The Flippening

Bitcoin’s teething problems have not gone unnoticed. This week, Ethereum came closer to surpassing the market cap of Bitcoin. ETH price broke past $300 to an all time high of $400, backed by mainstream media and speculator bids on the flippening. Bitcoin’s scaling deadlock and high transaction fees, have led to doubt amongst investors over its continued dominance in the short term. Ethereum, meanwhile, has roped in buyers into the crypto mania of the past 3 months. Amid proclamations of Bitcoin’s impending doom, Bloomberg reported Bitcoin Is at Risk of No Longer Being the Biggest Digital Currency, and days later ETH’s market cap clawed up to Bitcoin, at $36,290,735,803 and $43,645,356,249 respectively as at writing this.

Ethereum price went up from $110 on May 28 to $400 on June 12.

Bitcoin’s current dilemma is best summarized by these 2 threads on twitter by Joseph Poon and Zooko Wilcox (Zcash inventor)

“Bitcoin may end up not being a payments system (neither on or off chain,) if ETH claims network effects and the window of adoption. Post flippening, BTC has greater impetus to be a niche slow currency optimized for size/fungibility/portability. It is much more obvious that BTC should do something else if it loses payment system network effects.”

But the price of Bitcoin has rallied despite the rise of altcoins. In the last analysis, price had found support at a temporary bottom at $1800. Concerns of a second correction, or the end of the bull entirely, were alleviated as price gradually pushed up to $2300 resistance.

There were volume declines on localbitcoin, with China hardest hit. This was over the duration of Okcoin, Huobi and BTCC CHina frozen withdrawals and trading, while complying with Chinese regulator’s demands on their KYC and anti-money laundering policy.

When Chinese exchanges opened for business, on June 5 traders resumed to buying and Yuan volume buys pushed on price past the $2400 level to $2900. BTCCNY traded at a premium vs USD and JPY, a rare turn since the PBOC crackdown. Even at $5 average fees for transactions on the network, there was enough money flowing in to prop price to a new all time high at $3000.

Bitcoin is a gateway currency to the digital currency markets, and also serves as the trading pair for altcoin markets. Any money coming in to buy is partly flowing through Bitcoin, which creates demand pressure.

Ethereum also seems to be benefitting from acting as a transitionary “reserve currency”. Demand for ETH is partly from demand for Initial Coin Offerings ICOs. ICO crowd token sales are written as smart contracts on Ethererums ERC-20 token. Thus, Ethereum is the currency of choice for funding.

Bancor, an ICO looking to raise $250 million, raised $70 million in an hour fundraiser window. The crowdsale was scheduled 2 weeks ago. So any investors wishing to participate had to buy and/or hold ETH, even buying last minute. In the past 24 hours, ETH went up 30% from $250 to $400. Bancor has raised $200 million as at writing this. Ethereum’s portrayal as a successful public blockchain to new investors, however true it is, is great overall from outsider’s point of view.

If Bitcoin’s troubles persist, it might cede more ground to Ethereum in market cap. Already, traders are bullish on $500 – $1000 per Ethereum in the next 2 months.

As at writing this, Bitcoin is trading at $2730, after 2 sharp declines in 24 hours. The first drop bounced off $2700 from a $2980 top on Bitstamp. A correction from $2700 failed to break $2800, falling again to $2636, consolidating and dropping further down to $2480.

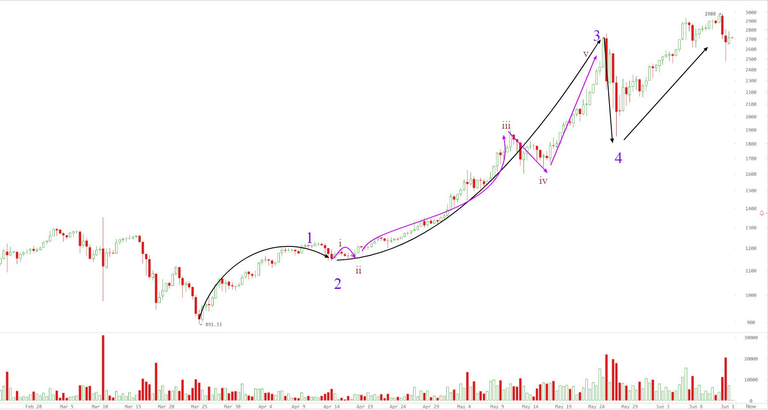

The price recovery from $1800 is part of a wave 5 of (4) playing out, so there is still more room to go up past $3,000. The targets for continued momentum are anywhere from $3100 – $3700. Yesterday’s drop was a likely lower degree wave (iv) of a higher degree wave 5. If wave 5 turns out like the lower degree wave 5s we have witnessed, then even $4000 is possible. This count is invalid if price breaks below $2343, where wave (ii) of wave 5 ends.

ZeroHedge reported Goldman Sachs was now covering Bitcoin in their investor reports. Chief technician Sheba Jafari concluded

“the balance of signals are looking broadly heavy” with the following view: “wary of a near-term top ahead of 3,134. Consider re-establishing bullish exposure between 2,330 and no lower than 1,915. Consider re-establishing bullish exposure between 2,330 and no lower than 1,915.”

Goldman’s Elliot wave count suggests that wave 5 is complete or close to complete at $3,134, and a correction to $2330, even $,1915 will follow for an even larger wave count wave 4.

Goldman shared these 2 charts – daily and weekly

The larger count on the weekly paints the highest degree wave 4 count

So a short term top to $3140 – $3300 is due, else, the top is in and price should correct significantly.

Congratulations @taxist! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!