Cryptographic money markets are at last hinting at life subsequent to persevering through a troublesome begin to the year that wiped $120 billion from the market in recent days, dragging it down from $590 to $470 billion.

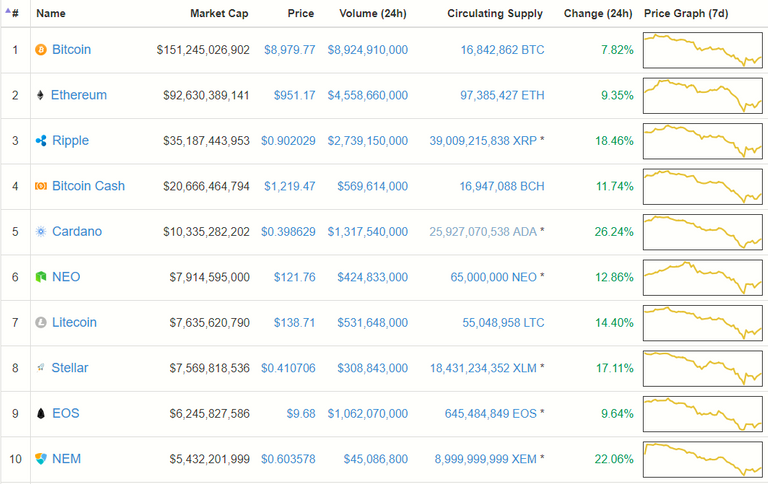

At the season of composing, Bitcoin was up right around 8 percent to just shy of $9,000 in the course of the last twenty-four hours, as per coinmarketcap. The biggest digital money, speaking to right around 35 percent of the aggregate estimation of the digital money market, had tumbled to as low as $8,369 just yesterday, a 17 percent drop in just a day. Having moved toward unequaled highs of nearly $20,000 in December a year ago, Bitcoin's emotional slide saw it sequentially rupture basic backings levels of $15,000, $12,000, and at last sneaking by $10,000. The present market developments give some alleviation to the attacked money.

Ethereum is up very nearly 10 percent to just shy of $1,000. Ethereum saw its unsurpassed highs on January tenth, on occasion an uncommon green spot in an ocean of red for the more extensive market in January. As the blood kept on spilling, in any case, it turned out to be resistant to the extreme rectifications in the crypto market, plunging underneath $800 on two events.

Having about divided from its record-breaking high market top of $653 billion in mid-December amid the present droop, crypto investors are at long last getting a charge out of some alleviation. In spite of the fact that it stays to be seen whether late picks up can be supported.

The market has confronted various headwinds as of late. Korea at long last settled on forbidding mysterious exchanging toward the finish of January, following quite a while of theory that it was set to boycott cryptographic money exchanging and maybe even computerized monetary standards themselves. The Korean choice was a help to numerous speculators, as it constitutes the third biggest market on the planet.

Just two days back, Indian Finance Minister Arun Jaitley delineated the administration's position on digital currencies, declining to acknowledge them as genuine methods for paying for products and ventures or as lawful delicate:

The Government does not think about cryptographic forms of money as lawful delicate or coin and will take all measures to dispense with the utilization of these cryptoassets in financing ill-conceived exercises or as a feature of the payments system.

On January 26th it was accounted for that the Tokyo-based trade Coincheck had been hacked, with $530 million worth of NEM stolen. To the daunt of many, Coincheck let it be known neglected to bolt away a large portion of its stores in frosty wallets, refering to troubles in doing as such. It likewise neglected to execute NEM's multi signature brilliant contract framework, an extra layer of security. The hack was the biggest in digital money history.

On January eighteenth, CBOE's first Bitcoin prospects contracts settled at $10,900, with bears winning abundantly. The cost of Bitcoin tumbled with the news. With fates contracts turning into the main chance to short cryptographic forms of money, numerous stressed the new monetary instruments and Wall Street would negatively affect the market, with retail investors whiplashed around by showcase powers they scarcely comprehended, not to mention being furnished to rival them.

On Monday January 29th it was accounted for that Bitfinex and its reviewer Friedman LLP had disjoined ties. The eagerly awaited review was important to the crypto group, as contention mounted around the issue of whether Tether, the USD-sponsored token that had achieved a market top of $2.3 billion, was really upheld by fiat money resources.

As Bitfinex declared there would be no review discharged, in any event for the time being, it was accounted for that Bitfinex and Tether, the organization behind the namesake computerized token, had been subpoenaed by the US Commodities Futures Trading Commission (CFTC) on December sixth.

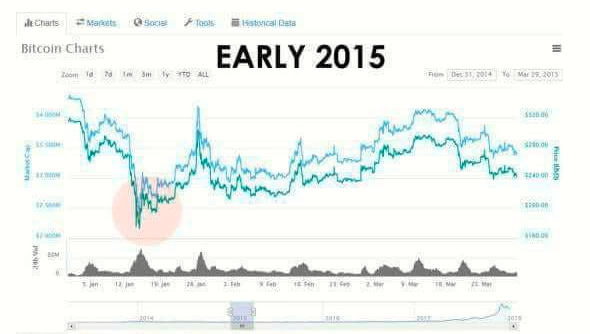

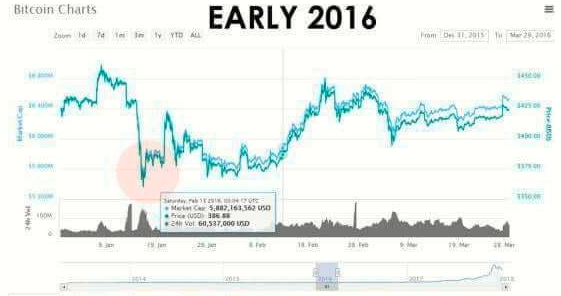

January has been a bearish month for digital forms of money consistently since 2015. Numerous credit that example to Asian market offer offs with investors liquidating out for Lunar New Year.

This year, be that as it may, it appears the market had significantly more issues to battle with. We should trust the present respite accumulates energy and reestablishes some certainty among crypto fans.

That's a very interesting position, we don't need governments to tell us what we can and can't do. They don't have the power to tell us what money is or is not.

Also if that is their position on Cryptos then don't tax people on them.

Lets all stick together and accept Cryptos between each other and tell the governments to take a hike.

Appreciate your thoughts but Tax is other issue. Tax will be deducted when people let the government know about their cryptocurrency earnings. Cryptocurrency could be used in money laundering, and money laundering is threat to every nation's wealth. That is why goverments wants it to be regulated by some authority. And secondly cryptocurrency could be used in whitening black money. That is why governments don't want it to be legalised.

Coins mentioned in post: