While Bitcoin's recent bounce off of $5,900 has been strong, BTCUSD may not be out of the woods yet. In fact, there is a somewhat decent risk the Bitcoin price will head lower and test its early February lows. A comparison of the candle structure from the 2014 selloff indicates this potential bearish scenario.

Keep in mind that traders and investors must constantly consider all possibilities when making decisions. There also exists bullish scenarios that might unfold, as shown below, and time and the price will tell all.

2014

In 2014, BTCUSD sold down from the highs it had reached in November and December of 2013. By late February, the weekly chart pushed well below its 26 EMA but was immediately bought back up. Bitcoin appeared to have bottomed. Unfortunately for bulls, BTCUSD wasn't able to close above the weekly 12 EMA. Instead, Bitcoin pushed lower and within weeks tested the lows it had made earlier in the winter.

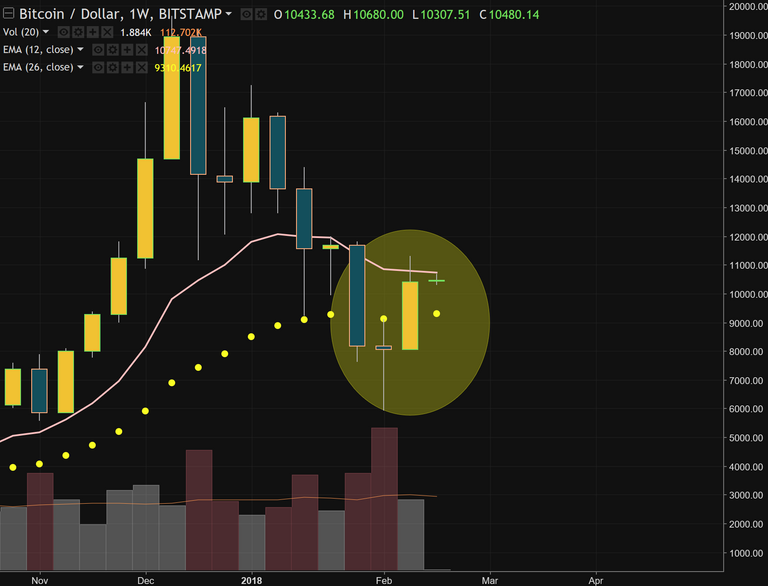

2018

Compare the above 2014 chart to today's. We've had a similar attempt to push the price of Bitcoin well below its weekly 26 EMA. Also, bulls reemerged and bought BTCUSD all the way to its 12 EMA but failed to close above it. Did that failure mark an intermediate top?

The Bullish Scenario

Bulls will ultimately need Bitcoin to settle above its 12 EMA on a weekly basis like it did in August 2016. Only then can the price reach for new highs. Time and price will tell all, but for now there is as good a chance that Bitcoin will sell down to further lows than there is that BTCUSD will break to all time highs.

DISCLAIMER

This post is for information and illustrative purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action.

DONATE

Bitcoin: 19498NLGwLbzN7yKrNbYqc4wuwZPkTGMVD

Ethereum: 0x76F2D78c81C6C97473DaF2aa3219F78Ce8C5A92f

Litecoin: LNhKXYTC5t2ZxcKYfo3pMzk8QsjZXsEbgT

CONTACT

twitter: sjanderson144

instagram: sjanderson144