Relatively still waters in cryptoland over the past month were finally roiled, after three tsunami waves of negative newsflow (aka FUD) broke on Thursday, painting the front page of Coinmarketcap red across the board.

Total Market capitalisation sank below $400bn and bitcoin broke major support levels to the downside, crashing through $10K and $9K levels in quick succession with heavy volume trading across multiple exchanges.

As we can see clearly in Chart one below, after rebounding from the early February lows, the market had been locked in a horizontal holding pattern, ranging between $9,300 and $11,700.

Chart 1. (BTCUSD 1H)

Frankly, the swift and sustained rebound from the Feb low, surprised us. Our last update spoke of further weakness to come for bitcoin and crypto more broadly, possibly even new lows, before an eventual turnaround in late March.

However, weak trading volumes and lack of bullish follow through since, kept us wary. Yes, the market recovered well from the lows, but it has since struggled to maintain any bullish momentum. The ceiling at $11,700 seemed strong, while the recent low at $9,300 also seemed secure.

As we write, having double tapped the top of the range exactly one month on from the February 6th low, Bitcoin has new lows in its sights yet again.

So, what the heck happened?

The market was rocked this week by a spree of negative news reports from three distinct sources; US and Japanese regulators, popular Asian exchange Binance, and most significantly the ghost of MtGox (yet again!).

Late last week, TechCrunch founder Michael Arrington, admitted live on CNBC that his $100 million cryptofund had received a subpoena from the SEC and were under investigation - as had every cryptofund he had spoken to. By Sunday night, reports suggested as many as 80 subpoenas had been issued by the US Securities and Exchange Commission - EIGHTY.

Fast forward to Tuesday, the US Department of the Treasury published a letter, a response to Senator Wyden dated February 13th, in which it clarified that FinCEN (Financial Crime Enforcement Network), considers the issuers of ICO's as money transmitters under the Bank Secrecy Act.

I.e. when the founding team behind a new Crypto blockchain/ERC20 token are marketing their project to a US citizen must register with FinCEN and obtain a Money Transmitter License, regardless of whether the token is marketed as a Utility Token or as a security. They are also under the obligation to conduct full KYC/AML.

Not done yet, On Wednesday, the SEC fired a shot at Crypto-Exchanges in their 'Public Statement on Potentially Unlawful Online Platforms for Trading Digital Assets', which was widely cited as the catalyst for the first big nosedive for the market.

If a platform offers trading of digital assets that are securities and operates as an ‘exchange,’ as defined by the federal securities laws, then the platform must register with the SEC as a national securities exchange or be exempt from registration. Coinbase released a statement claiming they qualify for an exemption as it does not list any coins or tokens considered to be securities (BTC, BCH, LTC, & ETH). No doubt the registration and audit process will take a long time.

The fastest option for compliance open to US based cryptocurrency trading platforms, would be to register as an alternative trading system (ATS) or Broker Dealer. But even this method would take four to eight-months to complete. Importantly, the laws are clear that a trading platform, is not supposed to be conducting the activity that requires registration until after it has been rubber stamped by the SEC.

Rather than shut shop to initiate the registration process, it seems likely that many US based Crypto exchanges will simply move abroad like the major Chinese exchanges did last year, or else delist hundreds of altcoins that the SEC deems to be securities.

Accompanying the public statement, SEC Chairman Clayton, in an interview on Fox business, made sure the public were aware of the SEC's intentions to clampdown on Crypto, with ICO's firmly in the cross hairs.

“Many ICO’s and many of the ones I’ve looked at specifically are securities. They are offerings of interest in an enterprise where the buyer of the ICO of the token, you can call it a token you can call it a security, is basically saying I’m investing with you with the promise of a future return, whether you deliver something to me in the future as a result of your efforts or because I sell it to somebody else who wants that return in the future. That’s a security, and the SEC’s job is to regulate the offer and sale of securities.”

Concurrently, not to be outdone by their US counterparts, Japan's major securities regulator similarly rocked local Crypto markets. The FSA ordered second tier cryptocurrency exchanges — Bitstation and FSHO — to stop doing business for a month and ordered five others to improve their internal controls.

The announcement also awarded penalties to some even more obscure Japanese exchanges - GMO, Zaif (famous for the recent glitch which enabled people to buy Bitcoin for free), Bicrements, and Mr. Exchange. Finally, the FSA withdrew the license application of bitExpress and forbade Coincheck from returning stolen NEM funds until more audits have been completed.

Whilst these names are very much second and third tier exchanges, similar actions brought against Kraken or Bitflyer (who just opened in the US BTW) would have a significant market impact, given the importance of the Japanese to the market. Same goes for the big Korean exchanges e.g. Bithumb.

Unfortunately, global regulators will continue to be a constant menace to Crypto traders. Securities laws are most definitely coming to Crypto - trade and invest accordingly.

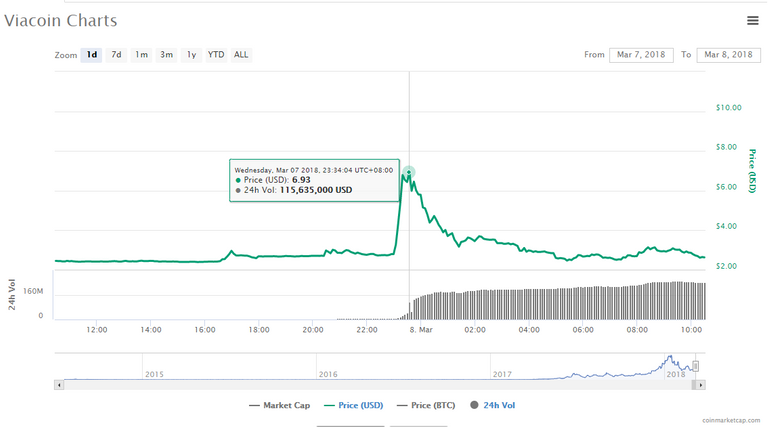

On the very same day, users of the popular Asian Crypto exchange, Binance, began making noise through the usual social channels (Twitter, reddit etc.) that withdrawals from Binance had been suspended. Shortly thereafter, many users noticed that all their altcoins holdings had been sold for Bitcoin, with the BTC proceeds then used to buy an esoteric altcoin - VE Chain (VIA/BTC) - at extremely high prices. Panic that Binance had been hacked erupted in cryptoland putting further pressure on prices.

To Binance's credit, CEO Changpeng Zhao (AKA CZ) responded quickly on twitter, ensuring customers that all funds were safe, precisely because Binance's internal controls picked up the abnormal trading activity in VIA and automatically acted to suspend withdrawals - thus preventing the attackers from withdrawing their ill-gotten gains - a world first for any Crypto exchange.

The attackers, spent months laying their elaborate trap, collecting hundreds of accounts, using sophisticated phishing techniques, dating back as far as January.

According to Binance's own summary of the attack (see @binanceexchange on Steemit):

'... it was around Feb 22, where a heavy concentration of phishing attacks was seen using Unicode domains, looking very much like binance.com, with the only difference being 2 dots at the bottom of 2 characters. Many users fell for these traps and phishing attempts. After acquiring these user accounts, the phishers then simply created a trading API key for each account but took no further actions, until yesterday'

Chart 2.

The hackers created dormant trading APIs for each phished account and decided yesterday to use those API keys to place a large number of market buys on VIA/BTC, increasing VIA’s price by some 1,000%. Meanwhile, 31 pre-deposited accounts controlled by the hackers (likely with fake credentials) were there selling VIA at the top.

UPSHOT:

Not only did Binance's automatic risk controls act to cut off the hackers, the exchange was also able to reverse most of the irregular trades, safeguard user funds, and managed to confiscate the hackers pre-loaded VIA coins - donating the illicit funds to Binance Charity.

The gold standard Binance PR machine did not stop there however; since the foiled attack, the company has declared a $250,000 bounty for information that leads to the arrest of the hackers. With users of their platform voluntarily offering translations of the medium.com article into their own languages to spread the word far and wide.

In fact, Binance has currently allocated the equivalent of $10,000,000 USD in crypto reserves for future bounty awards against any illegal hacking attempts on Binance. From a user standpoint, this is encouraging as it takes the fight to the hackers, who would otherwise simply regroup and try again elsewhere.

InfoSec lessons to be learned for all traders!

Before everybody goes and opens an account on Binance right now, there are some big caveats:

A foiled phishing scam does NOT mean that Binance is safe from a more sophisticated hacking attempt on its exchange.

To avoid being phished: Bookmark your exchange URL & NEVER click a link to it! Beware using Google to access the website, because phishing sites are widely known to buy google ads to promote fake sites designed to steal your login details.

Just because you have 2 factor verification enabled, does NOT mean you are 100% secure. By phishing accounts and creating new API keys, hackers effectively bypassed the 2 factor verification security protocols. If you use an exchange's API for automated trading bot purposes, take extra precautions.

If Binance's platform, had simply sent users an automatic notification (email/SMS) whenever a new API key is created on an account (as many other platforms already do), this attack surface would not have been so easily exploited.

The absence of effective KYC controls before account sign-up on Binance allowed the hackers to create 31 pre-deposited accounts likely with fake credentials.

So, credit to Binance for their handling of the situation and transparency, but questions remain to be answered on security. Great PR does not necessarily mean safe users.

The Big One

And so, we turn to the most important story of the week (probably the whole year), the return of the ghost of MtGox. Summed up perfectly in the following tweet:

Yes, indeed, the now defunct former exchange, rose from the dead, putting the fear of God into even the most determined Hodlers. Late Wednesday, the MtGox bankruptcy trustee uploaded the document that were distributed at the tenth creditors' meeting that was held in Tokyo on Wednesday.

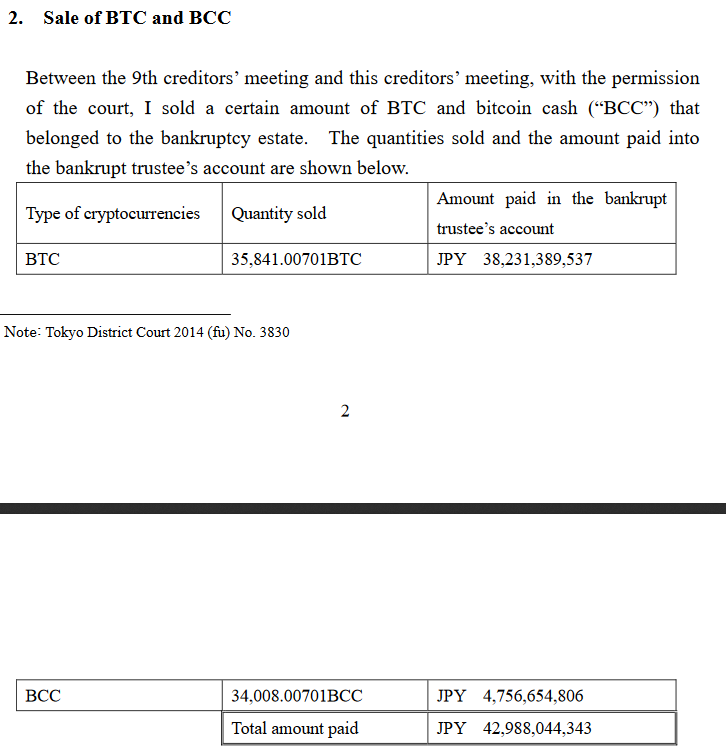

Gut Punch for MtGox Creditors

To summarise, in order to raise the required funds to pay back the legion of MtGox creditors (approx. $400m) that lost their Bitcoin held on the exchange when it collapsed in 2014, trustee Nobuaki Kobayashi, the lawyer in charge of managing the MtGox bankruptcy estate, sold 35,841 BTC and 34,008 Bitcoin Cash on the open market. The fiat sum raised by these sales is, unsurprisingly, very close to the precise amount of claims made.

Credit alistairmilne on Twitter

Thanks to some clever blockchain sleuthing from accounts we follow on twitter, wallet addresses associated with MtGox saw several large transfers of BTC between December and the February. These transfers coincided with several big drops in the market price seen in the chart below.

Chart 3.

Credit for the great Chart matt_odell on Twitter

The MtGox trustee filling mentions that the sales were facilitated by one exchange. The exchange in question is believed to be Kraken, who's CEO is on the record, plainly stating online last week, that he himself advised Kobayashi not to sell on the open market but via private auction. He further offered to facilitate the sales via Kraken's Over the Counter (OTC) desk, where large blocks could be marketed and sold to institutional investors without affecting the price. (Note: The US Government sold nearly 400K Bitcoin confiscated from the Silk Road via private auction)

The decision by Kobayashi, to sell on the open market rather than OTC must be the biggest insult of all to those who lost their funds on MtGox four years ago. Not only will they not receive their lost Bitcoin (writing off the huge price appreciation in the interim), but the Bitcoin they have since purchased or mined over the years, has lost more than half its value since December, because the trustee decided to sell their lost bitcoin on the open market to pay them back in Fiat!

So, what to make of all this?

Q: How does a sell order of 8,000 BTC (which is only 0.05% of the total circulating supply) cause the entire Cryptocurrency market crash?

A: The consensus here is that the trustee put all 8000 BTC up for sale at once, on the same exchange. A sell order of this magnitude can easily cause the price of Bitcoin to sink 5-10% in an instant because most Exchange orderbooks are so thin. The dramatic plunge caused by such an enormous sell order, would then trigger stop loss orders and short sellers. Many weaker hands likely panicked sold at any price when they saw the market collapsing, further exacerbating the move lower. Since all altcoins are traded against BTC, the contagion spreads rapidly and they all follow it lower.

Q: What happens to the 166,344K BTC (Worth approximately $1.5B) that Kobayashi has left in the MtGox bankruptcy estate pot?

A: We think it was the huge amount left in the pot that COULD be sold later that really spooked Bitcoiners over the past few days. From the Trustee's report, any further sales can only be permissioned by the Japanese court at the eleventh creditor’s meeting which is to be held at Tokyo District Courtroom at 13:30 on September 26, 2018. Clearly, if a sale of 35K BTC can cause a 50% drop in the Bitcoin price, then a sale of 166K probably sends it close zero.

However, given the uproar caused by the trustee's reported sales, it seems obvious to us that any future sales will be conducted OTC. Literally thousands of MtGox creditors are bombarding Kobayashi and the Japanese courts as we speak, with angry letters and emails to that effect. This man is public enemy number one in Cryptoland. There will be picket lines outside the court in September.

Frankly, we strongly doubt that the trustee will be allowed to make any more sales. This man had a fiduciary duty to protect MtGox. claimants and he failed miserably - there will be class action lawsuits to come for his ineptitude.

So, what happens next?

With the Tokyo Whale now out of the way (for 5 months at least), the market now has the room to resume its upwards trend. Currently, we are in no man’s land… Our technical indicators aren’t really telling us anything interesting. The market has been wounded deeply by global regulators and Japanese Lawyers and needs some time to regain confidence and find some direction.

Chart 4.

As you can see in the daily chart above, the price will have to breakthrough significant resistance from the 50-day moving average (red line) as well as the 150-day EMA (light blue line) which appear to be forming a death cross (bearish) over head. We remain bearish in the short term until we see a daily close above $10K.

Encouragingly, the daily chart closed green on Sunday, perhaps in reaction to a brilliant Cryptocurrency special on John Oliver's Last Week Tonight show which aired in the US on Sunday evening. A must-watch for anybody interested in Cryptocurrency regardless of experience.

Happy trading!