Sorry for the lack of updates over the last two days, I had a 2,500km epic drive back from the South of Spain, and I have been getting my head down to rebuild my crypto tracking document, looking at the performance of each of my investments and rebalancing my portfolio.

The new structure of my portfolio is designed around my strategy and goals, where I am looking for robust growth against a risk profile, where I:

- Make long term investments in coins which demonstrate stable growth

- Make speculative investments in small up and coming coins with the potential of high gains

- Take 5% profit off the table every time my portfolio grows by 25%

This process will be in three stages, whereby I:

- Stage 1: restructure my Investment Tiers around coin performance criteria

- Stage 2: rebalance my portfolio based on individual coin performance potential

- Stage 3: sell-off junk coins and make new investments across tiers

I will cover Stage 1 today and the other two stages over the next two days.

Stage 1: Restructure my Investment Tiers Around Coin Performance Criteria

The first stage in rebuilding my portfolio is a redesign of my investment tiers, considering the following:

- What is the goal of the tier

- What are the criteria for a coin to be included within it

- Which coins make the cut

- What % of my portfolio is allocated to it

Previously I had four tiers, but I have now upped this to five:

- Tier 1 — Large Stable Growth Coins

- Tier 2 — Developing Stable Growth Coins

- Tier 3 — Developing Unstable Growth Coins

- Tier 4 — Emerging Growth Coins

- Tier 5 — Punts

Tier 1 — Large Stable Growth Coins

This tier represents the majority of my portfolio, around 70%. As Crypto trading is now my source of income, it is important that I can take profit off the table each month to support my cost of living. This has changed my risk profile in that I am now more interested in stable growth over chasing 10x growth coins.

The criteria here is that each coin tends to be (but not limited to):

- Top 10 by market cap

- A +$1bn market cap

- In existence for over a year

The criteria above ensures that I am invested in the most promising long term coins, and thus, they have an established brand, development team and price history that can be tracked.

If you look at the chart below for Dash, this is a perfect example of why these coins represent the majority of my portfolio. Ignoring the post recent parabolic price moves, Dash has kept within a steady range and also survived the crash of June/July relatively unscathed.

The portfolio can change, but as of today, this tier includes the following coins:

- Bitcoin

- Bitcoin Cash

- Dash

- Ethereum

- Litecoin

- Monero

- NEO

- Iconomi

- Ripple

- Ethereum Classic

There are some necessary notes and exceptions to the criteria:

- Ripple is a tiny legacy investment, and I am out for the moment

- Ethereum Classic is a tiny investment based on free coins from the Ethereum fork

- Iconomi does not fit the criteria based on market cap size and position but it is one of my leading £ investments as I believe it is a fantastic project and growth will be similar to the other coins within this tier

Tier 2- Developing Stable Growth Coins

The second tier is for those coins with a lower market cap but have demonstrated stable price growth. These are coins which are more susceptible to wider market movements than tier 1 coins but are also resilient when the market crashes.

Being lower in market cap than tier 1 coins, they have the potential for higher % returns if they catch a wave but historically grow in price against a steady range.

The criteria here is that each coin tends to be:

- Top 50 by market cap

- A +$100m market cap

- In existence for over a year

If you look at the chart below for MaidSafeCoin, you will see that it has grown in price in a steady range this year, though it did jump with the May/June boom and drop back with the June/July crash. It has though recovered well and looks good for a new all time high soon.

The portfolio can change, but as of today, this tier includes the following coins:

- Komodo

- BAT

- Augur

- Maidsafe

- Factum

- Cofound.it

- Waves

- Lisk

- Ark

- PivX

Tier 3 — Developing Unstable Growth Coins

The third tier is very similar to the second tier but represents coins which are a little more unstable in price, perhaps have pumped too much at some point or are a service based token where the development team is attempting to control price.

While the price is less stable than the tier 2 coins, I keep these investments within my portfolio if I believe in the project as there is every chance that these will become a good long term investment.

The criteria here is that each coin tends to be:

- Top 10 by market cap

- A +$1bn market cap

- In existence for over a year

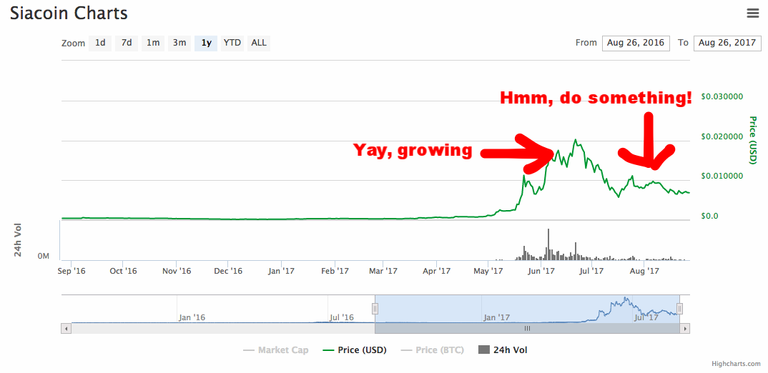

The chart below for Siacoin is a great example of an unstable growth coin. The price grew during the boom of May/June, and while it dropped with the correction of June/July, it hasn’t fully retraced and is now trading sideways. They represent a small % of my total portfolio, but any significant move can lead to significant returns.

The portfolio can change, but as of today, this tier includes the following coins:

- Stratis

- Syscoin

- Siacoin

- Storjcoin

- Golem

- Steem

- NextCoin

- Ardor

- EOS

Tier 4 — Emerging Growth Coins

The fourth tier is for those smaller investments which are growing well and showing signs of stability too. These coins are ones which, if they continue to show traction, may become the next NEO and as such will move tier. These are projects which I try and invest in quite early and ride the waves up.

The criteria here is that each coin tends to be:

- Top 100 by market cap

- A +$25m market cap

The below chart for Blocknet is an example of one of these and as you can see it has shown a steady increase in price from April/May, surviving the June/July correction and making new highs within an excellent range.

The portfolio can change, but as of today, this tier includes the following coins:

- TaaS

- WingsDAO

- LBRY Credits

- Blocknet

- GameCredits

- Edgeless

- Monacoin

Tier 5 — Punts

These are small, speculative investments in new coins which show promise. I try and invest in these as early as possible and accept that I may lose everything, but if they become a significant project, then the returns can be excellent.

The only criteria for a coin to be included within this tier are for it to sit outside of the top 100 coins and thus have a very low market cap.

The chart below is for Chronobank and demonstrates the kind of punt I am looking for. It is currently 144 by market cap at £14.7m. It is making nice gains but is quite volatile. I will sit on a coin like this for a long time as tier 5 represents a very small part of my portfolio. There would have been a time when NEO was part of this tier, so you can see how things can change quite quickly.

The portfolio can change, but as of today, this tier includes the following coins:

- Zencash

- GridCoin

- SynereoAMP

- TokenCard

- ZCoin

- RLC

- Matchpool

- Verge

- Swarm City

- LomoCoin

- Mysterium

- Chronobank

Next Steps

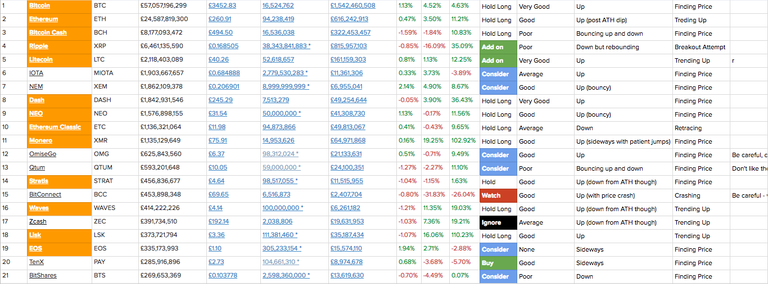

The next step for me is where I will rebalance my portfolio based on individual coin performance potential. What I will be doing here is changing my levels of investment both in tiers and coins, whereby I will be looking at the average growth pattern for each tier, the general reaction to market crashes and thus updating my risk profile.

I will likely be reducing my investment in tier 1 to increase my investment in tier 2 with tiers 3, 4 and 5 staying relatively the same.

Hopefully, I will be able to post this tomorrow. Please give me a shout if you have any questions.

11 COINS FAUCET FREE EVERY DAY

FULL WALLET FUNCTIONALITY

https://goo.gl/aCKaJ4 Qoin

START WITH FREE COINS

Signup and we will credit your Qoin wallet everyday with:

0.00000250 BitCoin

0.00007671 LiteCoin

0.00604838 FeatherCoin

0.24640460 Virtacoin

0.00056826 PeerCoin

0.00004063 Dash

0.00025130 Neo

Trusted 2014 - 2017

Thank you for sharing your portfolio! Upvoted and re-steemed.

Nearly everything you do is of no importance, but it is important that you do it.

- Mahatma Gandhi

Nice post. Good to see I'm not the only one who thinks like this. The crypto space brings the biggest group of uneducated investors with it. This group will only grow. I was researching a way to do better investment analysis on the current cryptos. I found this great website: https://www.coincheckup.com This site gives a complete analysis and investment stats on every single tradable crypto out there.