Summary:

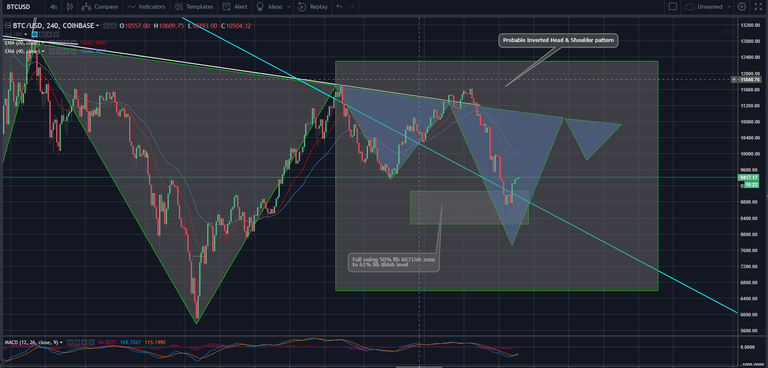

Bitcoin is bouncing 50% fib support as expected and we have 3 4 hr candles closed above the trendline support (please refer to my previous BTC post for details). But the body of these candles doesn't give an indication of the strength in this bounce up yet. We might see a small retracement back down to the trendline to retest the suppport before heading up.

This price correction would probable form another small inverted H&S formation with Head low at these level. This could make BTC extreme bullish and gives more confidence on upside targets of 17k, 24k and 33k in long term.

Volume has been at raising level and MACD has crossed to upside on 4 hr chart. Most of the other indicators are turning bullish, but it would be nice to see price retest and confirm the trendline support before heading up.

If you like this post please upvote, follow and Resteem this post, You can also follow me on twitter to get instant updates @tradewithtechie

Disclaimer:

I am not a financial advisor, nor the information posted in this article is a financial advice. The information in this article is my personal opinion and is not recommended to make any investment transactions based on it. I do not take any responsibility for the investments made based on my analysis.

All of these are possitive signals and another signals price is trading over 200 daily ema. Thanks for share. Have a nice weekend.

yup, thanks for let me know about 200 daily ema, I missed it some how.