Creating new ways for clients to get involved in the digital currency market

Image source: pixabay - Pexels

Let's hope this is a reliable piece of news and not "fake news".

Morgan Stanley, investment bank and financial firm, will be providing indirect exposure to Bitcoin via its derivatives. In today's Bloomberg - Alastair Marsh article, talks about the latest plans for the Wall Street firm to join the cryptocurrency market.

A person familiar with the matter said that, "investors will be able to go long or short using the so-called price return swaps, and Morgan Stanley will charge a spread for each transaction".

The bank is currently preparing to offer Bitcoin swap trading. A swap is derivative that could offer profits to the investor or losses based on the current market interest rates as well as the interest rates Morgan Stanley offers to its investors. Like other currency swaps, banks will eventually take a cut from performing this transaction.

Image source: pixabay - AaronJOlson

There is an eventual bank advantage, however investors are also shielded from some of the direct risks of buying Bitcoin directly from coin exchanges. CEO James Gorman himself said earlier:

"... the bank wouldn’t let customers buy and sell cryptocurrencies directly through Morgan Stanley, but would instead build a trading desk to support various derivatives tied to digital assets."

Source: Bloomberg - Alastair Marsh

The article also confirms from sources that the bank hired "Andrew Peel as head of digital asset markets from Credit Suisse Group AG in June". Other financial firms such as Citigroup and Goldman Sachs are also forwarding plans to offer crypto derivatives.

The Citigroup will be creating a digital asset receipt, where banks would hold these "foreign stocks" that are not available on the local exchange.

It [Digital Asset Receipts] works much like an American depository receipt, which has been around for decades, to give US investors a way to own foreign stocks that don’t otherwise trade on local exchanges. The foreign stock is held by a bank, which then issues the depository receipt.

Source: BusinessInsider - Frank Chaparro

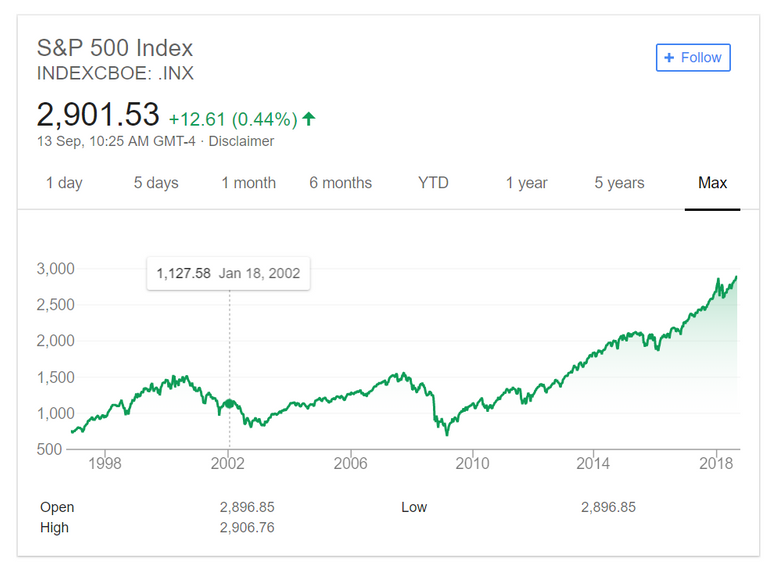

Image source: Google Finance

The most recent bubble that we should be concerned about is the stock market. Looking at S&P 500 Index, we are once again at the 9.5th year high prices. The previous long run lasted a period of 6 years (2003-2009). It is unclear how markets could continue to inflate while its citizens do not get any richer in the past 9.5 years.

Would the S&P 500 prices double in the next decade as reported by CNBC - Jeff Cox? Stock market bulls are as stubborn as Bitcoin bulls. Reports could be easily swayed to support either side of the story.

Moral of the investment story is to remember to hedge your assets in different markets and industries and to play a balanced game. Not everyone of us is Warren Buffet who can play pump-and-dump and tell his victories to his grandchildren.

Derivatives are inevitable disaster for crypto, make no mistake it will cause a crash like never seen. Obviously not now but in the long term. Derivatives have gone way beyond practical application and have caused several market crashes.

This is the price of the financial institutions playing the game.

strangely investors are attracted to the 'middleman' rather than lower the cost of investment fees themselves..

Morgan Stanley and JP Morgan are biggest game changer of Crypto market, by Giving statement, this custodian banks spread news against crypto but hold large amount of crypto.

Finally an intelligent article with actual analysis and not the usual crap you read on trending Crypto - like the dude who wrote a post with the words ding - over and over again - to describe cryptomining - and got over a hundred dollars vote. FFS.

hi @onepracticalcat, thank you for your kind words :) I will continue to write good quality articles here on Steemit

If you want to resteem or wanna upvote your post and want to promote your post, you can send 0.5 SBD to @steemvive and give that post link in memo, then it will be get upvote from our groups and 100% payment back if you won't get back. Steemvive gives you more back than you want. we have 20k followers in our group and many delegates. so don't worry to upvote your post.

Our website is coming soon....