When you're drunk on Twitter you end up making promises that lead to posts like these. Never again.

A technical concept claiming to provide SPV clients with improved protections by giving non-bad acting full nodes the capability to identify an invalid chain during a time when there’s more PoW backing the invalid chain.

If I understood the Plasma explanation correctly, it’s a tree structure where each branch represents a blockchain, and the sum PoW of all the branches is considered the “root chain”.

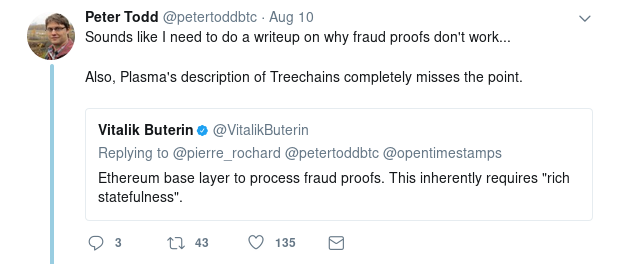

According to the Plasma paper and Ethereum wiki, the data availability issue is regarding situations where not enough information is available to detect potential fraud. My interpretation of the matter might not be completely accurate.

An Ethereum wiki entry to a solution called “Erasure codes”. This is a way to recover information based on the data currently available. In the context of Ethereum, the idea is to use data recovery methods to expand partial data (deterministic), and then use probability to decide to accept or reject the block in question.

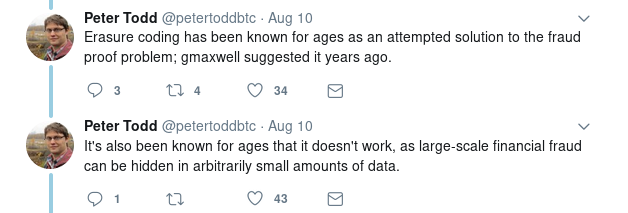

The claim is there’s a method of obfuscating and ultimately bypassing the fraud detection by using small amounts of data.

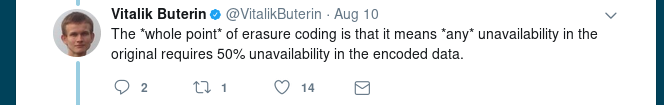

I’m not sure I understand this response. Emphasis on being able to recover all information.

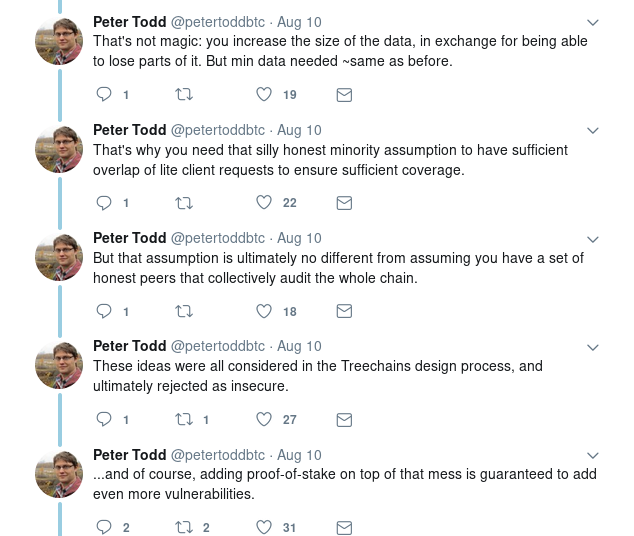

The first Tweet is referring to the approach Ethereum is or will be using to implement their EC strategy. The minimum size of data needed to recover the unavailable data is the same, but the criticism being that they inflated the block so that more data can be lost, and although it’s safer for EC, it’s not exactly optimal because the requisite data size for the EC remain the same.

The second Tweet is referring to a trust method that I believe only exists as an Ethereum concept. The idea is that a light client will download random chunks of a block and essentially trust that everything is okay if those random chunks are valid. It’s more complicated than that but I believe that’s what’s stated in the wiki.

The third Tweet is stating that the approach being taken is potentially no better or different than trusting all connected peers to audit the chain.

The final two Tweets are essentially stating that there’s a compounding of vulnerabilities by implementing previously rejected concepts and merging them with additional experimental concepts.

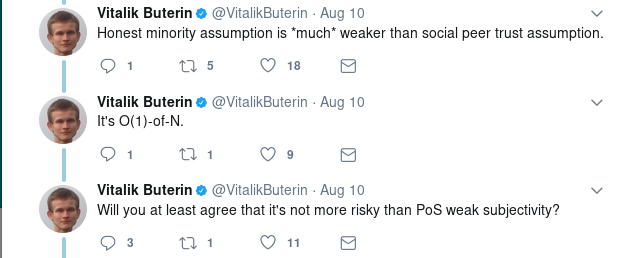

The first two Tweets are referring to the complexity of the algorithm utilized in his solution. He’s stating that his solution is of constant complexity time. This means that the number of operations performed are fixed (constant) and this means the time to complete the operation(s) won’t change. I believe the argument here is that the “minority assumption” is efficient because it is O(1) (and that means the execution time is independent of the input) divided across N clients.

The final Tweet is referring to a concept I believe has it’s roots in Proof-of-Stake. The idea being that redundant data is needed to produce multiple versions of a blockchain and then the proper chain is later identified. I could be wrong about this and I’m not familiar with the concept.

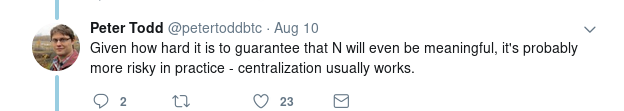

I believe the argument here is that N being a natural number greater than 0 (which is the numeric representation of clients) is difficult to guarantee that the number itself is a healthy sub-sample of the network to ensure the safety of the method.

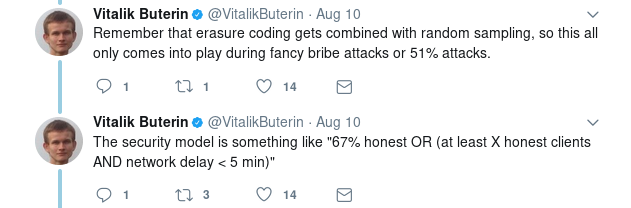

I believe the argument here is that there should be no concern because there’s a combination of methods being utilized to come to the same conclusion.

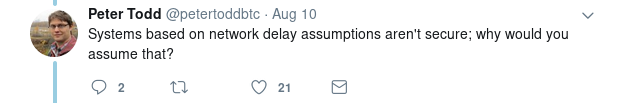

He’s stating that network timing attacks are well known and is emphasizing that trying to reason with network delay in such a manner could lead to potential security risks.

He’s claiming that Bitcoin isn’t secure because there’s network time considerations above 10 minutes. His implementation as stated in his last Tweet is less than 5

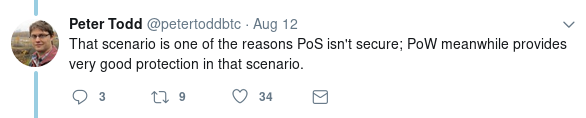

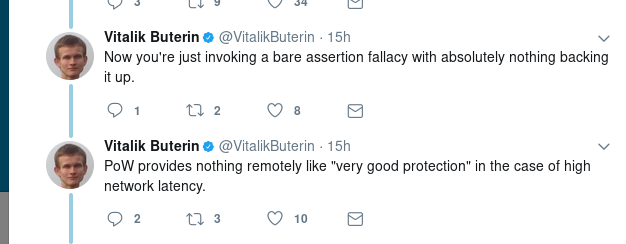

He’s pointing out that network delays in PoW isn’t an issue because PoW itself is a protection from such attacks where PoS probably can’t be.

I’m not sure I understand the argument here. Maybe I’m not smart enough or I just don’t understand the thinking here.

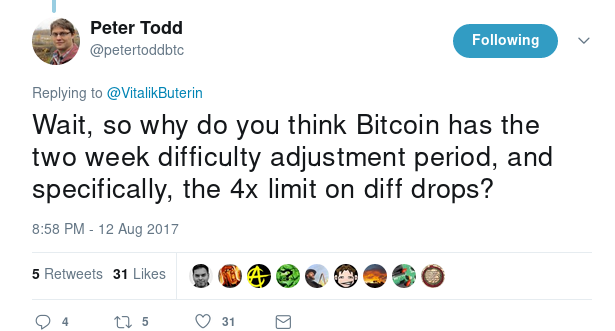

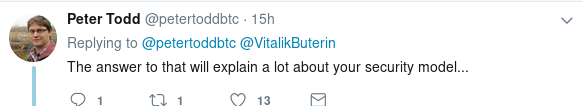

He’s questioning Vitalik’s understanding of Bitcoin and the innovation that is PoW.