

Added to my follow list. Keep up the good work and what do you think of the current market?