Topics for Wednesday Morning Trading Group :

Bob Shenberger - Markets Trends

Ken Yamasaki - BPI and RSI

Kim Sharpe - Crypto Investing Strategies

George Crawford - Market

1.Low Volatility: VIX < 15

US Markets finally break out to the upside after being range bound for 7 weeks. However, Dollar is still rising and 10 Year Treasuries Interest Rates are above 3%. Enjoy the upside but be prepared to take profits or tighten stops.

2.Crypto Currencies vs US Dollar

Bitcoin is range bound between $8000-$10,000. CME is adding Ethereum along with Bitcoin. Coindesk has released their 1Q/2018 Blockchain Cryto report. Check out the link below. This is a trader’s environment, where you can buy or sell a small positions and take profits quickly. Are you mining cryptos in private wallets yet? US Dollar is still rallying up in anticipation of 4 more Fed Rate Hikes. Upside target is $95.

https://www.coindesk.com/coindesk-releases-2018-bitcoin-blockchain-industry-report/

https://www.coinbase.com/charts?locale=en-US

3.US 10 Year Treasuries:

Interest Rates cracked through 3% again. The yield curve is flattening and could go inverted. In the past, this has been an early sign for recession and market drop. Perhaps this time will be different…...

4.Cherry Picks Newsletters:

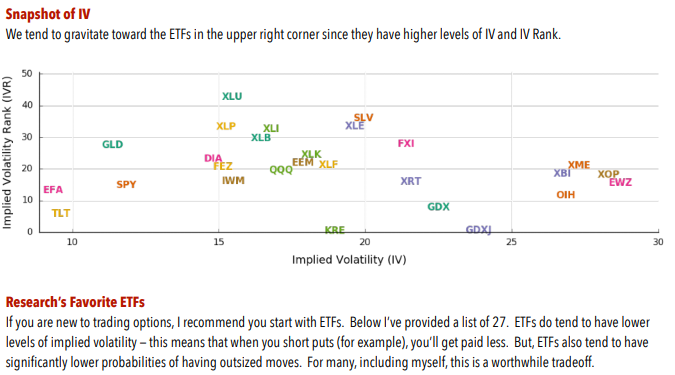

Tasty Trade Researchers publish an awesome weekly newsletter every Tuesday. Check out the link below. If this blog sounds like gibberish, watch "Where do I start 101" free education series on Tastytrade.com

https://s3.amazonaws.com/cherry-picks-s3-bucket-newsletter/live/18_05_15_tastytrade_Research.pdf?mc_cid=6cb97fa536&mc_eid=e9e24bad07

5.TRADE Log: VIX < 15, Low Volatility

- Long GOLD, BITCOIN

- Jade Lizards, Broken Wing Butterfly, Dynamic Iron Condors

- Debit and Diagonals Spreads

6. Videos

Theotrade - Doc Severson: Where Will Markets React in a Rising Rate Environment?