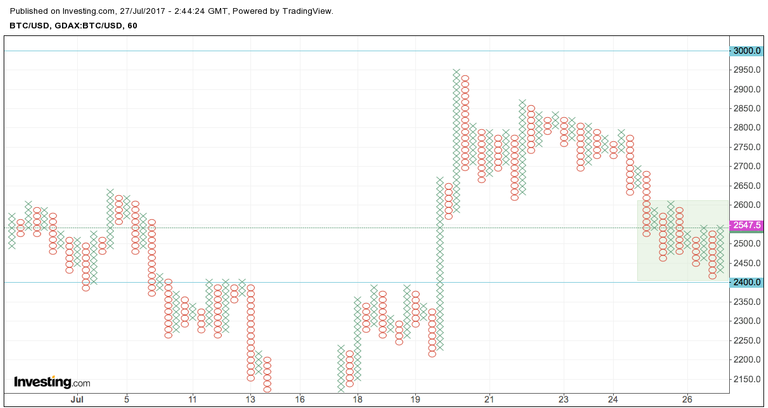

Thursday 27th July 0333 GMT - Bitcoin has been ranging around a high of $2,600 to low of $2,400 since the FOMC meeting minutes that sent the US Treasury bond yields and DXY plummeting last night.

Price action has been consolidating around the $2,500 range, easing out of the previous decent from the higher $2,750 numbers but unable to come back up.

The market is coiled ahead of July 31st/August 1st Segwit Bitcoin blockchain split which could potentially see a new currency emerging entitled Bitcoin Cash, with the weakened Dollar sitting at fresh 2 year lows having no upward effect on Bitcoin, the general market consensus for subdued behaviour in recent times, is reflected by the extremely low VIX levels and general uncertainty about the Dollars buying power as we continue through Q3.

In case of continued market uncertainty, and a growing bearish sentiment - we could see Bitcoin fall back into the intraday channel from last week, in ranges of $2,200 to $1,800.

Levels To Watch

Range Resistance: $2,600

Range Support: $2,400

Intraday Channel Top: $2,200

Intraday Channel Mean: $1,800

hey nice logo, btw :P

yeh looks good bro! Thanks for that! :) will be using on my posts