Week 49 - Dec 2 Investment moves

This might be my most important post in the last 2 or 3 years. Not to say any of my previous posts did not contain some amazing trades (like AXON, PLTR, GBTC, etc).

This is the first time I will be explaining what MSTR is doing and how you can play this trend.

Summary:

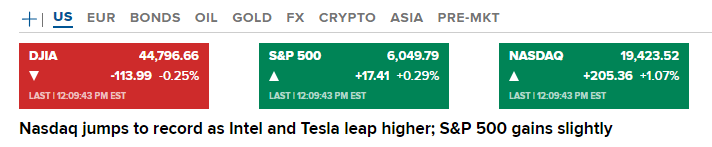

- Current US market conditions @ as of 12:10 pm (EST)

- Dec 2 Investment moves

- Bitcoin Treasuries - Why is it super important?

Current US market conditions @ as of 12:10 pm (EST)

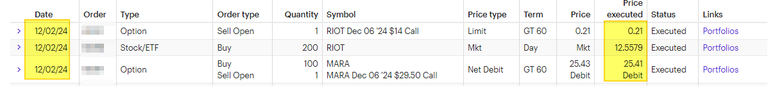

Dec 2 Investment moves

Here are my moves for today:

Dec 2 Summary:

- RTX put credit spread - Rolled down and out.

- FSLY covered call - Rolled up and out.

- F Covered call - Rolled up and out.

- V put credit spread - Rolled Up for $6 each.

- Buy/Write on MARA - spending $2500.

- Buy 200 shares of RIOT.

- New RIOT covered call collecting $21.

Bitcoin Treasuries - Why is it super important?

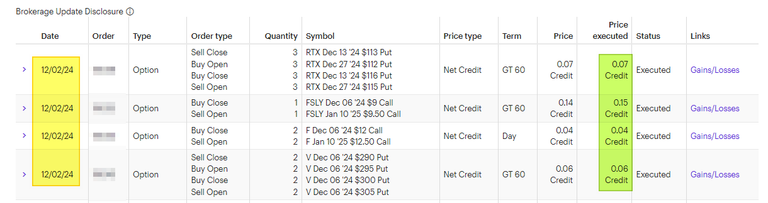

This website is centered around what I want to talk about: Bitcoin as an ASSET that others are holding.

https://treasuries.bitbo.io/

The data is organized in such a way that is easy to view:

We all know that in Jan 2024, BITCOIN spot ETF was available. This created an easy onboarding of those with assets in BROKERAGE (IRA / 401K and 403b) accounts will some chance of buying these products. Now, not everyone's plan can, but the one that can give the investor more choices.

In one year, these SPOT ETFs now control 6% of the total market share of Bitcoin. This means some people like ME sold other assets and moved some money into a BTC product.

Public Companies with BITCOIN assets.

Do you know that some Public companies own Bitcoin? If you are new to this, you might only think only ONE company owns Bitcoin since 2020. Square (SQ), now called BLOCK allows some user to trade BITCOIN on their CASH APP in 2018.

Since 2020, most of the attention has been around Michael Saylor's MicroStrategy. He has been one of the LOUDEST bull in this space and he has backed his view with a TON of BITCOIN on his company balance sheet (402K as of DEC 2, 2024).

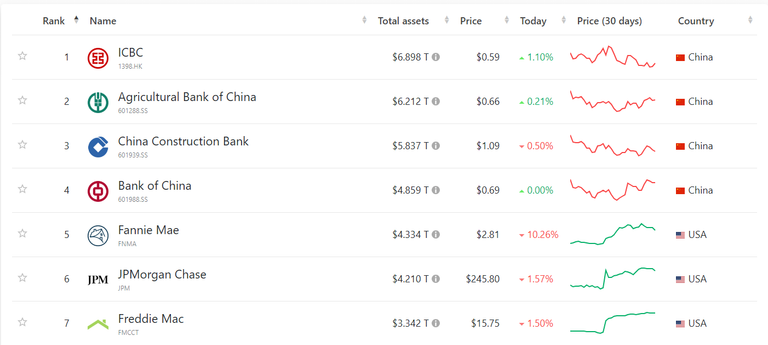

In the past, public companies have similar assets (cash, real estate, etc) on their balance sheet. Some of the biggest asset holders are banks, insurance companies, and other types of holding companies.

What if MSTR is at the beginning of something new? Where cash, real estate, and other asset classes are not as important as BITCOIN.

As of DEC 2, 2024:

- MSTR announced 4 weeks of buying BITCOIN!

- MARA buying $700 million in Bitcoin (https://finance.yahoo.com/news/maras-3-3-billion-bitcoin-134426947.html)

- MARA CEO - "Bitcoin should be on every company's balance sheet".

- RIOT owns 10K Bitcoin. They are debt debt-free company with more Bitcoin than Tesla and Coinbase.

What does this mean?

MSTR (MicroStrategy) stock has been one of the best-performing investments since 2020, even beating NVIDIA. As long as MSTR keeps buying BITCOIN and as long as people's view of BITCOIN will be more expensive in the future, this trend will continue.

However, there are risks to buying MSTR, just like with any investment. One way to reduce some risk is to buy into a company like MARA, which is using the same playbook as MSTR.

You can also buy Bitcoin miners like HUT 8 or Riot Platforms, which might also follow along with MARA to ride the same wave. As an investor, I want to reduce the RISK but have the best chance to have a similar UPSIDE. At this point, I decided to pass on MSTR and use MARA and RIOT to do that.

I already own Tesla via my holdings in SP500 ETF funds and QQQM.

I owned BLOCK for a few years and I think they will continue to benefit from payments and CASH APP.

Regardless of which way you play this, we all should have at least 1% of exposure to the BITCOIN industry. I would guess that in the future if more and more public companies own BITCOIN on their balance sheet, this will become a normal thing.

My suggestion is to:

- Own some BItcoin directly and store in a hardware wallet.

- Own some Bitcoin ETF shares (like IBIT, FBTC, etc).

- Own some public companies with BITCOIN on their Balance Sheet (MSTR, MARA, RIOT, etc).

Have a profitable day!

Posted Using InLeo Alpha

Nice post and thanks for the info.

Did not know who/what owned how much Bitcoin.

This helps.

I like the MARA/RIOT play.

Do you think it might make sense to look at the smaller players like Bitfarms?

Congratulations @solving-chaos! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 900 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: