Betcuen is a digital currency, sometimes referred to as an encrypted currency, and is derived from a source called Blockchain. It is commonly known as the first non-central bank currency, which is traded on a currency basis. The exchange rate is determined against the US dollar and the major currencies Other on the basis of supply and demand as is the case for other world currencies. The value of KFH has fluctuated and gone into recession and prosperity, and in the end, many believe that KFH is a storehouse of value against government-backed currencies.

Petcone is known as BTC, and is traded significantly against the rest of the major currencies through decentralized markets. The currency of the home is kept in places called "portfolio" which rely on special keys and encryption to maintain the home of a certain user or entity.

In comparison to the government-backed global currencies, the use of the currency as a currency is still somewhat complicated for the average user to get and use in normal transactions. The global investor interest in the portfolios of the Petequin has increased, but blockchain technology made buying and selling of homeowners easier for the average user. Increased acceptance by government agencies has improved the ambiguity of the legal and regulatory status of Pitcullen.

You can find the trading prices on the Betcuain on our graph and the latest news and analysis on the price of the trading of Petcavin

Betcuen vs. Gold: Major differences that traders should know

Betquin or Gold ? For traders, they are two entirely different markets to focus on; a binary is a decentralized digital currency from peer to peer that was "mined" for the first time in 2009, while gold is the precious metal, a highly tangible asset with high value since thousands of years.

Looking at the major differences between the pair will enable traders to make informed decisions and benefit from price movements. Key differences include levels of volatility, storage procedures, and demand sources.

There are similarities, too, such as the scarcity of each - there are no more than 21 million Petchemin, while there are about 180,000 tons of gold around the world according to recent estimates. There are other factors, such as the use of Betquin and gold as a currency, which is disputed. Here we will delve into the major differences that people must consider in order to be willing to trade on pectin or gold.

THE BIGGEST DIFFERENCES BETWEEN BETQUIN AND GOLD

- Volatility

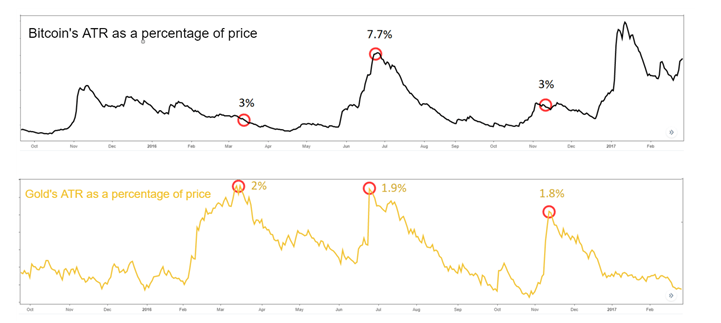

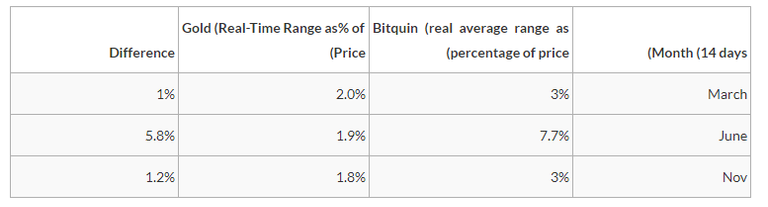

One of the most important differences between betquin and gold is the extent of volatility for both. One important measure of volatility is the real average range, which describes the extent to which the market moves, on average, over a specified period. Real-range averages are used in the charts below since 2016, as each segment is surrounded by a circle that provides the average range of price action over the past 14 days.

It is clear that the average real range of the bitumen, as a percentage of the price, is much higher when compared to gold. Moreover, the table compares between Betquin and gold when gold is subject to volatility, and the Betcairn is exposed to low volatility. Thus, we can conclude that, most of the time, Betquin tends to move further distances, making there more opportunities than gold.

BITQUIN VS. GOLD VOLATILITY PRACTICALLY

During 2017, the vicissitudes of the Betquin proved to have a dramatic impact, rising from 1,151 to 1,783 US dollars between January and December. And then dropped to $ 5951 by February 2018, before rising again to $ 11537 over several days, with more sudden rises to appear throughout the year.

Gold prices have been less volatile in recent years; since 2013, the price has remained fairly constant at around $ 1225 to $ 1,050 to $ 1,400 (as of November 2018). In fact, in 2017, there was not a single trading day during the year when gold ended more than 2.5% or less than the day before, an event we have not seen since 1996.

2. Storage procedures

The second difference between the Betquin and gold lies in the storage method. Because gold is a physical asset, it is stored in safes and safe deposit boxes in banks and personal safes in small quantities. On the other hand, you can not store Pitcuene coins in the traditional sense. Instead, what is stored is a secret number called a "private key," which facilitates the transfer of bitquins from one party to another. Buying a homeowner may be risky if you do not use a portfolio of hardware or software to secure your own key.

There have already been a lot of breakthroughs in the Betcairn exchange that have resulted in the theft of up to four million coins so far (Fortune, 2017). Strikes can have a negative impact on the price of Betquin, but they can also provide traders with opportunities to Sell. This can be seen next to other market events in the figure below, which highlights the sensitivity of the Betiquin price to market news and events related to the digital currency specifically.

Bitquin price is affected with market news

- Sources of demand

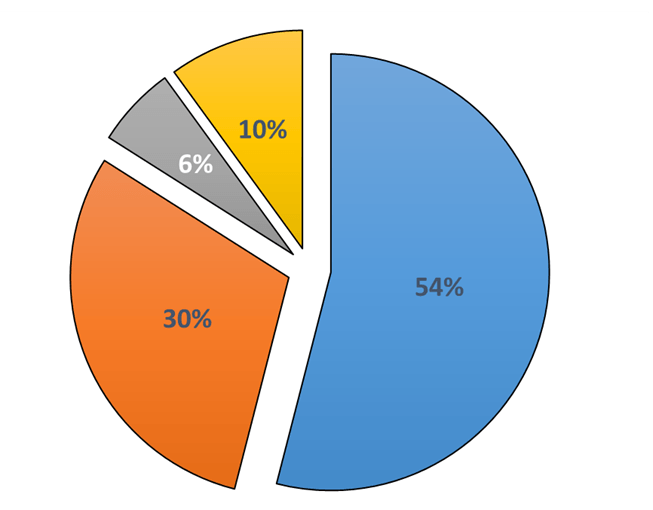

Gold, being an asset, has a history of 7000 years and can easily identify its own demand engines, as shown in the chart below. Demand for Betquin, on the other hand, is less clear and tends to focus on price speculation, procurement and retention strategies, and the underlying plucin technique itself.

Sources of Demand for Gold (2013 - 2017)

Source: World Gold Council, Metals Focus, GFMS-Thomson Reuters

In addition to readily identifiable sources of demand, gold tends to show seasonal trading. Sales tend to rise in January, February, July and August when the average returns are seen over a five to ten year period, as shown in the graph below:

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

our discord. If you believe this is an error, please chat with us in the #cheetah-appeals channel in