Being fairly new to Steemit, I have been perusing and enjoying some of the older posts. I came across the article, Crypto: The Dawn Of The Single Greatest Wealth Transfer In The History Of Mankind...? posted about nine months ago by @rok-sivante, https://steemit.com/crypto/@rok-sivante/crypto-the-dawn-of-the-single-greatest-wealth-transfer-in-the-history-of-mankind. I found the post informed, well written and full of optimism and enthusiasm for the crypto space. As a crypto-enthusiast, I love to see these sorts of posts. However, this post really got me thinking about what is really going on and where the world is headed. As I look at the world of cryptos just nine months later, I have to admit that I don’t share his optimism about the effect of cryptocurrencies on the wealth distribution. Nor do I share the belief that Satoshi’s vision of a fully decentralized currency that replaces financial institutions is likely to become a reality, via bitcoin or any other cryptocurrency project currently in existence. This post is not meant to discredit or criticize the work of rok-sivante or anyone else for that matter, but to lay out the other side of the conversation in hopes of starting a candid dialogue with the Steemit community about the current state and future of the industry. To that end, I have referenced several Steemit posts that I found providing quality content relevant to the subject and included @ mentions for their authors. I am also offering an award of 1 SBD to whoever has the best counter to the argument I have laid out. (Details provided at the end of the post)

(royalty free photo courtesy of Pixbay.com)

In the Bitcoin whitepaper, the document responsible for sparking the crypto-revolution, Satoshi Nakamura sets out to describe his idea for a new, decentralized electronic currency that would serve as, A purely peer-to-peer version of electronic cash (that) would allow online payments to be sent directly from one party to another without going through a financial institution. This revolutionary idea has millions of people clamoring for the downfall of the banking cartels and the massive transfer of wealth currently consolidated in the hands of the 1% (more accurately, .01%) global financial elite, to the hands of the people. It’s been almost a decade since Satoshi released his whitepaper and his project is worth well over one hundred billion dollars, but is it the disruptive force we hoped it would be?

An article from MIT Technology Review (link below), describes research done by Emin Gün Sirer, a cryptocurrency expert at Cornell University, on why the two largest cryptocurrencies, Bitcoin and Ethereum may not be as decentralized as most people think;

Perhaps the most striking finding is that the process of verifying transactions and securing a blockchain ledger against attack, called mining, is not actually that decentralized in either system. Bitcoin and Ethereum are open blockchain systems, meaning that in principle anyone can be a miner … But organizations have formed to pool mining resources. The researchers found that the top four Bitcoin-mining operations had more than 53 percent of the system’s average mining capacity, measured on a weekly basis. Mining for Ethereum was even more consolidated: three miners accounted for 61 percent of the system’s average weekly capacity.

They also found that 56 percent of Bitcoin’s “nodes,” the computers around the world running its software (not all of them engage in mining), are located in data centers, versus 28 percent for Ethereum.”

The article fails to mention that two of the top four Bitcoin mining operations are actually owned by the same company. Bitmain Technologies Ltd, a privately-owned Chinese company founded by Jihan Wu, a former financial analyst and private equity fund manager. Wu is also a proponent for Bitcoin Unlimited, a proposed scaling solution for the Bitcoin blockchain that intends to improve transaction speed by allowing for larger block creation. Critics of the solution claim that it could result in miners opting for bigger and bigger blocks – making it harder for miners with limited resources to mine, thereby concentrating the ‘mining power’ in the hands of few miners, (link to article below) effectively circumventing portions of Bitcoin’s decentralization protocols. So while the current situation where 53%-61% of the power to secure and verify the two most valuable blockchains rests in so few hands is bad enough, it could conceivably be much worse in the near future.

Next we are on to, “the greatest transfer of wealth in the history of mankind” where did the idea come from, and what does it mean? The origins of the phrase are hard to determine, but people have been tossing this buzz phrase around to describe many different situations, including: the real estate boom, commodities like gold and silver, the looming debt bubble and the passing of the baby boomers’ fortunes to their heirs. Recently we have heard the phrase used to describe the transfer of fiat currency to digital crypto-assets. Within this scenario is the vision of Bitcoin’s founders and early adopters, of the disruption of the existing economic system, dethroning the financial oligarchy and creating a more egalitarian currency system. Rok did a great job of expressing the sentiment and enthusiasm behind this viewpoint:

coming back to the concept of "the greatest wealth transfer of all time" - this will not just be a fresh round of executives or elites comparable to the 5% of humanity currently holding the majority of the global wealth. It's a new breed.

This class aren't merely traders addictively getting into crypto for quick pump-and-dump profits - they're a fresh generation of leaders, working on solutions to the world's largest challenges. These aren't the ambitiously-driven in the power & paper chase, but a wiser, mature tribe of intelligent creatives seeking to build new societal structures completely unlike the profit-obsessed, destructive, oppressive old.

The transfer shall occur from the aging sociopaths threatening mankind's well-being, to the misfit youth that never fit into "the system" and bought into the corporate B.S., but whom always felt it part of their mission to right the wrongs of the world through a sweeping movement putting the power back into the hands of the people.

And though some might criticize, suggesting the wealth is just going to move from one 5% group to another 5% who happened to be early adopters, that's not quite the case. Yes, there may always be a majority who've created massively more amounts of value than others, thus reaping their proportionate compensation. However, the power and influence of this new class of emerging leaders shall be directed much differently with a contrasting set of values and priorities than the previous...

As much as I would love to see this, I wonder if it is representative of our current reality . With the conditions of the ever-changing market it is impossible to identify exactly who stands to profit the most from cryptocurrencies, but we can see some trends in who the major investors are currently. Investopedia released an article January 8 identifying the top 5 Bitcoin investors (link below). The list includes:

Barry Silbert- former Wall Street investment banker

Blythe Masters- former managing director at J.P. Morgan Chase & Co

Dan Morehead- former Goldman Sachs trader

Michael Novogratz- former partner at Goldman Sachs

Tyler and Cameron Winklevoss round out the top investors, and while I don’t see any evidence they worked in the financial sector, they hail from the historically affluent town of South Hampton, NY and attended Harvard. I’ll let you decide if these factors alone are enough to lump them in with the financial elite, but they are certainly closer to that group than they are to the cypher-punk innovators we were all hoping for.

The Winklevoss Twins join Silbert and Novograts on Forbes Richest People In Cryptocurrency list (link below). Here we see more of a mixture of independently wealthy, early investors like Matthew Mellon, heir to a banking fortune and high-ranking member of the New York Republican Party, and financial sector whales, such as former Goldman Sachs executive Joseph Lubin, with crypto space innovators like Ethereum founder Vitalik Buterin and Binance CEO Changpeng Zhao. The most telling addition, or should I say additions, to this list are Chris Larson and Brad Garlinghouse of Ripple.

Ripple is considered by many crypto-enthusiasts to be the most un-crypto of all cryptocurrencies. That is, being a centralized system designed to help current, fiat based financial systems integrate into the coming paradigm, it is probably as far away from the original founders’ vision as a project could possibly be and still be called a cryptocurrency. Yet, as we can see in this post from @avilsd, https://steemit.com/cryptocurrencies/@avilsd/top-10-best-performing-cryptocurrencies-of-2017, Ripple, a centralized crypto-asset designed to support, not disrupt the current financial system, was the top performing cryptocurrency of 2017.

increasing adoption from institutional investors in part for Bitcoins rise to its all-time high a few months ago, due in part to, increasing mainstream coverage from networks like the Wall Street JournalBitcoin investment suitable for institutional investors.While the individuals I have listed above are technically considered non-institutional investors, many of them have a background in, and made the money they have subsequently invested in cryptocurrencies, in the traditional financial trading space. Also, they are not the only people from the financial sector to take notice of the potential for profit. In point of fact, this post from Steemit user @stewpeed https://steemit.com/bitcoin/@stewpeed/rapid-adoption-of-bitcoin-mainstream-media-institutional-investors-merchants credits . Moreover, many individuals and companies are actively trying to make the space more inviting for financial institutions, such as the recent ICO Cybertrust. According to the post https://steemit.com/steemit/@westonmills/a-cryptocurrency-based-banking-platform-for-institutional-investors-cabs-token from @westonmills, one of the main goals of Cybertrust is to make

Despite the FUD surrounding institutional investors adoption of cryptocurrencies, they seem to be doing so more and more recently. Steemit user @chayon showed us that nearly two-thirds of institutional investors are either already invested or considering investing in this recent post, https://steemit.com/bitcoin/@chayon/62-of-institutional-investors-are-buying-or-considering-buying-bitcoin. The implementation of Bitcoin futures and pending ETFs, which, according to an article this month on BusinessInsider.com (link below), JP Morgan dubbed the “Holy Grail,” give investment professionals a broad array of crypto related investment options. Even banking giant Goldman Sachs is getting in the game with the development of their new cryptocurrency desk (article link below), and financial backing of the tech startup, Circle which recently purchased the crypto-exchange Poloniex .

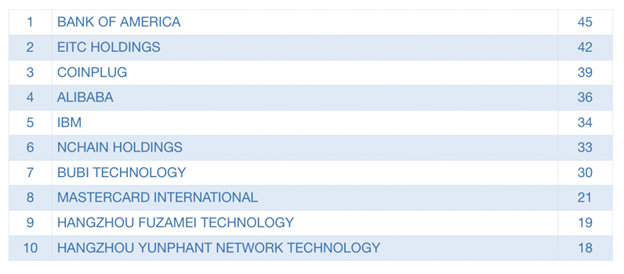

On top of all the financial sector money invested in current crypto projects, banks and other financial service providers are also investing in the future of crypto technologies. In fact, according to an article posted on News.Bitcoin.com (link below), the company that currently holds the most cryptocurrency related patents is none other than Bank of America.

Maybe I am misreading all of this information and these former high-ranking banking executives and hedge fund managers in the space were simply the first wave of individuals from their industry to see the writing on the wall. Maybe they were fed up with the corporate greed and the Wall Street rat race, and decided to go all in on radical social change. Rok-sivante included a quote from Buckminster Fuller in his post which has come to be a battle cry of sorts for crypto-visionaries, You never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete. The claim being, the new model is here. It’s gaining a foothold and the old guard are shaking in their boots. Unfortunately this manifesto doesn’t apply to our current situation. Crypto’s could have fit this ideal if the world population, or at least a large portion of it, had adopted them directly, abandoning the fiat system completely, instead of purchasing them with the money already in circulation. The reason that Fuller’s solution doesn’t work in the case of the transfer of fiat to cryptocurrency is that fiat has not become obsolete. In fact, cryptocurrencies rely completely on the value of fiat and can only succeed with an orderly transfer of that value. Anything less than massive adoption of a currency system with zero cost in fiat money is simply an exchange of value. It is true that this exchange of value comes with opportunities for profit for early adopters and wise investors, but there’s no getting around the undeniable fact that this is a buy-in system. Therefore, the outcome is weighted heavily in favor of those who have the most resources to buy in with. The banks know this, and while they are spewing FUD out of their public faces, they are buying in. And what’s more, as crypto investors, we not only want this to happen, we need it to.

If you would like to join the discussion or if you found this post interesting or useful please follow me. I will be posting a part 2 to this discussion, where we can debate what the effects of the crypto-revolution will likely be and what we can do to make the most of it.

1SBD award information

Thank you so much for reading my post. I put a lot of time and effort into this piece so if you feel like it was worthwhile an upvote would be greatly appreciated. As I stated above, I want to start a dialogue with Steemians interested in the cryptocurrency space as a whole, and where we are heading. To encourage discussion I will be sending 1SBD to the best counter-argument to my thesis: Satoshi’s vision is a pipedream. I will start a thread in the comments and share the top 3-5 comments for users to vote on. You may vote for your favorite by upvoting the posters comment.

(I’m not sure if this is the best way to set this up, but it seems like the most logical to me. I would like to do more posts like this in the future so if you have any suggestions on how to make this better, please let me know.)

References:

https://www.technologyreview.com/s/610018/bitcoin-and-ethereum-have-a-hidden-power-structure-and-its-just-been-revealed/

https://news.bitcoin.com/bank-america-filed-cryptocurrency-patents-company/

https://www.investopedia.com/articles/people/091516/top-5-investors-investing-bitcoin.asp

https://www.cnbc.com/2017/08/24/most-americans-live-paycheck-to-paycheck.html

https://www.forbes.com/richest-in-cryptocurrency/#37717cc01d49

http://bitcoinist.com/jpmorgan-proclaims-bitcoin-etfs-holy-grail/

https://www.bloomberg.com/news/articles/2017-12-21/goldman-is-said-to-be-building-a-cryptocurrency-trading-desk

http://www.businessinsider.com/jpmorgan-explains-why-a-bitcoin-etf-is-a-holy-grail-2018-2

https://www.investopedia.com/news/who-jihan-wu-and-does-he-basically-control-bitcoin-today/

History is riddled with unactualized ideologies. Humans have tended to glorify an idea as though it is to be the end-all-be-all, upon which utopia is to be realized. Frankly, I feel there are many who view “decentralization” in the same way - looking to the concept as though it’s the holy grail, expecting far too much far too soon.

Is crypto changing the playing field? Absolutely.

To the degree subscribers to decentralization dogma would like? Of course not. And it never will. Welcome to reality.

Nonetheless, it is serving as a powerful vehicle of the notorious “wealth transfer.” Not to the degree of any Marxist ideal, though the positive benefit the tech has already brought to many is not worth disregarding. I’m only one of many on this platform who’ve transformed their financial life through the opportunities this has all allowed to be created, and that I’ve been able to support authors in third world countries replace their monthly income through contributing to this movement... well, that makes a difference. Period.

So if the ultimate grand vision of a decentralized ideal hasn’t materialized... so what. constructive progress is still being made.

At least, that’s my outlook on the matter...

Thanks for the upvote and comment Rok. I really did enjoy your original post and appreciate your views. Even with the things I have seen in the market I am invested and plan on being in for the long haul. I got in at the end of December so the only way my life has changed so far is by becoming more stressful, but I can see where things are headed. Once I am able to radically change the circumstances of my life I will be in a better position to influence the lives of those around me in a positive way. Thanks for the inspiration!

Very interesting post, Upvote & RS

I must admit it was a dream idea but we see how it goes now. But maybe we can find solution for true decentralisation .

IdiocracyThank you for the upvote and RS @hanjo42. I plan on trying to start a discussion about a solution for true decentralization with part 2 of this post. I am also following your content ad recommend that anyone who enjoyed the movie check out your post, https://steemit.com/society/@hanjo42/dumb-and-dumber-scientific-proof-that-people-are-getting-stupider

My counterargument goes like this:

As new cryptocoins continue to proliferate, new kids of distributed ledger technology and new transaction confirmation methods will be devised, with wildly diverse potential impacts on the decentralization or concentration of wealth. These will become contenders in a partly competitive, partly collaborative process of diversification and selection. That is what crypto portends for the future of money in the marketplace.

Each person is individually susceptible to their own mix of media categories and rewards. Already there are algorithms that can look at our Likes — even without reading what we post — and infer things about us, things like whether we are already pregnant and when we are likely to out ourselves as gay, before we know them ourselves. Enticements can be tailored to us, using appeals that each of us finds as irresistible as beach vacations, bacon smell, kitten pics, or porn — whatever cranks our tractors.

While some coins will offer and perhaps even deliver privacy, other blockchains will accumulate and expose to the world Big Data about each of us that once was known only to Google, Facebook, and our credit card issuers. This accumulation will suffice, not only Big Brother, but also a plethora of Little Brothers, to target us with precisely those enticements that we cannot resist, rewarding us with coins that are specific to our desires.

Each of us will be specialized by the mix of coins we seek, drawn along our individual pathway through the world economic polyhive as if by a trail of pheromones in front of us. The hive will be a strange one, with as many multi-specialized castes as it has ants.

The super-rich and super-powerful, the Zuckerbergs and Putins, will not be immune. They will be pulled along their coin-lined pheromone trails by their susceptibilities, just like the rest of us.

When enough people cannot be enticed to do what the economy requires without hope that the vision of Satoshi Nakamura will be realized, then such hope will be manifested in the coins that the global hive drops in front of them.

The people who bring into existence those coins and the ledgers they embody will already, by then, have been lured and rewarded into specialization for this impressive task by the invisible smithy hand of the evolving polyhive.

In other words, the media nöosphere that rises from the confluence of all enterprises will select among a proliferation of cryptocoins to make Satoshi's vision real, because nothing less will suffice to keep a key sector of the population motivated and economically productive. Since the freight must ship, the dreams must flow.

Thanks for the resteem @wodahs! I'd love to hear your input on this subject.

Thanks for the upvote @sensation. Any thoughts on the discussion?

Thanks for the upvote @francescaelena. I would love to hear your thoughts on the discussion.

I can't counterargue, because I don't see where you are wrong. It's just another power and control tool :/ Totally agree that a new system can not be introduced gradually. I also think we as mankind should live in smaller settlements, to interact more with each other, physically. with a good distribution system. But then another dilemma shoots in: "He(she/those) who control the distribution system, control the world." We are all corrupt, or will be. Or oppressed. Don't worry, it won't last long. Unless we manage to make people grow much older. Then they can be tortured for eternity. ...sigh... how I wish I had more power :D

Ha ha, if you did have more power, you, by your own admission, would be corrupt. Is it better than being oppressed? Thanks for the reply and the upvote. I am following you and upvoted your introduction post!

The 1 SBD went to @custone Thanks for the replies!

Congratulations @thedialectic! You received a personal award!

Click here to view your Board

Congratulations @thedialectic! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!