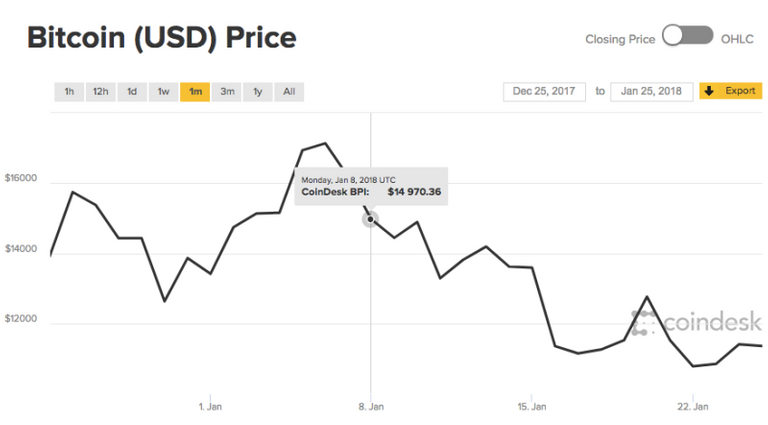

That the value of Bitcoin and other cryptocurrencies can be very volatile is no secret. On January 8, the entire market with Bitcoin at the top entered a freefall from which it has not yet recovered. At the time blame was put on a multitude of factors. Actually it could be just one.

Neither the regulations initiated by different governments, nor the frivolous investment of all those who have boarded the bitcoin car in recent months. According to The Wall Street Journal, the culprit for the entire cryptocurrency market to fall apart was one person: Brandon Chez.

Chez is the creator of coinmarketcap.com. In 2013, this 31-year-old developer created this page that tracks changes in the values of different cryptocurrencies from his apartment in Queens. The page works by averaging the different currency exchange markets. When Bitcoin and the other currencies became popular in 2017, coinmarketcap.com became one of the most popular websites in the world and even managed to beat rivals such as CoinDesk, Coinbase or Blockchain.info. The source of income for the page is Adwords advertising.

Up to here everything normal. The problems began on January 7, when Chez made a significant change in his page that had important repercussions. The developer decided to eliminate the South Korean market from the algorithm that calculated the Bitcoin price. The reason for this decision is that the value of the currency in this market was ridiculously higher than the rest.

Chez did not make the change public. He simply applied it, devaluing the value of Bitcoin at once without any apparent reason. The response was almost immediate. Prices began to plummet and have not yet recovered. coinmarketcap.com is still a very popular site and Chez has stayed out of the matter. The Wall Street Journal has tried to contact him to the point of showing up at his apartment, but neither opens the door nor answers the calls.

It would be very optimistic to say that this incident will not happen again. coinmarketcap.com or any other page can change an algorithm again and cause the coin to fire or re-enter auger. It is a problem that does not have a clear solution until hard-hand regulation arrives (which is already underway in many countries). Until then it is the price that you have to pay for investing bet with cryptocurrencies.

Scary how coinmarketcap is so widely used and no one really knows much about its beginnings. Definitely worth pointing out.