SIGNALS will start its token sale on 26 February 2018 so it's only 16 days from now, maybe my friends all can not wait to wait for the presence of this one token.

For yesterday may just discuss a little about the example and how to register it, for this time I will explain completely about SIGNALS.

SIGNALS may be my friend's traders are familiar with the word signal is as a marker or a notifier. SIGNALS is a trading platform where SIGNALS plays a role to tell users when to buy or sell tokens. This makes SIGNALS very reliable because SIGNALS can predict the increase and decrease of the token price. I think this is what is needed for a trader so no longer wary in making sales and purchase tokens.

After viewing the above mentioned vidio by SIGNALS, the SIGNALS platform connects several leading token platforms such as Bitcoin, Ethereum and other tokens that connect with SIGNALS. So that makes it easier for my friends to do token trading, so no need to be complicated again to move the website to do trading and exchange.

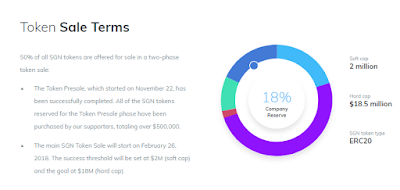

More than $ 500,000 of SGN tokens that have been in the message or purchased in November 2017 in the second phase, precisely dated 26 February 2018 which is the main phase of SGN token sales with a total of 2,000,000 tokens to be distributed for a total price of $ 18,500,000

HOW TO TRADE ?

After my friends enter and register as a member at SIGNALS my friends will find some strategies that have been prepared by SIGNALS to make trading.

First there is a strategy called BOLLINGER BANDS, this strategy is based on indicators to create ribbon volatilities this pattern that tells when we should sell or buy. Also included is the price of the tokens we will transaksikan, as well as we can move the point where we want to sell tokens automatically with a certain profit.

Second there is a strategy called CANDLESTICK PATTERN, in contrast to the BOLLINGER BANDS strategy, this strategy identifies the specific combination of open, high, low, close and uses it as a signal to sell and buy. This strategy identifies the specific value of the profit of the target set as a closing trade with a predetermined profit.

Then DONCHAINS CHANNELS, for this strategy is based on previous trade history indicators by measuring the high and low levels of past trades and strategies allowing users to be highly dynamic so as to respond to rapid price changes. This strategy uses the StopLoss function to avoid massive withdrawals on trading accounts of friends as well as this strategy utilizing parabolic SAR indicators to be more effective in their use.

MOMENTUM, this strategy measures continuously the movement of prices within a certain time. If the price rises above a predetermined limit, it will give a buyout. This momentum causes the next short-run price movement and this strategy also uses the StopLoss function.

MOVING AVERAGE This strategy is the fifth strategy provided by SIGNALS. This strategy is based on two indicators that move with different time periods of signals to make purchases and sales. The buy and sell signals are generated when the moving average crossed itself. The goal of this strategy is to buy when the uptrend starts and sells when the downtrend begins.

Those are some of the strategies I have captured from SIGNALS. For the rules contained in the strategy I will explain one by one, the rules as follows:

BOLLINGS BANDS, temen-temen must buy when the close price above the upper band closed open position if the PSAR value is higher than the actual closing price. Set StopLoss protector in the closing position with a predetermined loss. Set profit targets for closing positions with pre-set benefits, move StopLoss to break even point with open profit that has specified

CANDLESTICK PATTERN, buy when the high price of the StopLoss prototype candlestick pattern for the closing position with prodifined lose, set the profit target for the closing position with the pre-set profit.

DONCHIAN CHANNELS, buy when the price breaks the last 20 bars high close position when the PSAR value is higher than the actual closing price, use the StopLoss function and set the target profit.

MOMENTUM, buy when the price broke the previous high, thus creating a new high and moving over 5% put the StopLess function and set profit target.

Buy when Moving Average (fast period) above the moving average (slow period) close position when moving average (fast period) below moving average (slow period) set StopLoss function.

Okay that's the rules for some strategies that have been prepared by the SIGNALS, for more details try to read WHITEPAPER HERE.

For all friend who like bounty please check the following address BOUNTY SIGNALS

The SIGNALS party provides 2% of its tokens for the BOUNTY program.

Further information visit LINK below:

SIGNALS official website

bitcointalk SIGNALS

telegram SIGNALS

twiter SIGNALS

facebook SIGNALS

reddit SIGNALS

linkedin SIGNALS

youtube SIGNALS