So you've gotten yourself into the cryptocurrency market, you're holding some interesting coins, and you're starting to get really bored because the markets have cooled down for a few days. You find yourself sitting at your computer or pulling up prices on your phone thinking, "Has anything happened yet?!" Nope! Prices are plus or minus a percent or two, trading sideways, and there really isn't any incentives for you to buy or sell. Sure, you could try to "buy the dip" on a coin that you're into and try to add a little here and there, but overall you're just sitting there hoping for it to shoot for the moon so you can tell your family and friends how smart you were for getting into cryptocurrencies!

There is more you can be doing to improve your position for the long term in these markets and it's called Arbitrage trading!

Arbitrage trading is where you find a price discrepancy between different exchanges and buy a coin that is worth less on one exchange and sell it on another exchange for a profit.

Price discrepancy is a common occurrence in crypto markets, particularly between Western and Eastern markets. The problem for many in crypto currency arbitrage is that many exchanges don't offer their local currency (or any fiat currency) to "cash out," "sideline," or "take profit" from an arbitrage trade. This makes the system much more complicated and many people give up on the idea at that. In this article I hope to help people realize that there is a way to stay actively trading your favourite coins, add to your holdings, or make up for panic selloffs that ended with you holding less coins than you started with!

I don't know why people always state this stuff, but I will here just to be safe! I am not a financial advisor and nothing herein should be considered trade advice. I am a cryptocurrency investor, trader, and enthusiast only and simply wish to share some of what I've experienced with others so they can also be successful. Any information found herein should be used at the sole discretion of the reader. I will take no responsibility for any trades based on this information (good or bad, it's all you! ;))

How to Identify opportunities and pick your exchanges:

First, you're going to need to go to a website like www.coinmarketcap.com to start investigating which exchanges have different prices for the coins you're interested in. We are looking for coins that will allow us to generate value by buying and selling based on price difference. To do this we want to see if we can find exchanges where there is, for example, a 5% or more difference in the price of ETH -- it doesn't necessarily matter which coin you're looking at, but it's good to start with coins that have fast transaction times and low fees. The speed and price of transactions is a factor here because we're making as many transactions as possible while a price difference exists.

To do this go to www.coinmarketcap.com (Or similar website like, www.coingecko.com), pick the coin that you are interested in increasing your holdings with and click on the name. Once you are on that coins page you want to click the markets tab that appears above the graph - if you're on a mobile device it may appear up near the name of the coin as "Markets". Once you're on the market page, you can see the price of your chosen coin on different exchanges. We're looking for the biggest gaps in prices on the exchanges with the highest volume -- higher volume means quicker trades and when using market orders the price shouldn't change as much if you're using larger amounts of coins.

If you're looking to "cash out" your earnings every day like a day trader, you're going to want to find an exchange that has your preferred "fiat' currency to do this (or USDT if you're into that). It can also be beneficial to have a fiat currency pair on an exchange of your choosing if you're living off of your cryptocurrency earning or want to take profit in fiat currency occasionally.

I'm a Canadian so I often look for price difference between Quadrigacx which has Canadian Dollar and US Dollar pairs, and Binance which is a high volume exchange based out of Hong Kong.

So What's Next? Set up some pricing analysis and start up the process!

Once you have your two exchanges that you have found can have gaps in pricing, it's time to start keeping and eye on those price gaps!

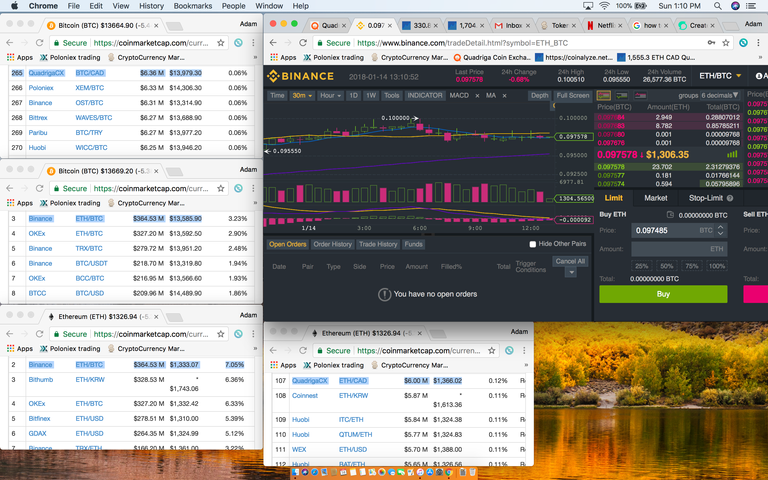

For this I will open 4 separate windows with coinmarketcap.com. Because all of the trading pairs are broken down into USD (even if you're looking at a BTC/ETH pair for example), using coinmarketcap.com allows you to look at a glance and see the price difference in one convenient currency. Here's an example of what this looks like on my Mac:

Limit Orders or Market Orders?

For those of you new to trading and using exchanges, "Limit Orders" are when you place an order for a specific amount of a coin at a specific price. "Market Orders" are your 'Buy Now' option where you place an order to buy a specific coin with a specific amount of money and the exchange will fill orders from the top of the order list. When placing a "Market Order" for buying you tend to pay a slightly to much higher price as the cheaper orders are filled -- this depends on how much money you're spending, more money, more orders need to be filled, higher price and depends on how much volume there is on the site, more volume generally means less influence on the price.

At the time of writing the charts are not actually any good to do an arbitrage trade, and unfortunately I don't have any older screen shots to show successful set ups. In the above picture were looking at about 2.89% gain if we transfer from Binance to Quadriga with BTC, then about -2.47% when we trade back from Quadriga to Binance in ETH. With fee's and paying miners we are looking at a loss by the time we complete the cycle. The lesson here is how to set up your information to see whether it's worth it to start an arbitrage trade but more importantly Not every day will have setups that will work for you! Be patient and pick your opportunities!

The above example shows one direction for an arbitrage trade but you could easily pivot to going Quadriga: Buy ETH -> Binance: Sell ETH for BTC -> Quadriga: Sell BTC for CAD, or, you could go Binance: Buy ETH -> Quadriga: Sell ETH for BTC -> Binance: Sell BTC for USDT, or any other combination where the gaps to make extra coins or fiat currency. If market conditions change and a gap opens in a different direction you can always "Pivot." If you're assets are all on the wrong exchange you may need to transfer them over to the other exchange to initiate an arbitrage cycle or you can simple change your coin pairs or wait for better price set ups. If you transfer your assets over to the other exchange keep in mind that this will cost something that you will have to make up with your trade cycles -- you're now starting your arbitrage cycle(s) at a loss, so pay attention to fees and keep a steady eye on prices throughout the process!

Alternately, if you're in trading pairs like BTC and ETH that can be traded straight across for one another, and you don't want to "cash out" your profits or "sideline" them to wait for another opportunity, you could simply skip trading ETH or BTC into CAD, USD, or USDT. This eliminates one trade in the cycle which eliminates fees and also increases the speed of your cycles. Time is money and arbitrage opportunities don't last forever!

Limit Orders or Market Orders?

For those of you new to trading and using exchanges, "Limit Orders" are when you place an order for a specific amount of a coin at a specific price. "Market Orders" are your 'Buy Now' option where you place an order to buy a specific coin with a specific amount of money and the exchange will fill orders from the top of the order list. When placing a "Market Order" for buying you tend to pay a slightly to much higher price as the cheaper orders are filled (this depends on how much money you're spending, more money, more orders need to be filled, higher price). On higher volume exchanges like Binance the price of your "Market Orders" tend to stay fairly close to the average price, particularly if you're not trading in hundred of thousands of dollars but this is not a rule! Market conditions can vary a lot!

There are times when you may want to use "Limit Orders" and times when you may want to use "Market Orders." If, for example, I have found a massive gap between prices that I want to take advantage of, I want to use Market Orders. The reason for this is because I have a limited amount of money, but the more times I can cycle it, the more I will make. If I have $5000 sidelined and I can trade it five times in a day for 10% gains, that 10% gain equates to the value of one trade with $5000.

Ex.1. Start with $1000, traded 5 times for 10% gain each time = $500 in profit (minus fees). My portfolio is now worth $1500.

Say I had the same $1000 sidelined amount, and instead of cycling through 5 times with Market Orders I've decided that I really want to wait for the price to hit a lower amount before buying or a higher amount before selling and I place a limit order. Assuming that the gap stayed the same between the two examples for the same amount of time, we would still have no idea whether we will be able to fill that limit order for a better price in 1 minute, 15 minutes, an hour, or ever. There is a chance you may end up making more than the 10% with limit orders and still complete 5 cycles while the price gap is there, but in my experience it is very unlikely and chances are you complete less cycles if you complete any at all -- the longer you wait, the higher the chance that the window closes mid cycle.

Ex.2. Started with $1000, traded twice over the same amount of time as ex. 1, for 15% gain each time = $300 in profit (minus fees). Your portfolio is now worth $1300.

If you are cashing out all of your coins every day like a day trader, using "Market Orders" is going to be the best way to go if you're watching your price gaps and entering into good trade cycles. If you're simply trying to add coins to your long term holdings, it's not so important to cash out every day and you can just hold a different coin until it's beneficial to trade.

When might you want to use Limit Order's then?

There are a few times when using "Limit Orders" may be something you decide to do but no matter when you use them, you are relying less on a system and more on your judgement and speculative prowess.

The first and most important reason to use a limit order in my opinion, is when the market volume isn't high enough, and by using a Market Order the average price you will be selling or buying at is going to close the gap you're trying to make money off. Lets say you're projecting to make a nice 5% return on trading a price difference of 100 and 105, but if you were to do a market order the average price you will sell at is 102 when the market orders start filling the current available orders. In this situation you may way to use a limit order to ensure you're getting the 105, and if ti doesn't you will not sell. As has been mentioned this is risky because you don't KNOW for sure which way the market will go while you wait.

The second, is what I like to call adding gravy at the end of your trade cycle:

Let's say you completed 4 cycles of systematic trading using Market Orders and on your last trade cycle you noticed that your ETH was going up in value on the charts and your BTC was going down and you are about to exchange ETH for BTC. If you are confident that ETH will continue to raise in value compared to BTC you may decide to place a Limit Order where your ETH will buy you more BTC if the trend continues -- maybe you place an order for an additional 5% gain based on the future price just to see if it can happen. This can be a very valuable trade if you're trying to add to your BTC holdings but it does require that you are right about the trend continuing, so it is more risky than just taking what extra coins you can while they are there.

There are other reason to use Limit Orders but any time this happens you are moving away from arbitrage trading and starting to move into speculative trading, and for that reason I'm not going to go into detail here about what they look like. I will say that if you're mid cycle and holding a coin that you don't want to end up with, or if you're moving your coins from one exchange to another without urgency, and you're confident in your ability to analyze market trends, limit orders can definitely be your friend. That being said, if the market is showing a pretty flat trend and you're stuck with a coin that you're not interested in holding long term, it may be best to simply wait for an opportunity to resume your cycle later from the point you're at than trying to reset everything. If you're a day trader, you may either want to take a loss, a little less profit on the day, or sidelining your daily bread on your alternate exchange."

A rule of thumb in these arbitrage trades is to not look at how much the coins you end up with are worth, but whether or not you have more coins than you started with. EVERY TRADE YOU DO SHOULD RESULT IN ADDING COINS TO YOUR HOLDINGS! Check after every cycle that it's resulting in more coins or you may be being fooled into thinking you just made a good bit of money when really you would have been better off just holding the coin and riding the upward trend.

There are also opportunities to add coins to your holdings when you see one market correcting or appreciating faster than another. This can occur for a number of reasons. Maybe some new's is released in North America about a Vitalik Buterin leaving Ethereum (this has not happened!!) but it hasn't been translated or disseminated in Asia which caused the price to drop in North America but not in Asia. In this situation, You may want to buy and transfer ETH from a North American Exchange where it's cheap to buy, to an Asian exchange, then use it to buy BTC or LTC or whatever before the Asian Markets correct . This isn't a "Flat Market" strategy, it's definitely a "Dynamic Market" strategy so consider it a value added on the the nature of this article and as a taste of what opportunities there are when you start looking at taking advantage of price differences between exchanges. "The more you look, the more you see" - Robert M. Pirsig

If you've found this article helpful or interesting please Upvote!

HELP A GUY OUT! If you haven't signed up on Binance.com or Quadrigacx and you're interested in those exchanges it would help me a great deal if you would use my referral codes!:

Binance: https://www.binance.com/?ref=15707135

Quadriga: https://www.quadrigacx.com/?ref=ijraaii2aw4gfex732wwye8t

Happy Trading!

Hello @siprex. Very interesting strategy. I am new to crypto and on a limited budget. However, I will try your proposal when I have just a little more confidence...

PS. I tried and cannot sign up for Quadriga because I am in the US.

Instead of Quadriga, you could look at using Coinbase, Kraken, or Poloniex. Thank you for reading, and I wish you luck in all your investments and trades!

Congratulations @spirex! You received a personal award!

Click here to view your Board

Congratulations @spirex! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!