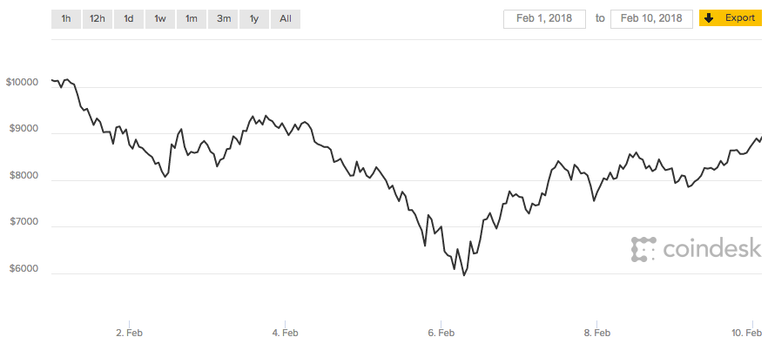

Bitcoin began its free-fall in mid-December when it exchanged just shy of $20,000 until a couple of days prior when it bottomed ideal around $6,000. The 70% drop finished soon after the Dow 30 Industrials had its initial 1,000 point in addition to decay a week ago. On the off chance that there ever was a period for Bitcoin to proceed with its slide to $1,000 or less this appeared as though this was the "right" time. In any case, Bitcoin beat not only the value markets from Tuesday to Friday yet additionally gold and the U.S. 10 year Treasury bond.

[Ed note: Investing in cryptocoins or tokens is very theoretical and the market is to a great extent unregulated. Anybody thinking of it as ought to be set up to lose their whole investment.]

The value markets had one of the most stunning exchanging a long time in years

The value markets were on an exciting ride a week ago with the Dow 30 having two 1,000 or more point drops that were 4.6% and 4.1%. Two of alternate days saw increments of 330 and 567 focuses or 1.4% and 2.3%. For the week the Dow was down 5.2% or 1,330 focuses. It likewise "moved" more than 22,000 focuses from its tops to troughs and back again finished the five days.

The S&P 500 and the NASDAQ saw comparative exchanging designs with decays a week ago of 5.2% and 5.1%, separately. Prior to the value markets energized on Friday the Dow, and likely alternate Indexes, were on track for their most noticeably awful week since October 2008.

Something that exclusive Bitcoin bulls thought could happen did

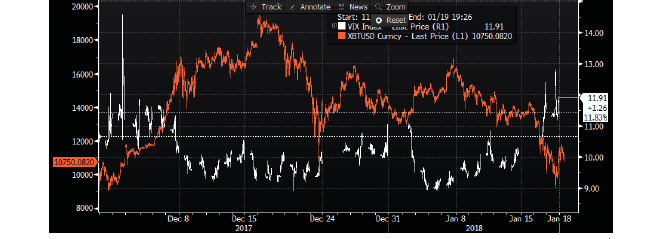

Bitcoin has ordinarily been more unstable then the value markets. Deutsche Bank's Global Financial Strategist, Masao Muraki, distributed a report indicating how Bitcoin's cost is conversely identified with the Chicago Board of Exchange's VIX record (nicknamed the Fear Index). The VIX utilizes choices to ascertain close term unpredictability for the S&P 500 and is a decent measure of speculator assessment.

Muraki's chart beginning on December 1 a year ago until the point that January 18 demonstrates that as the VIX diminishes, the white line, Bitcoin's value moves higher, the orange line. This is the Risk On exchange. Then again as the VIX expands Bitcoin's value tends to fall. This is the Risk Off exchange.

Be that as it may, the VIX bounced to levels not seen since August 2015. On the off chance that Bitcoin had taken after its past examples the digital currency ought to have been hit hard. Rather it aroused and beat the value files each of the four days beginning on Tuesday. Subsequent to falling on Monday Bitcoin something other than stood its ground.

Bitcoin versus the Dow a week ago:

Monday: Bitcoin down 16.8% versus the Dow down 4.6%

Tuesday: Bitcoin up 8.4% versus the Dow up 2.3%

Wednesday: Bitcoin up 4.4% versus the Dow down 0.1%

Thursday: Bitcoin up 1.4% versus the Dow down 4.1%

Friday: Bitcoin up 4.2% versus the Dow up 1.4%

For the week: Bitcoin down 0.4% versus the Dow down 5.2%

From Tuesday to Friday: Bitcoin up 19.6% versus the Dow down 0.6%

Different digital forms of money, for example, Ethereum, Ripple and Litecoin additionally observed comparative exchanging designs a week ago as Bitcoin's.

Gold didn't move particularly a week ago

Gold can be a place of refuge when there is a great deal of unpredictability in the value markets, particularly when expansion turns into a potential issue. For the week gold fell $22 to $1,316, or 1.6%, which isn't what you would anticipate. Bitcoin additionally beat it consistently beginning on Tuesday.

just wow

Thank you.