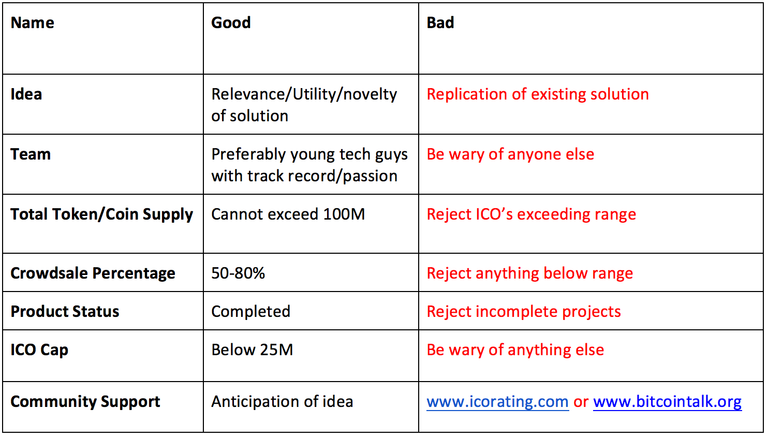

One of the very first things you need to be aware of in this fickle market is that, you cannot operate on the same information as the masses and expect any great wealth from that. How else do you think Nathan Rothschild gained control of the London Stock Exchange in 1815? Look it up. The relevant question for cryptocurrency then becomes, how does one avoid the countless ICO scams and actually find great financial opportunities in spite of the risk. A few criteria I find useful for my selection are compiled in the table below.

A critical thing I look for when analyzing a project is the idea. I ask questions such as, how relevant is the idea, does it have any utility, and what is the proposed solution? If the solution is a replication of an existing product, I will most likely reject the project since it lacks novelty. The second thing I look for, which is just as important if not more crucial than the idea, is the team.

What is their track record? Is this their first project working as a team? How long have the members known each other? If it is a technology company––what are their technical background? Other things I look for include the total token supply. Any project with total token supply exceeding 100 million is not appealing to me. This is not to say that a project with 1 billion total token supply is going to fail. I am merely saying that such a project wouldn’t appeal to me for the sheer number of the total supply. It would make more sense to have a 1-billion-coin supply for a global economy but token is a different story. The crowdsale percentage should be somewhere between 50 to 80 percent of the total supply or the project is not appealing.

Kin and LAToken are recent of examples of projects that deliberately took advantage of the masses through their ICO by massively diluting their supply and then selling a small portion of that in the crowdsale. There must be a completed product or I will wait until there is a completed product before investing in a project. I don’t know about you but any project trying to raise more than 25 million through their ICO seems very suspicious to me since that sort of money is almost impossible to raise from VC. The Last thing I look for is how supportive the community is to the idea. You can check this through mediums like bitcoin talk, www.icorating.com, and so forth. And remember, foresight and patience are key with investment. Vote this post up if you found the information helpful and comment with some of the determining factors you look for in an ICO. Thank you

Congratulations @sylvester152535! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!