There are bad times for bitcoin, which does not end up raising its head. From the highs that reached in January over 16,000 dollars, the currency loses half of its value and has no sign of taking off on the rise. The growing doubts about its regulation have added all the concerns regarding the security of transactions, and the reaction of some technological giants, such as Google, which has just banned the advertising of cryptocurrencies on its platforms.

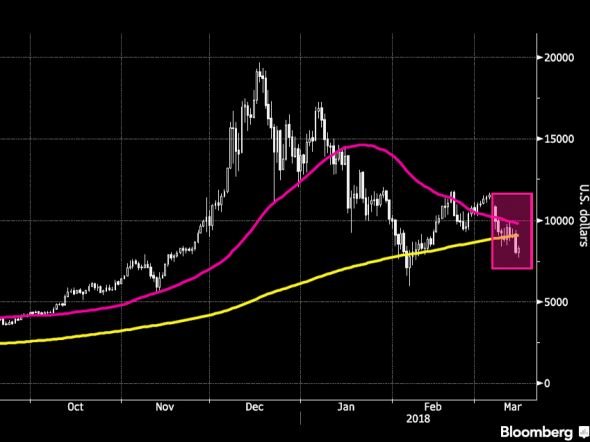

As if that were not enough, the technical analysis does not invite optimism either, because the fact that the currency made a double ceiling close to 11,800 points, adds a potential downward signal that could send contributions to the environment of 2,800 dollars. Specifically, what is known as a 'crossing of death' is developing, a situation that is known when the average of 50 sessions (in purple on the graph) cuts down to the average of 200 sessions. If this crossing ends up being realized, something that was not produced since 2015, the downward pressure can be redoubled over bitcoin.

Many investors have been attracted to bitcoin since it jumped into the futures market at the end of December, and the use of technical analysis is beginning to spread over its quotation. "There has been a definite change in recent months, after the bubble at the end of 2017," Paul Day, technical analyst at Market Securities Dubai, told Bloomberg. This expert has been studying the price of bitcoin since 2013 and its conclusion can not be more discouraging, as it is predicting a 76% drop from the highs of February, which will bring the price of bitcoin to 2,800 dollars.

The news flow is not good either. Yesterday, the Director General of the Police, Germán López Iglesias, warned about the "disturbing" and increasing use of cryptocurrencies for tax evasion, money laundering by criminal organizations and the financing of terrorism and has estimated that it is necessary strengthen the regulation of virtual money.

In his opinion, virtual currencies are an ideal tool for money laundering due to their global availability, ease of access, low cost, speed of international transactions and especially their potential concealment of the true identity of their owners.