Feb 15: 3rd half of a month is gone - Investment Update

- Feb 15 Date

- 2025 Income Source for Investment

- Feb 15 Progress so far

- Week #7 Option Results

Feb 15 Date

Today is Feb 15, 2025.

That means it is day #46/out of 365.

That means it is week #07 out of 53.

That means it is the third half month out of 24.

That means it is the 2nd month out of the 12.

What have you done since Jan 1, 2025?

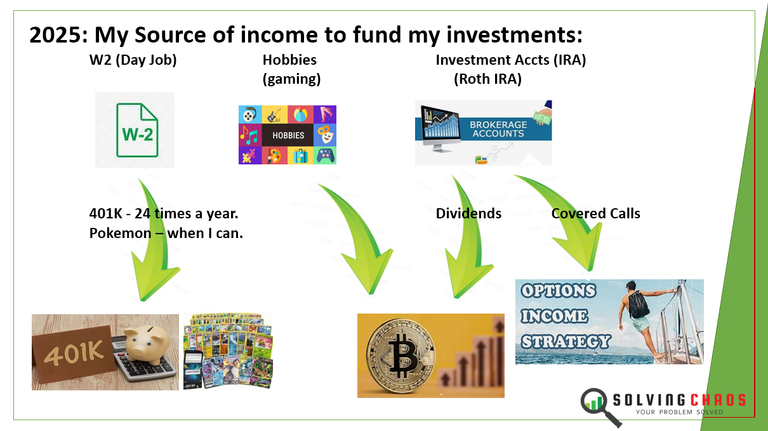

2025 Income Source for Investment

Folks always wonder how someone who MAKES so little money has so much to invest.

To better answer that I wanted to provide a flow of what type of things I have that generate income.

First is the W2 Job (Boring and Stable). Yes, I trade "TIME for MONEY" here.

I have been in the range of 50K-100K over the last 5 years and mostly true during my ENTIRE working life.

50K is not much for a family of 5, so you can imagine how things are when you make TWICE or 3X more than I do.

Next, I have Hobbies that can generate Income. Right now that is NFT gaming. I do Wealth Coaching and in the future, my Pokemon side business will also provide me with some $$$.

Last are assets that I own (mostly in brokerage accounts) that can also be used for other things. Since most of that is in tax-deferred accounts, I use that to purchase more assets.

In 2025 here is the breakdown:

- W2 Job --> buy more assets in the 401K plan as well as more Pokemon cards.

- Hobbies --> buy more BITCOIN.

- Brokerage Accts --> buy more stock (reinvested dividends), buy more BITCOIN, and options are used to grow the size of the cash balance of the account.

Feb 15 Progress so far:

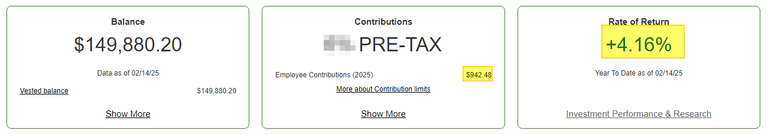

401K: $149K. New Capital $942. ROI 4% (as of Feb 14).

Bitcoin: Adding more when I can!! Check with me in 2029-2030. I think my holding will grow before the next cycle. I think last year, I only used 2K or 3K from dividends to get more Bitcoin. This year, I would like to come in at around 6K or more from dividends that go into Bitcoin.

Options Trading: Flat for the year (due to AMD's early Assignment on a PUT). But if the option continues to trend the way I have been doing it for the last 5 years, I would expect that the hedging and income will work itself out. The only side note is that my DIVIDEND growth will be SLOWING down in 2025 and beyond because I will be shifting that into BITCOIN purchases.

Pokemon: Just getting started with buying CARDS. The hobby gives me something to do that reminds me of Beanie Babies. It's fun to go out and collect them in the "wild" and in a few years have a growing collection of CARDS that are worth something. This is the same as those that collect BASEBALL cards.

From Dark explorers - 104/108

From Dark explorers - 106/108

I do have some cards from when my kid used to play at the local library. The first step is to see which one of those cards should be graded and maybe traded to help JUMP start the collection. I need to learn how to check the quality of the cards before selling them. Otherwise, it can be UNPROFITABLE.

My goal for 2025 is to collect and learn the hobby. I don't have a collection value goal yet. But my future goal is to have the ability to leverage the "flow of money" and see if I can hit a margin of 10%-15% per TRADE/Transaction. Then if you can repeat that multiple times a year, that should produce a return of over 15%-20% a year.

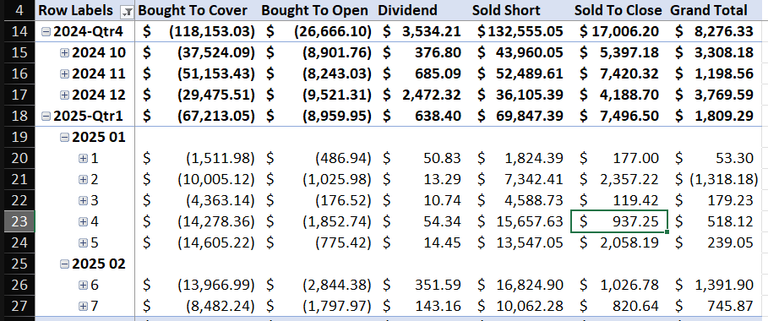

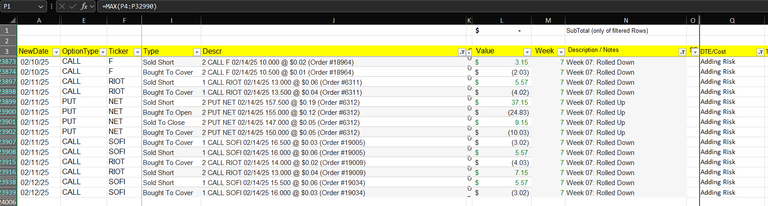

Week 7 Option Results

This week, I made about $600 from options trading. Some of this came from ADDING RISK to a winning position (like a covered call).

To further explain this, I extracted the data from all my weekly trades that fell into this type of trade:

Summary:

- Filter on Covered call / Credit spreads

- Filter on those that rolled to the same expiration of FEB-14 only.

- Do not look at adding risk for those beyond Feb-14 expiration.

- Only look at those where I adjusted the STRIKE price toward the market price (Adding RISK to the TRADE).

I made $22 just from these trades alone, and all of them ended up the way I expected.

I made $53 if I looked at trades in the last week two with the Feb-14 expiration where I adjusted the strike price.

And in Week 7 only, If I remove the Feb-14 expiration, I made $83 from adding risk to trades that I most likely will WIN again even after the adjustment.

The more I trade options, the better I understand that while it's a ZERO-SUM game, you can win (or LOSE) and that over the LONG PERIOD of TRADING have a positive winning rate (ie: making money).

Gamblers take on too much risk.

Investors take on managed risk with the highest possible chances of making money.

Have a profitable day.

Posted Using INLEO

I love the pictures.

Much better to see than to read.

Keep making more content. I enjoy the stuff you make.