As Bitcoin enters 2018 with more hype than ever, one debate that re-emerges is whether Bitcoin is Tulips or Gold; i.e., is it a bubble (Tulips) or a store of value (Gold)? I'll go into the details of the history behind Tulips and Gold in another post. In this one, I'll go through an overview of the financial, technological, and political reasoning that affect the fate of Bitcoin.

Profiling Bitcoin

Before we dive deeper into the analysis, let's take a look at what some of the trends in 2017 have helped us better understand Bitcoin, from both a financial and technology perspective.

1. Prices have skyrocketed: 20x for Bitcoin (BTC)

| Date | BTC Price |

|---|---|

| January 1, 2017 | $974.18 |

| December 17, 2017 | $19,340.10 |

2. Transaction fees skyrocketed, too: 76x for BTC

| Date | BTC Tx Fee |

|---|---|

| January 1, 2017 | $0.35 |

| December 17, 2017 | $26.52 |

3. Average Confirmation Time is extremely volatile and spans between 10 minutes at 42.4 hours in 2017 for Bitcoin

| Date | BTC Tx Speed (Minutes) |

|---|---|

| January 1, 2017 | 10 |

| June 8, 2017 | 2,548 |

Bitcoin's Scalability Nightmare

Current scalability issues limit Bitcoin to be, at best, a store of value.

Back in January 2017, the transaction fee was approximately .04% of the price of Bitcoin; in December, it has increased to almost .14%. The average transaction fee has a faster growth rate then the price of Bitcoin.

What do those numbers above tell us? Bitcoin is facing scalability issues. The skyrocketing, parabolic price increase is telling us there is more demand than supply of bitcoin. The increased average transaction fee and slower confirmation rates also indirectly implies more activity; Willy Woo estimates an increase of 2x users every 12 months (although I personally believe it's much more). In fact, forks like Bitcoin Cash were born to address Bitcoin's scalability issues. But that's getting into another debate.

The reality is, at its current pace, Bitcoin is headed toward only one of two options: it will become the next Tulip bubble due to speculative pricing, or it will become the next Gold as a store of value due to its outrageous transaction fees and slow transaction time, which make it impractical as a day-to-day transaction. Its fate, though, will ultimately be decided by regulation.

National and Global Regulation Probably Won't Favor Bitcoin

Satoshi Nakamoto alone would have the economic power of many nations.

For all you US citizens out there, remember when we first started sending troops to Afghanistan, then Iran, for Operation Freedom? Sure, the naive ones will say we're fighting for democracy, or freedom, whatever those mean. The more analytical critics of the war would argue that we're fighting for control over oil supply, because economics.

It's unlikely that governments will love bitcoin because, well, economics, too....

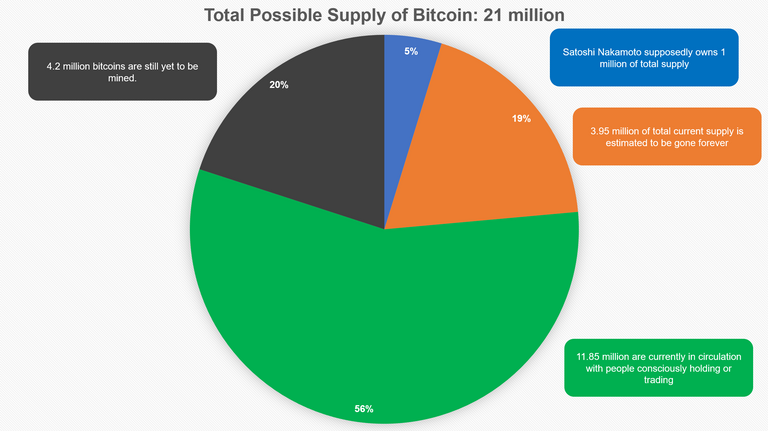

Currently, there are approximately 16.8 million bitcoins in circulation. That's 80% of the total bitcoin supply in existence today. In total, there can be 21 million bitcoins mined, so at the most, only 21 million bitcoins can exist.

Out of that 16.8 million, it's estimated that approximately 25% of the total current supply is lost forever. So that's approximately 12.85 million in circulation today, of which Satoshi Nakamoto supposedly owns approximately 1 million of them. So... There's really 11.85 million consciously held or traded. Even with the remaining 4.2 being pushed into circulation, that means only 16.05 million bitcoin would possibly obtainable.

Only 76% of the entire possible supply of bitcoin can be obtainable, not accounting for people who will hodl until their fingers bleed off. If governments decide to lean in favor of bitcoin as a store of value like gold, they would essentially be fighting over the leftovers at this point.

On top of that, someone or some group somewhere by the pseudonym Satoshi Nakamoto owns 5% of the possible supply; without knowing Nakamoto's intention(s), risk is increased tremendously; e.g., what would happen if one day he/she/they decided to transfer the 5% to, say, an unstable nation? That nation would probably then hold more wealth than many other nations, perhaps even combined. On a similar note, this implies Satoshi Nakamoto itself would hold the economic power of a nation.

So is bitcoin tulips or gold?

Currently, while it shows strong signs of tulips, it is behaving more like gold. With the introduction of futures by CME and CBOE we're likely to see more scrutiny with bitcoin in 2018, with possible regulation creeping up more in Q1 and Q2 of next year (we've already seen the Coinbase & IRS court ruling in Q4 2017). As an active participant in bitcoin myself, I hope for bitcoin's future as Gold 2.0, but I can smell the faint whiff of tulips not too far in the distance.

Congratulations @thekenny! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!