If you currently holding Bitcoin BTC you should take a neutral stance and just analyze what exactly is going on in the market. There is a huge temptation in us humans that we always searching the way of least resistance, the easy way. So for most of us, it is just very uncomfortable to take a neutral stance and analyse a new situation – it would be much more comfortable if things just go on like they gone on for a long time.

Sure, the easiest way for Bitcoin holders is it, things go in 2018 on like they gone before in 2017 – Bitcoin just gain a few hundred percent again and everybody becomes super easy super rich. Sounds perfect. Is it also realistic? An old investment rule says: Past Performance Is No Guarantee of Future Results.

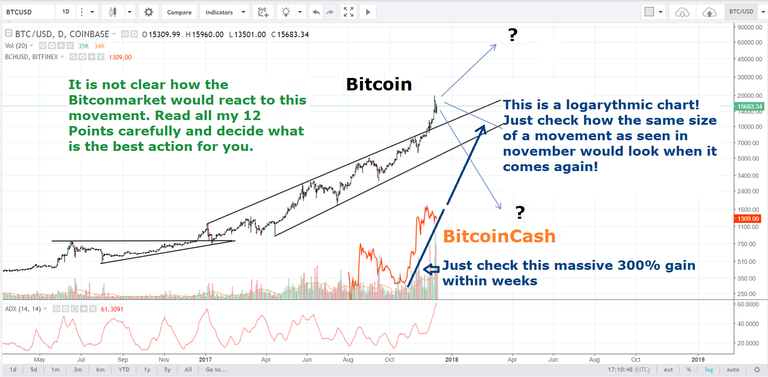

12 Things you should take into consideration:

1

Many Bitcoin investors sitting on giant profits. Many of them are very professional. If some billionaire saying at this moment that they holding Bitcoin and everything is fine, next target is 40.000$, it must have no meaning for you – this are markets, completely unregulated markets, if somebody want to reduce his Bitcoin holdings, and sitting on huge profits, he will not say anything that could affect the price. Not until he has sold everything, and this can take some time. Nobody just can drop a billion dollars in Bitcoin within one day, without producing a huge chaos.

2

From an investor point of view, it is all about where i can gain more in the long term. So the targets for Bitcoin are something between 40.000 – 100.000$ what most bullish investors claim. This would be something between 150 – 540% from now. When you compare this with targets for BitcoinCash, you will see that outlook here is much better. Some say it will be soon above 6000$, that would be already 400%. Many believe in surpass Bitcoin. If Bitcoincash reaching the current BTC Bitcoin price arround 16.000 Dollar, this would be something around 1150%. If it is even surpassing this price, gains over 2000%, a run like Bitcoin did from 2016 – 2017, would be possible. So in terms about what is thinkable for both, BitcoinCash leads cleary. Don`t get confused with absolute numbers! If Bitcoin reaches 40.000 Dollar but BitcoinCash reaches in the same time 10.000$, BitcoinCash would be clearly the better investment, since in make nearly 700% when Bitcoin makes only 150%. It is not important where a market is in absolute numbers – it is only important if YOU made in the end of the year 1,5 or 7 Million Dollar. Thats it.

3

Think about the heat in the debate and where the heat come from. Professional people very seldom speak out loudly against BitcoinCash. Many professionals are already behind BitcoinCash. The heat in this debate comes mainly from from people who are just not want that their Bitcoin holdings losing value. So they try to claim that people like Roger Ver are scammers and it is all a big manipulation. As BitcoinCash rose since October more than 400% immidiately claims started that this is a pump & dump sheme. People who are claiming things like this have obviously not idea about how markets functions and what pump & dump schemes are. We have now December and the market for BitcoinCash is stable above 1200$. This is no pump & dump, this is the new reality, BitcoinCash is worth 300% more than in October. This is much more than BTC Bitcoin gained in this time, in percent terms.

4

The people who are supporting BitcoinCash are definitely no idiots and they are much deeper involved in the whole Bitcoin history than most people of the Bitcoin Core team. The head of the core team, Wladimir van der Laan, is only since 2014 in the Bitcoin Team. The scaling debate started 2015 and becomes more and more hot with the years. Names like Dr. Craig Wright or Roger Ver are much much deeper and longer involved in the development and adaption of Bitcoin and they turned not without reasons from legacy to BitcoinCash and pushed this hardfork forward.

5

Cryptos look so new and fantastic that everybody believes this time will be EVERYTHING different even from a market perspective. It is true, crypto is something completely new and it is changing the world – but this was the new economy during the dotcom area also. And there was also same big changes during this time. Remember apple? They kicked steve jobs, the creator of apple out of his own company, apple nearly disappeared and was nothing worth anymore, but he comes back and made it the biggest company ever. What this have to do with Bitcoin and BitcoinCash? Today, the original inventors and initiators of Bitcoin are also kicked out of the Bitcoin development. The chances that they come back and take it over, are very high. Cause they live for Bitcoin. The current core team instead are just employees. Only.

6

Cryptos change a lot of things in the world and i`m convinced they will make this world in the end a better place. But one thing even cryptos cannot change: Basic human behaviour. Analysing markets is analysing human behaviour, cause the markets are made by humans. Even daytrading what is today managed mostly by machines, is in the end made by humans, cause humans programmed the bots. It reflects our behaviours. At this point, take into your mind what i wrote in point 1 and 2. Now imagine fear and greed. This are two human behaviours not change in million of years and never will change. What do you think, how fast can a market fall, if people accumulate there wealth over years in great great gains? If a market that is at lets say 40.000$ and it drops in one day to 30.000$, you can be assured there will be so much fear, that people have only ONE wish: Exit and forget everything.

7

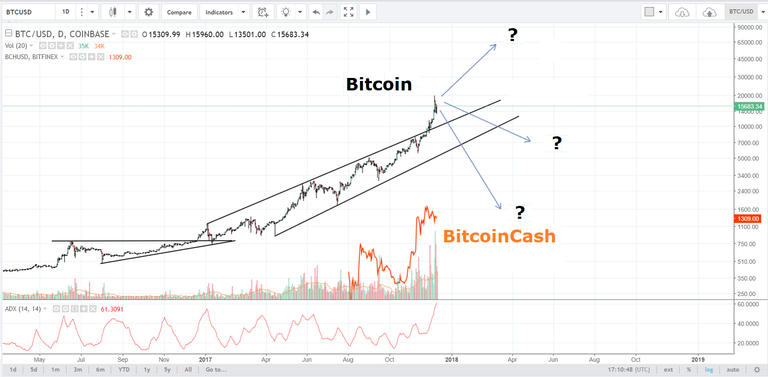

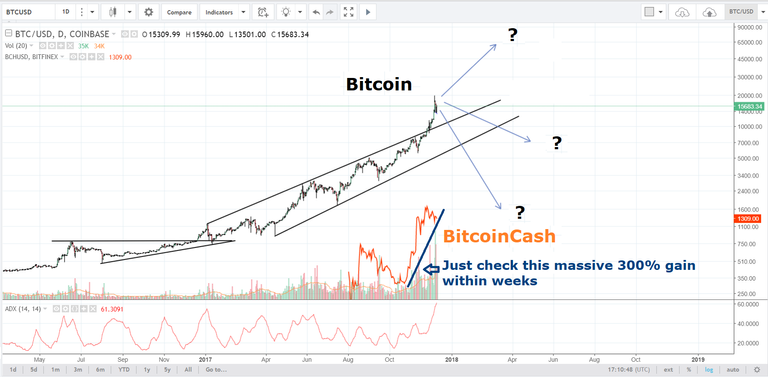

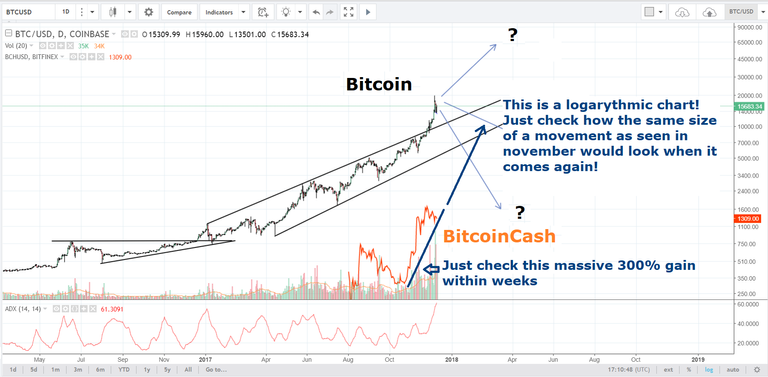

Now lets take a look at my chart. You see there in orange the price of Bitcoin Cash, the other graph is the Bitcoin price. You see how fast Bitcoin Cash gained 300% within a few weeks. Now imagine: It is ALL about the percent, not about absolute numbers. Imagine fear and greed. Imagine the sell panic and the buy panic. Can you imagine, how fast this both price curves can meet somewhere in the middle?

How fast things can develop, on one weekend, if it`s a weekend like the second in November?

How the Bitcoin market will react? Can we know it? What are the right actions to do the best to protect our capital?

8

I spoke about sell-panic and buy-panic. For BitcoinCash it is very unlikely to see a sell panic, since it is Bitcoin, it is considered already „on the floor“, compared with the other Bitcoin and what is on the floor, cannot fall deeper. But it is very likely for BitcoinCash to enter a buy-panic, the so called Fomo if price starts to rise fast. It is always a good thing to enter a market BEFORE FOMO (Fear of missing out) starts. And exit BEFORE a sell-panic starts. The other Bitcoin, the BTC Bitcoin, is very likely to see a sell-panic – but very unlikely that we would see above 40.000$ really a buy panic. It is to high than already – and do not forget, with 40.000$ BTC would only advance 150%. BitcoinCash instead only need 4000$ and would have this percent already outperformed and gained more than 200%.

9

Take into consideration which people have more to lose, if BitcoinCash fails? Behind BitcoinCash are people who are so strongly believing in cryptos, they have 80, 90 or more percent in cryptos. Many people who are cheering now for legacy Bitcoin just entered the field of cryptos this year and they of course hope it go on forever like this. There are a lot oft he people, some have barely any idea about Bitcoin, they just bought cause everybody is talking about. They have no idea about the fundamentals behind, the Technics. But the professional people, the people who are deeply involved in Bitcoin, much deeper than some employees from Blockstream, they understand the whole thing in full detail. And so they put a lot at stake. I am sure they are not gonna lose – they simply can`t afford and they are not willing to do so, cause it is there „baby“.

10

Take a look at the Technics and history. Similar situations in human history was there over and over. It lays in history of this world, that evolution wins. And that the fastest evolution wins. BitcoinCash is fast and now. BTC Bitcoin has until now no working solution to the scaling problem. Everything what they claim what can solve this problem, is not ready yet. Nobody know if it will be workable or if it is maybe vulnerable. Just imagine they launch lightning in a hurry and than suddenly a hack happen that would make Bitcoin vulnerable. This would be a nightmare. Changing something that works so perfect like Bitcoin so deeply like they want to do it with segwit and lightning, and just needed bigger blocks to handle more transactions, so , is dangerous. If becoming more under pressure, it is more likely to make mistakes. The pressure will rise cause the people around BitcoinCash have only one target: Mass Adoption, processing as many payments as possible, everywhere in the world, for everybody. Legacy Bitcoin can`t compete at this point with BitcoinCash.

11

Think about time. BitcoinCash has gained a lot within 4 month. But most people need more time to hear about it, to read and understand it. Time works for BitcoinCash. Most people who are changing to BitcoinCash, not change back to bitcoin. Simply cause the technic works better and there is this original grassroots movement feeling, like it was long time ago with Bitcoin. So when BitcoinCash reached already 4 month after the hardfork place 2 or 3 in marketcapitalisation, you should now think again about point 1- 3 i wrote above. People sitting on high profits and have a lot to lose with Bitcoin, on the other side there is a lot to gain at BitcoinCash, and many professionals already switched sides or keep quiet. Or they change sides in silence cause they not want to affect market price during they doing so. So if time works rather for BitcoinCash than for Bitcoin, it`s an amplifier for the whole Situation. After everything what we saw in October and November is it very unlikely that BitcoinCash just will disappear. It is much more likely that we see something like this again after more people get educated about BitcoinCash, tried BitcoinCash, get negative feelings when using legacy Bitcoin and must wait hours or days for confirmations and spending a lot of fees during doing so. Time works clearly for BitcoinCash.

12

Think about that nobody who supports BitcoinCash today, comes from outside – all supporters was long time Bitcoinsupporter. They just changed there mind during the scaling debate and during events. Nobody want to „destroy“ Bitcoin like so often claimed in the internet. This feelings come from people who are scare that BitcoinCash could disturb the process how Bitcoin can gain further profits, they scare BitcoinCash could take some profits away. The truth is, grow and profits are already limited due to the fact that the network cannot breath anymore. A congested network is not functional for a cryptocurrency – cause a cryptocurrency IS a network. If the network is congested, it is like the network is sick. So all these people who are fire for BitcoinCash now, not want to destroy Bitcoin – they want to cure it, they have another idea about Bitcoin, their idea is to cure Bitcoin with a hardfork. That means, BitcoinCash is not an altcoin. Simply cause it is founded by Bitcoinusers and follows the original BitcoinBlockChain – just with bigger blocks to fix the clogging issue in Bitcoin.

Conclusion

After you read all this you should carefully consider what to do. If you hold only Bitcoin and no BitcoinCash, it would be a wise decision to test the waters, just exchange some Bitcoin into BitcoinCash as backup, and check out how it works for you. Be prepared to jump if something huge comes. You must take into consideration that if something big come like in November, when BitcoinCash jumped more than 500% during two weeks developments can go so fast that you maybe not will be able to switch sites fast enough when you must transfer first money to an exchange. This can take than hours. On the other hand, it is not wise to store to much money on an exchange. So the best way to be prepared is holding your holdings so, that what either comes, it would not harm you. If you hold as much BitcoinCash as Bitcoin, you will not go broke if for example Bitcoin faces a heavy crash and loses 80% value. All this things are possible. It not must come but it is possible, we do not know how markets react to a sudden increase in BitcoinCash demand. If they react same as on the second November weekend, than a crash is really highly possible. So higher Bitcoin is priced, so more and faster fear will develop, and this is what causes crashes. If you want that 2018 become as successful with Bitcoin as 2017, it will be not enough just to hold on Bitcoin. It is necessary to take an eye on BitcoinCash, prepare yourself, test the waters, increase your holdings in BitcoinCash. You can decide how much risk you want to drive, but the risk must be alway stay in good relation to the reward. As read in Point 2 in this text, the reward in Bitcoin is expeceted lower than in BitcoinCash in procent terms, and only procent terms are important for investing, not absolute numbers. So if you looking for a high reward investment, it is even more important to monitor BitcoinCash and be ready to enter the market before the market takes off, cause the BitcoinCash market can be a lot more faster than Bitcoin, as seen in November.

I hope this article was useful for you and give you some new information and thoughts. Enjoy Investing, enjoy Trading. Wish you all success in 2018. Thank you for your up vote if you like this article.

The globalists have hijacked BTC! BCH to the rescue!!

Great article between those two, I transfer BCH yesterday and it take little bit longer then LTC, and ethereum... but nothing to compare to bitcoin.... the fees are still hire then ltc or ethereum but, it still as bitcoin as a first name 😉

That was also my experience

great analysis!

Many thanks for your feedback!

There are other alternatives than directly increasing the block size whether it will work is not known https://steemit.com/bitcoin/@sames/here-are-all-the-plans-bitcoin-plans-to-scale-without-increasing-block-size

It will work.... Temporarily. It is like plugging a leak with a piece of sticky tape. Eventually it won't hold

That i do agree offchain will be able to support alot of transaction but not lower thr fees on chain. I really wish core just increase block size for a temporary fix

It will not work cause BitcoinCore not want it. Simple. They reject every solution since 2 years cause they are occupied by the mining cartel and they are happy with high fees. BitcoinCash IS the working solution. People CAN`t wait even one day longer, BTC needs a Solution already months ago. So people will see that there IS a working method, and one group that just tries to calm down the masses with promises - since 2 years.

Bitcoin cash may have solved the problem temporarily by increasing block sizes, but they introduced a much, much bigger problem. Dividing the Bitcoin camp into two was the worst thing that could possibly happen. Roger Ver is just a greedy twat.

No, i don`t think so. BitcoinCash will win in the end and will show the world that it is impossible that a company or any institution can control a decentralized network. Thats what Blockstream does. The network will heal itself.

so what is bitcoin cash?

you're buying into the bullshit that Roger "Self Made Millionaire" Ver feeds you - he is just in it for personal gain in the end of the day.

I would never invest a dime into bitcoin cash - and a lot of people share that position - they did more damage to crypto currencies than you could imagine.

If he has his own vision then fine, create your own currency, start with a new chain, just like everybody else does. forking a chain is morally reprehensible, it it set a terrible precedent. Trying to "attack" the chain you forked from is morally reprehensible. This is the number one problem with crypto right now and you can thank your friend Roger.

**" forking a chain is morally reprehensible, it it set a terrible precedent. Trying to "attack" the chain you forked from is morally reprehensible"

I couldn't agree more. Shameful.

No these are solutions that core has admitted to support or blockstream supports

No these are solution that either core or blockstream supports which means it will happen.