I am writing somewhat of an introduction. You could call me a crypto-investor, but I am not the guy who owns this channel on youtube

He is rather informed and I tend to watch what he published. I also enjoy watching Vincent who is quite entertaining

I started some serious investment in crypto just a few months ago. Things are going great, and there were a few setbacks. I burned some balance when trying a trade margin (dont trade margin, ever, even if I will continue doing so) - the recent bitcoin dip was not expected at all but then some other alt-coins grew over 10x.

Everyone still wishes that they bought some bitcoin when it was worth cents on a dollar - FOMO is strong. I remember mining a bitcoin when it was around 50 USD. I spend about 800 USD in electricity to do it - wish I bought it then and did not loose it in the MTGOX bankruptcy.

I also missed my Etherum train when it was just starting up, and people would go around, leave those ETH cards, and try to get others involved - I remember thinking they were crazy when they tried to explain to me how ICO's would work.

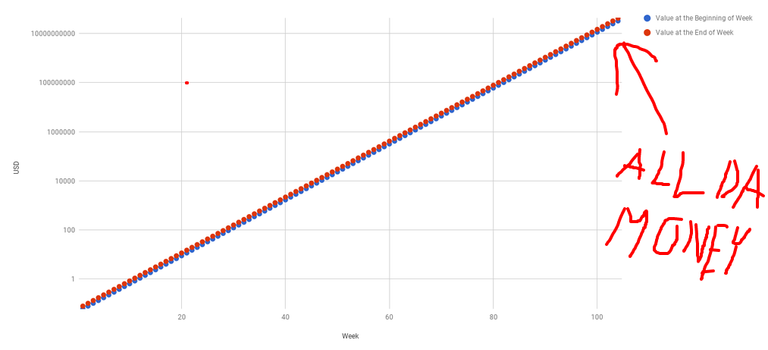

These days I am obsessed with cryptos, buying, selling, holding every day. I got my work colleagues infected with this virus. Gave a gift of 10 Bytecoins for one guy and the below chart to help manage his expectations - hopefully, all will go well:

I am using critical thinking to sift through the FOMO and FUD these days, but it seems the market is more about the FOMO than anything relating to reality such as roadmap, features, userbase or even vision - how else would you explain legacy bitcoin? I am also working on ICO and organizations that, if successful, will transform our society immensely for the better. This year 2018 will be the ultra bull run of bitcoin, ETH and altcoins. I expect ETH will do great and is a decent investment, but if things move as quickly as they do, IOTA will do even better.

I have a masters degree in software engineering and training in UX, and as such I expect this channel to look like the more technical aspects of cryptocurrencies, to explain them to less technical audience and from the user experience aspect to make the entry into the crypto space as seamless as possible.

Lastly some pics for 2018. This year is going to be big for ETH. It has all the stuff that bitcoin lacks, smart contracts, tons of tokens and, active development and a bit more scalability. Unfortunately that last one - scalability - will not be sufficient - with the market going like crazy (considering crypto-kities and ethertanks) it will demand more and gas prices will go way up similarly to bitcoin fees. As such tokens will migrate to other less loaded or more scalable token-chain technologies such as Stellar and once people feel sufficiently frustrated with unsolved scalability problem probably to IOTA. If that happens fast enough, then 2018 will be the year of IOTA as it has 0 fees and self-balancing scalability - the more users you have, the faster the networks gets. So load up while its below 4 usd as ETH was similar in 2017 on January.

https://www.youtube.com/channel/UCTKyJALgd09WxZBuWVbZzXQ

https://www.youtube.com/channel/UCs4Z_s2SngU_f4HpIz1o4mw

I hope what you say about Bitcoin is true, but once people stopped doubling their money every 10 days, the love affair with Bitcoin may be over.

Every new ICO labels itself "the next Bitcoin" and everybody that got into crypto in December's bubble now is looking to throw money at every coin that's worth .20 cents or less.

According to Crypto Investor there is still a huge reason to pump bitcoin. It is all about brand recognition and that market share will recover even if there is no real use case at the moment (digital gold?)

Everyone pumping shitcoins is a bit of a concern, but there is enough money for everyone in a bull market which we have and for bear markets people prefer bit caps. I would say stagnation in technology is even more of an issue, but what do I know - I am just a geek and again this can be turned around if the community at least tries to do so. There is some evidence of that: segwit adoption is growing and coinbase is being pressured to get segwit and batching implemented, which should eliminate any queue on memory pool and reduce the fees, but again that is a bit too much to explain in a reply, so should deserve its own article.

vincentb upvote