Bitcoin price is rising as we speak. This week is the 'eve' of August 1 Hardfork or Softfork or whatever. When it comes to making investment decisions on cryptocurrencies such as BTC, ETH or XRP, it is always tougher for small-time investors than a seasoned investor because fiat money such as USD, EUR, GBP, CAD, MXN, CHF, RUB, CNY, JPY, AUD, INR, KRW, and so on are hard to earn in the physical world and cryptocurrency market is highly volatile! These currencies are the foundation on which cryptocurrency revolution is currently happening.

BTC and BCC

If you are an ardent follower of cryptocurrencies you might be well-informed of the possibility of Bitcoin splitting into BTC and BCC on August 1, 2017. BTC is the currently existing Bitcoin, while BCC refers to Bitcoin Cash, a clone of Bitcoin. This split is called Hardfork and happens as a group of Bitcoin miners move away from the currently existing mining software and choose to run a different software version for mining that doesn't support the existing version. The reasons for split - ego, power and conflict of interest.

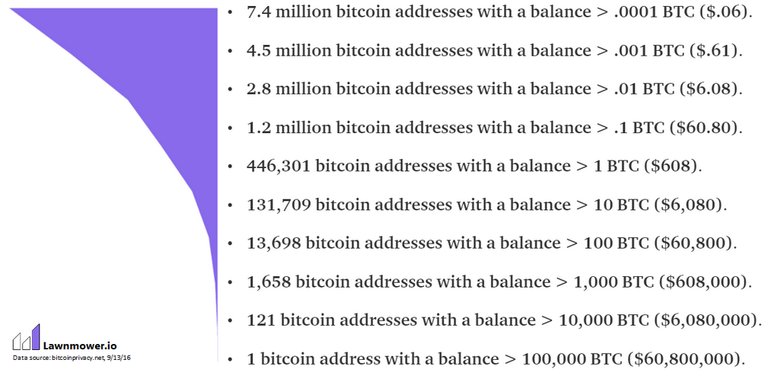

This, September 2016 figure, shows that 96% of Bitcoin addresses held less than 1 BTC (the first four rows of data). Yes 1 BTC was $608 at that time and now $2650. Let us assume that the percentages of BTC in addresses remain the same. If we consider these 96% addresses to be of small-scale investors' then that gives a high probability that you could be one among this large group of investors. Should you suffer because of the clash between Bitcoin miners? - No. There is always light at the end of a tunnel and Bitcoin is not going to be a dead end.

2x Bitcoin

By holding Bitcoin in your wallet, you can potentially double the quantity of Bitcoin you possess! After the Hardfork, there will be two separate entities - BTC and BCC, that operate from the same user-base as before. But the catch is, as you might have heard, Never store Bitcoin in online crypotocurrency Exchanges for the next 2 to 3 weeks!

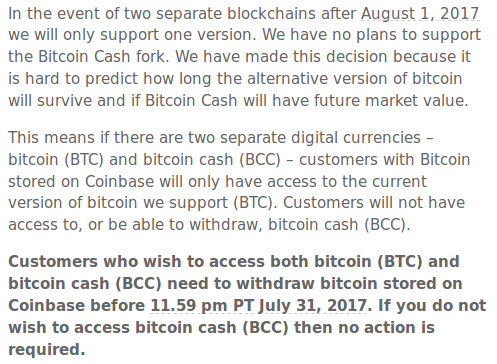

If you take it as a challenge and store your Bitcoin in an online Exchange, there is a high chance that your Bitcoin will completely get stolen away! But this doesn't apply to all Exchanges. Take Coinbase for example, they just sent me an email stating that they will keep all BTC secure and also that they will NOT include BCC in their Exchange by default.

Coinbase e-mail

Online, Offline and Hardware wallets

Bitcoin can be moved out of Exchanges and stored in any of the three wallets - Online, Offline or Hardware wallet. Online wallet and Offline wallet are almost the same. In Online wallet you would need Internet connection to access your account but the Offine wallet is a software installed in your computer/phone that stores a copy of your Bitcoin account details. To access these wallets you would need a key, which can also be simply called 'a password'. There will be some other identifier keys too, which you need to store safely (save it on a notepad in your computer or write it down in the notebook next to you, as you wish).

Check out the Blockchain wallet - a Bitcoin wallet available Online, and also as Offline wallet from App Store | Google Play

https://blockchain.info/wallet/#/

https://blockchain.info/wallet/#/

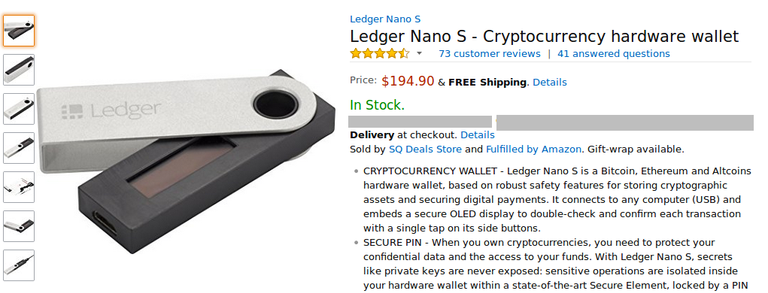

Hardware wallet

https://www.amazon.com/Ledger-Nano-Cryptocurrency-hardware-wallet/dp/B01J66NF46

https://www.amazon.com/Ledger-Nano-Cryptocurrency-hardware-wallet/dp/B01J66NF46

Clearly differing from the previous wallets is Hardware wallet, which is a physical device. It can cost anywhere between 30 USD to 200 USD or even more. These wallets can store account details of multiple cryptocurrencies like BTC, ETH, XRP and so on. The device has a provision to enter a PIN and this procedure will give access to the account details. It is as simple as that.

But if you are a small-scale investor, and not inclined towards spending for a Hardware wallet, then you can very well make use of the Online wallet or Offline software wallet. The current unrest in Bitcoin and the hacks that occurred in some ICOs, like CoinDash, can be used as a fear factor to sell Hardware wallets to the public. As long as you can keep a single piece of password safe and be on the look out for hackers who may ask your phone numbers or computer login details, you should be fine. Remember that, just as in any other sectors such as traditional banking, insurance, mobile and car industry, there will be prying eyes (and ears) to steal your personal information for their own benefits. Cryptocurrency industry is more volatile and new. Be safe. Grow rich!

As someone new to cryptocurrency, I enjoyed the article. I also gained a better understanding of the August 1st event. Thank You!

@emergehealthier Thank you for your comment! I'm glad that you found it useful :)

Thank you! Appreciate it :)