Hello community! I wrote my first post on Steemit about the relationship between the price of Bitcoin and its scarcity. This post will be an introduction to this subject. I would really appreciate additional feedback/discussion!

First, let's start with the beginning of Bitcoin in early January of the year 2009. In this month, version 0.1 of Bitcoin was released. Which included a Bitcoin generation system that would create a total of 21 million Bitcoins by the year 2040. Currently, there are about 16+ million Bitcoins in circulation. This means that Bitcoin should become scarcer as years’ progress. What effect will this scarcity have on its price?

As in any other economic good: the scarcity of an economic good is derived from their limited availability with respect to the actual ends that they are capable of satisfying.

This means that the effect of scarcity on the price of Bitcoin will largely be determined by the role Bitcoin will fulfill in the cryptocurrency world by the year 2040. When Bitcoin grows in value, the effect of scarcity will be even greater. I want to focus on two different subjects that quite possibly can determine the success of Bitcoin in the future. Namely:

1. The acceptance of Bitcoin in the global economic system

2. Competition with Bitcoin alternatives/other crypto currencies

Multiple factors will determine the global acceptance of Bitcoin in the future. These factors are coherent to the developments of Bitcoin in the future. The two most important questions I ask myself are: What route will Bitcoin take? And what are the consequences of these actions leading to this route? (For example: the ongoing scaling dilemma)

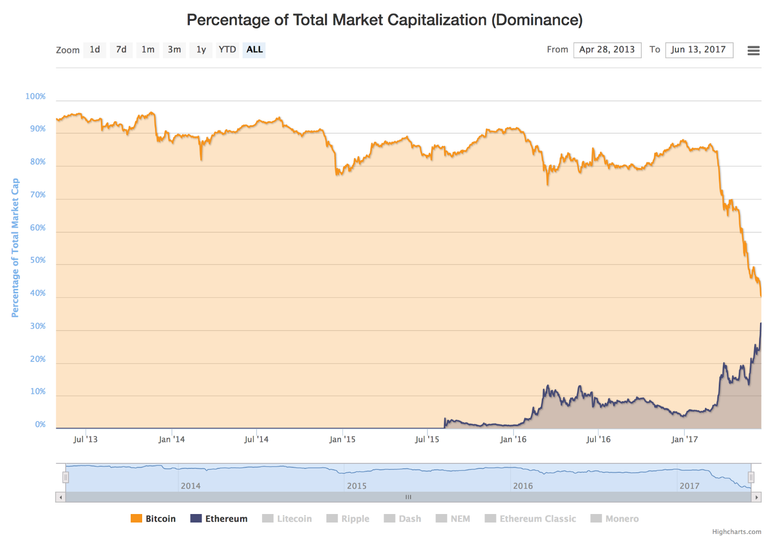

It may be even more interesting to look at the role Bitcoin has/will have in the total cryptocurrency market. As being the first cryptocurrency to exist, Bitcoin has established a dominant position throughout the years, in which it has become the biggest cryptocurrency available. But Bitcoin will not be able to keep this position for a long time. Recently, Ethereum has shown a recent growth in its price and market capitalization. Ethereum currently holds a market cap of 35+ billion dollar, comparing to a market capitalization of 44+ billion dollar for Bitcoin. With a key role of token sales and recent consensus on May 22-24 (2017), Ethereum is expected to have a greater market capitalization than Bitcoin.

And this indeed is huge for Ethereum! Bitcoin dominance is on the decline while Ethereum is booming. What position can Bitcoin hold in the cryptocurrency market as many other cryptocurrencies want to take over Bitcoin, to do the same as Bitcoin, more importantly: even better.

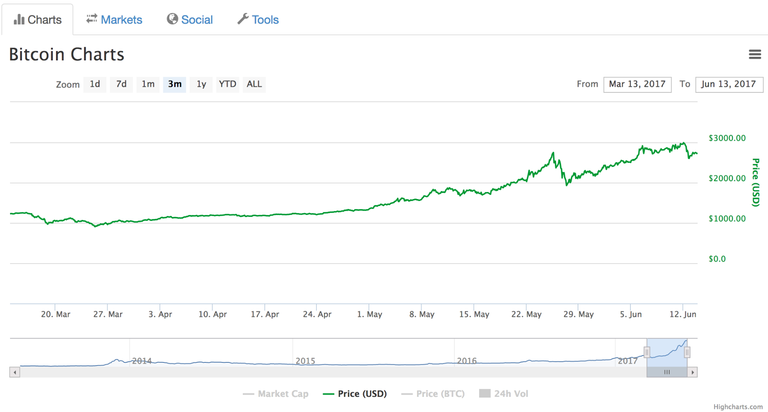

Originally this post was about the scarcity of Bitcoin and its price. With a small detour, we are right back at it. So, the market cap of Bitcoin is decreasing compared to other cryptocurrencies, but what is happening to the price? The price of Bitcoin seems to grow steadily, and even reached the 3000-dollar mark. The biggest observation that can be made is that Bitcoin holds value even when its percentage in market capitalization is decreasing.

The market has shown that the demand for Bitcoin is still strong. It seems that a lot of Bitcoins value will rely on future developments of Bitcoin. In my next post, I want to dig deeper into the correlation of Bitcoins price and its scarcity. Please share your opinions on the subject!

Wow, thanks for the detailed summary of this topic, im looking forward to see more of this correlation :)