Last time we had a major bull run, Tether spiked down massively a few weeks before. Guess what has just happened. Same thing.

If you compare BTC now to BTC 2014, you can see we are setting up very similarly to a large move, this recent spike up has confirmed it in a lot of ways.

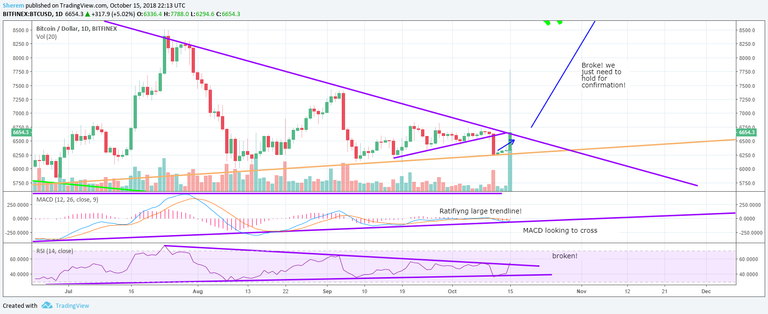

If we zoom in we can see we have

- Broken Trendline . Check.

- Broken Wedge to the upside. Check.

- Broken RSI wedge . Check.

USDT scare drove price up. Right now we are getting some disparity on different exchanges. On Bitfinex for example, we have BTC 5.05% printing around $6,900, but on Gemini and Coinbase we are printing around $6,400. If this dispairty holds, this will be very good and will drive prices higher. Bots (and people) will begun buying cheap BTC 5.05% from USD on Coinbase and GDAX and selling it higher to profit, or just holding knowing they can sell it higher. Think about a bot making a $500 tick every time they buy and sell almost instantly. Arb bots have been dormant for some time, I bet they get turned on agian. Ultimately, if we see this price disparity continue, we will see prices go higher substantially.

Volatility returning is great news. It will bring in more action, more buyers and attract people that have been on the sidelines.

BTC to 10k, looking a lot better after last night.

Happy Hodling,

-Sherem

Check out my article on TradingView and the Daily HODL

https://www.tradingview.com/chart/BTCUSD/eZJNu1n8-BTC-to-10k-The-Broken-wedge-of-BTC/

https://dailyhodl.com/2018/10/15/bitcoin-price-analysis-btc-eyes-10k/