South Korea has been on a steady rise towards establishing itself as a major financial powerhouse for the cryptocurrency market.

Over the last few months, South Korea’s three largest digital currency exchanges, Bithumb, Korbit, and Coinone, have been experiencing massive amounts of trading volume, allowing the country to snatch the throne as the world’s largest Ethereum exchange market.

With a $335 million average daily volume and 38% market share, the KRW/ETH trading pair has recently accounted for more processed trades than ETH/BTC, which had previously covered over 50% of all Ethereum trading.

However, all of this seems to be coming to a shortly-lived, abrupt, and potentially temporary halt. As of yesterday evening, South Korean officials announced that all domestic companies are prohibited from participating in the lucrative ICO fundraising option.

Following a conference with the FSC (Financial Services Commission), Korean officials stated that newly placed regulations will prohibit all forms of the blockchain-based funding method “regardless of technical terminology,” while margin trading of cryptocurrencies will also be deemed illegal following the ruling.

Initial coin offerings, a crowdfunding method utilized by blockchain start-ups that has gained popularity in recent months, are overly speculative and constitute a “violation of capital market law,” the FSC states. An “intensive crackdown” will ensue, along with “stern penalties” issued on all parties involved in token offerings.

Other methods to ensure cooperation, which are likely to affect blockchain companies more broadly include: on-site inspections from the FSC beginning after September and the analysis of virtual currency accounts for user data from December.

Nonetheless, it still remains unclear how far this intensive crackdown will extend into domestic cryptocurrency exchanges. However, this should be seen as a potential threat, as South Korea has steadily risen in market dominance over the past few months, and has a total trading volume of $427 million at the time of writing, according to CoinMarketCap.com.

Price Effects

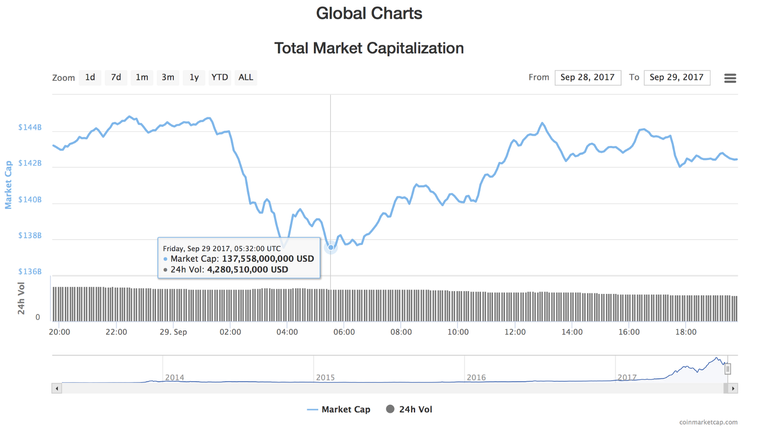

Quite similar to that of China, South Korea’s recently issued regulations have caused substantial turbulence throughout the cryptocurrency market. In a matter of minutes, massive sell-offs sent the markets total capitalization on a downward plunge of over $7 billion, according to CoinMarketCap.com.

However, since South Korea’s regulations never implied a shutdown of domestic exchanges, and were solely directed toward ICO’s, prices almost immediately jolted back up the same amount they had corrected.

Nonetheless, this disregards nothing, as this markets extremely speculative nature could allow any news (especially regarding exchange regulation) to send its valuation plummeting beyond respects we’ve encountered before, and will certainly hinder investor optimism moving forward.

Technical Analysis

BTC/USD:

As you can see from the chart above, the BTC/USD exchange rate experienced a steep downward plunge as a result of South Korea’s official ICO ban. However, BTC’s pullback was quite short-lived, as it’s price immediately regained momentum directly above the 100-day SMA at the $4025 level; indicating the communities substantially low regard for the newly implemented regulations. Along with this, the two EMA’s on the MACD were substantially diverged at the time of correction, indicating that volume was quite over sold. As of today, the 12-day EMA has successfully crossed over the 9-day EMA with very minimal separation, signaling that buy-volume is steadily making its way back into the market.

On the technical side, if Bitcoin can continue to hold support at its current price level ($4,184 at the time of writing), this would indicate that previous momentum has been regained and investor optimism is remaining intact.

However, on the fundamental side, it is important to note that investors should remain cautious in the short-term future. If any news regarding South Korea banning domestic exchanges is officially announced, the market will continue to plunge until it reaches stronger support.

ETH/USD:

There seems to be quite a different scenario going on with ETH/USD at the moment. While Bitcoin’s price almost immediately regained all of its lost momentum, Ethereum continues to struggle to breakthrough its previously formed uptrend. Along with this, the ETH/USD rate fell substantially below the 100-day SMA at the time of correction, causing it to bounce off strong support at a lower point and stabilize around the $293 level. However, the 12-day EMA has successfully crossed over the 9-day on the MACD, indicating the strong possibility that buy-volume may continue to steadily seep back into the market.

In my opinion, it would be safe, and smart, to hold off from increasing any positions in Ethereum. Although its USD rate seem to be regaining some momentum, it has still not crossed the necessary threshold to verify an intact uptrend.

LTC/USD:

Litecoin, on the other hand, seems to be repairing itself just fine. Although it broke below its month-long uptrend and 100-day SMA, it immediately regained enough momentum to verify its uptrend to be intact. Along with this, it seems to have currently met and gained support around its 100-day SMA price level ($53 at the time of writing), and buy volume seems to be making its way back in (indicated by the 12-day EMA (blue line) crossed over the 9-day EMA (orange line) on the MACD).

If Litecoin can continue to hold support at this price level, (assuming that no further regulations are placed in South Korea) this would indicate a strong possibility that it will continue to follow the upward momentum it began to form earlier this month.

XRP/USD:

XRP has been one of the largest gainers from the South Korean market.

Over the last few months, South Korean exchanges have accounted for up to 70% of XRP’s daily trading volume, and still continue unabated today. While that rate currently sits at 23%, XRP has witnessed billions of dollars in volume this month directly from Bithumb alone.

However, due to XRP’s inherently stable nature and lack of tie’s with ICO’s, the XRP/USD exchange rate experienced a very minor pullback compared to the rest of the market. From $0.21 to $0.19, XRP found strong support directly above its 100-day SMA, and continues to hover around that price level. In addition, buy volume remains relatively strong and the MACD is indicating a possible continuation of this action.

Conclusion

Thank you for taking the time to read this article and I hope that you truly enjoyed it. If you did find this of value, dont forget to show your support by clicking the 👏 button! Also feel free to share my content wherever you like!

Follow @TheCoinEconomy on all social media platforms in order to receive the latest insight on the cryptocurrency market and advancement of blockchain tech. (TradingView, Twitter, Instagram, Facebook, StockTwits)

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@TheCoinEconomy/bitcoin-ether-litecoin-ripple-prices-hold-strong-amid-south-korea-sell-off-8256e6e2630e