Fixing Bitcoin’s Scalability Problem

Crypto’s Derivative

BIP-X-0001

Foreword

I been long fascinated with the Bitcoin “scaling” debate. What has left me daunted is how the same Infection that breaks government - has also broken the governance of Bitcoin. What encourages me is that the creation of bitcoin might be the first true republic. To be able to vote, in the only way that matters as in with moving value behind it. With such a gift - we want to abuse it for little value.

What do I mean by Infection? Because value is on the line-there is a crash of utility between modesty and virtue. This manifests in the way you treat the opposing parties. The outrage developed is the reason progress is hindered.

The problem is and always will be your assumptions.

Defining the Premise

There can only be one blockchain. There should only be one blockchain.

Problem with Flow

The problem with flow is that it is constant. Imagine filling a bucket by setting a spigot’s fill rate and then being locked out of the control of the spigot for a set period of time. If you choose too high of a rate you risk of overflowing the bucket which in the case of bitcoin leads to the ability to highjack the blockchain by using absurd amounts of data and limit who can possess the entire chain. If you choose too low of a rate then you underfill the bucket which in bitcoin means you have an artificial scarce set of transactions in combination with inflated transaction fees. This means the people with more bitcoin can hijack the network all the same. One is a controlled inflation of disk space and the other by using the monetary unit’s division to inflate the price of a transaction. Plus, if you have a lot of bitcoin and a lot of miners - then you have a pretty good lottery of getting your fees back. The time which you are locked out is the 2016 blocks per difficulty revision. This is the election of the block as the main chain. This all means that the blocksize limit is the very essence of flow. This is because if all the mining power abandon’s your chain, it cannot complete anymore links to its blockchain and if more people spontaneously enjoin the blockchain they can hijack that block’s mining reward until difficulty is reset.

Breaking the Premise

There can/should only be one blockchain or that intertwined chains are slow, insecure, or problematic.

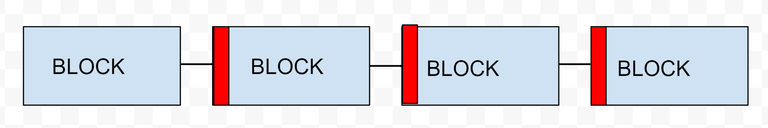

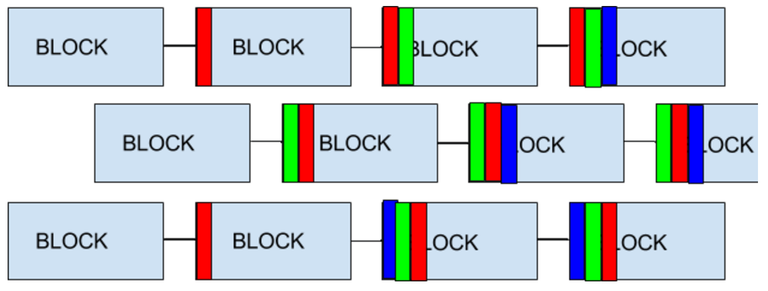

Above is a simplistic model of the blockchain. Each colored piece is the hash of the previous block of the respective chain. The longest chain of each color is deemed the blockchain for that consensus group.

By interlocking the hashes of multiple blocks, such as the diagram above, you can effectively create a new chain with a whole new dataset but originating from the same source. This effectively means each time bitcoin’s chain is split for a regional or theme split - the economical value of that split will be created by it’s use.

The link between blocks would be a merger of pools and exchanges. The process of chainsplitting would be automatic with software tools. The chain could exist as long as the entire dataset could have checksum calculated and incorporated in sufficient alternative blocks. With an API on the exchange, you could effectively send value from one block to another with the provided liquidity. This means that transactions would also fuel exchange liquidity. The overall value of the chaingroup is a multiple of the combined utility. The new overall chaingroup would be the summation of miner power in the constituency of the chaingroup. Since this is all automated, the chaingroup would elect the primary, or leading, blockchain. This allows the chaingroup to rotate, with minimal effort, around artificial market forces. This also allows voters to shift assets from chain hacks. On top of this, overall value transmission can be spread amongst the chains on what is now considered a single transaction. Imagine a dollar, where you have linked assets from regions. Your wallet would make this as simple as your work’s 401k distribution settings. With GPS, when you enter a region it could ask you if you want to buy local asset tied bitcoin. The regional transactions, say all of california, would be a side chain. People could create a new sidechain for any transactional load configuration. If the director’s of such chain obstruct reasonable policies, the users of the sidechain could split it in a matter of minutes effectively choosing new policies.

In truth this system completely exists, it is just not used in this manner. All one would have to do it wrap the wallet, exchange, and application to bitcoin interface to create a user friendly interface. Keep in mind - each time the block is split - EVERYONE holding the lead node’s currency division now holds that much command of the new chain. With cooperation, this could lead to a sort of insurance on chain hacks where people could donate the value they possess of a side chain to be sold to recover the lead node value losses. This insurance would be a percentage of the exchange/pool’s command and would influence the selection of chains to mine on or transact in.

By choosing the transactions you allow in the blocks your equipment mines, the asset control of sidechain could be throttled. For example, you could take preference to mine transactions for the local shop. By allowing registration and approval on mining groups, you could effectively create jurisdictions for each blockchain/sidechain.

Taking over the individual blockchain with miners would highjack what transactions are allowed into the blockchain going forward. It would also consolidate the power of pools since the minority pools could have the overall chaingroup’s lead in terms of sequential hashrate proof without having the overall mining power on the individual lead blockchain sidechain.

The value of the lead blockchain of the blockchain group would be determined by the scope of its use. For example, The US could create a new blockchain just for people holding currency in the United States. People could subscribe to whatever chains they wanted to accept value from and at any ratio to the lead blockchain of the chaingroup. This would also create a sort of inheritance each time the lead chain is split.

This inheritance could be used to start banks for bitcoin. Image the power to send x amount of value each time the blockchain is split. With competing interests between people outside of an isolated blockchain and those who use its purchasing value. If the value of the inheritance is squandered in the sidechain, it will collapse its purchasing power. However, if people actually compete as opposed to game the system, it will amplify the opposing interests into actual lending. The success of the origin of the copied system could be evaluated based on the time the system was copied - representing a allocation of held bitcoin assets at that time. As soon as a copy with sidechain linking data no longer has any comparison to the current chaingroup’s makeup - that origin to copy would become “stale”.

The reason you would have competing assets is because keys can now be shared before the copy. Pretend 3 banking assets from 3 regions of the world overlay 1000UBU (Universal Bitcoin Units) into the current lead blockchain of the lead blockgroup. Any regional blockchain copies from that point on, would have 1000 units in that new blockchain/sidechain copy. Because of the value difference between the lead blockchain’s unit and the sidechain unit - there would be a discount rate or exchange rate. The position you would want to be on this rate change would depend on if it can be used locally or not. Imagine you would charge $3.75 for a hamburger in dollars, $4.20 for Bitcoin because of its transaction costs, but because the local coin is prefered at local institutions, inside of the blockchain’s jurisdiction you may only charge $3.00 and have almost no fees. This would also allow for the tracking of asset flows from jurisdiction to jurisdiction.

Let’s consider Bitcoin and Bitcoin Cash to be the first of this kind. Right now Bitcoin is ~$3250 and Bitcoin Cash is $328 or about a factor of 10. If bitcoin cash were to get preferential treatment in a location like New Hampshire where bitcoin is currently widely accepted, people with no interest in the value of Bitcoin Cash could start loaning Bitcoin Cash to be repaid in Bitcoin at around a factor of 10:1 without profit. This could then be used to invest in to local blockchain prefered to use in New Hampshire. Perhaps another copy is created for prefered use in just wheat sales. The demand change in wheat could drive loans into New Hampshire. Once a loan is made on a sidechain it is valid for all compatible transaction signing protocols. People offering loans using this stored value could be rated across all jurisdictional sidechains to create a loaner profile. Any transaction using inputs from a banned output would be ignored by its miner pool.

The value of an output on a copy origin timestamp can be nullified by publishing the addresses’ private key. This would create race conditions of value of each nullified output. This would effectively destroy the keyholder’s assets of a copy origin’s holdings.

For example, let’s say a bank in 3 different regions charter’s using the above 1000UBU. If I make a loan on Region 1 to an address. That transaction is now valid on regions 2 and 3. If the terms dictate that you will not post that transaction unless there is a default. This now creates a financial regulator group. If you break the terms of the banking group then they publish your private keys.

Key To Success

The key to success will be with the new "wallet". For the first time this wallet will have different cards. Each card would be a different "jurisdictional" blockchain. if you think about it, every address is universal. If you have an address and a key you can transact on any blockchain in the group. You would discover blockchains like you would forums on message board. Remember, each new blockchain could be or become the lead blockchain of the chaingroup. This is because the hashrate will follow a combination of the transactions for the fees and the miners for security. The users would vote on where they want to enact trade under. With any one transaction, value would be optimized to transact. Subscribed blockchains would follow interlinks and subscriber information and be presented to the user for display purposes. Since difficulty is stored in the network, the computational power of the chains can be calculated. This also means that a chain can have time based valuations. Some way of embedding captcha's in the blockchain could be used as a means of tying human effort into the proof of work. That address times the number of transactions times the number of captchas in the blocks could lead to a calculation of work that requires a human as part of the process.

Linking Blockchains

https://proofofexistence.com/ is already a perfect example of how you can embed as many other blocks' hash and address to the lead blockchain. Modify this to support multiple blockchains and chaingroups - and you can build this system on the existing code base. As a wrapper of bitcoin, altcoins could be included in the chaingroup. Each blockchain sidechain bringing value to the overall blockchain.

Copy Size Problems

To solve the problem of blockchain size for each copy, you can use a linux filesystem such as ZFS and snapshots to immediately copy the blockchain with limited excess data requirements.

Congratulations @temper! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @temper! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @temper! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP