Toward the beginning of April, Bitcoin energized about $1,000 in a matter of somewhat more than 60 minutes. The amazing development was sufficient to drag the whole crypto advertise with it, including any semblance of Ethereum, Swell, and Litecoin.

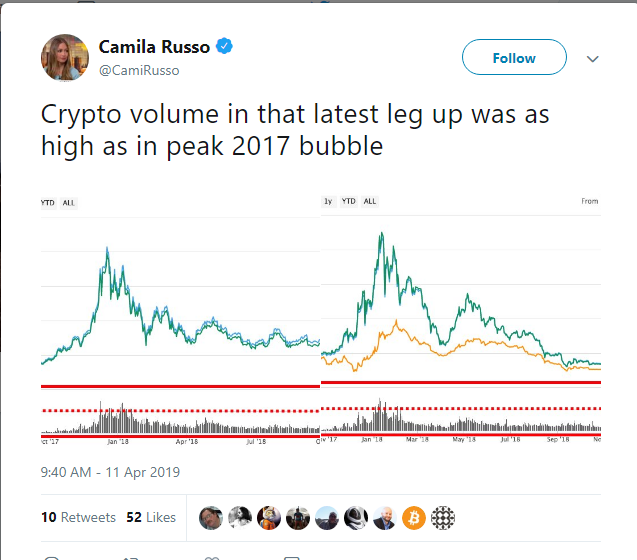

The rally, which many accept affirm that the bear advertise base is currently in because of the first historically speaking digital money painting a higher high on value diagrams, saw so much exchanging volume crosswise over Bitcoin and Ethereum, that volume achieved levels not saw since the pinnacle of the last cryptographic money positively trending business sector.

Is The Bull Kept running Back? Bitcoin and Ethereum #Exchanging Volume Return to 2017 Dimensions

As far back as Bitcoin's allegorical development was broken at the last part of 2017, its unsurpassed high of $20,000 has turned into ancient history, and bullish notion and general premium has everything except left the crypto showcase. As less financial specialists and merchants ran to the crypto space, exchanging volumes crosswise over top crypto ventures has decreased altogether.

Exchanging volumes regularly drop amid time of hesitation, however volume can likewise drop as examples lose their steam. It's not until a noteworthy development happens, that volumes start spiking once more, regularly affirming a pattern continuation or inversion, contingent upon which heading the development goes.

All through the 2018-2019 bear showcase, volume has constantly reduced. It started to increase amid the fall through $6,000, however immediately dropped back to the low dimensions.

Following the longest bear showcase for Bitcoin on record, a noteworthy pattern change happened amid a week ago's rally, that took Bitcoin cost from opposition at $4,200 to $5,200 in a matter of 60 minutes. The ground-breaking development likewise carried with it a huge flood in exchanging volume, affirming that the move was certified and that a pattern inversion might be a reality. Certain pointers recommend the inversion to be genuine, yet bears still can't seem to surrender as is apparent in the most recent pullback.

That flood in exchanging volume crosswise over both Bitcoin and Ethereum, achieved levels unheard of since in 2017 when digital forms of money went explanatory and overwhelmed the standard open. At the time, a media barrage tricked retail financial specialists to digital currency trades by the thousand, looking to strike it rich from Bitcoin and its altcoin cousins.

It's significant that the information previous Bloomberg money related writer Camila Russo utilized is from CoinMarketCap, which has as of late been put under the magnifying instrument because of cases of erroneously expanded exchanging volumes. While there is legitimacy to these cases, the correlation is being made against past CoinMarketCap information, so the example information ought to speak to comparative dimensions of exchanging volume, wash exchanging included.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord