Hello traders. Today I'm going to give you an update on bitcoin and where the price is heading next. I will be writing in a longer term perspective.

There are really great stuff coming for bitcoin that makes it fundamentally strong investment at these low levels. Following news and keeping eyes on these projects that are coming to bitcoin might give you an idea. I'm trying to keep this unbiased and also it is worth to keep in mind that this is not an financial advice. Do your own research and if you decide to invest or trade these decisions are totally up to you.

Overall sentiment and atmosphere is very bearish. Main reason for this is that a lot of people bought at the high prices, expecting high returns but each time it showed signs of a bullish reversal, downtrend resistance was hit and it dropped even lower. This is likely a good buying opportunity because when overall sentiment is pessimistic, markets are likely to recover soon after. This is known as "the herd effect" when majority of people follows a bit behind and have made some losses.

Anyways let's get to the technical part.

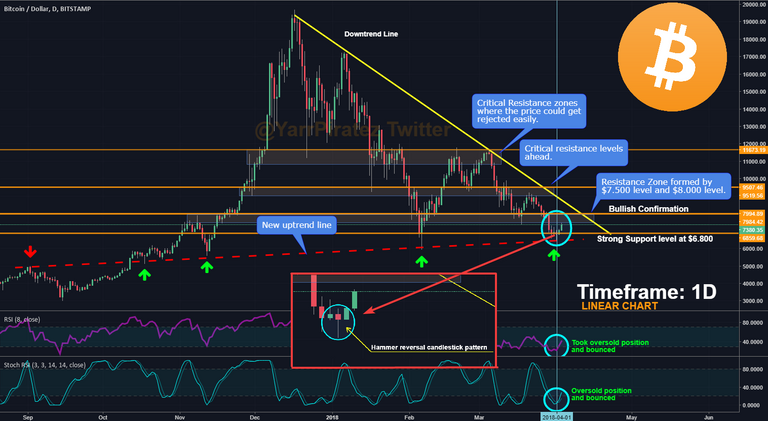

In the both charts (Linear & Log) - both downtrend lines got violated and it got pierced through. Linear managed to recover back above of the uptrend line and which also rejected strong support level found at $6.800.

[Image 1 LOG-chart]

[Image 2 LINEAR-chart]

The linear chart (Longer term)

is showing us signs of recovery on the daily timeframe.

- StochRSI has taken oversold position, pointing upwards and has a plenty of space to move upwards.

- RSI agrees with StochRSI when it took oversold position, bounced and now is pointing upwards

- Hammer pattern which can be found at $6.800 level.

The price is heading towards the first resistance zone which has acted previously as a support area. This area should not be neglected as the price might have a minor pullback from this level. More details on this down below.

[Image 3 The Daily Chart]

Confirmations are very important when it comes to trends. The daily candle needs to close above of $8000 resistance level to give a bullish confirmation and that the price is wanting to move further upwards or needs to break above of it with force to indicate that buyers are back in the game.

To see full bull mode on, the price needs to breach above of the second resistance level which can be found in between of $9.000 level and $9.500 level. This is why it's crucial to follow the price movement near to the first resistance zone and see which direction it will take from there. It's worth noticing that after huge downtrend, recovery should not be expected to happen quickly. Recovery from a bear trend takes time and will gradually turn in to a bull trend.

[Image 4 The 4h Chart]

The 4h chart (medium term)

is showing signs of exhaustion and minor pullback should be expected soon.

- StochRSI + RSI takes overbought position

- Hovering close to resistance zone ( formed by $7.500 level and $8.000 level) where it's likely to have minor pullback before moving back up again.

- No bearish divergence other than on the 1h chart (not reliable / confirmed yet)

Conclusion:

The daily and fundamental aspects of bitcoin are showing that with these prices it's likely a good opportunity to open longer term trades. If it does manage to break above of the first resistance zone, then there are two ways to enter this breakout:

- The breakout

- The retest of the breakout

For the short term traders minor pullback should be expected and for the longer term, it's starting look good.

DISCLAIMER:

Please be aware this is not financial advice. You are responsible for your trading and investing decisions. It is highly recommended to do your own research before investing anything.

My list of trading tutorials

Please consider upvoting if it has helped

More coming soon!

Lesson 1 - Beginner's Guide: How to use Moving Averages to Day Trade?

Twitter - http://twitter.com/YarrPiratez

Telegram - http://t.me/YarrPiratez Crypto Signals & News

Telegram - http://t.me/YarrChat Coin Chat Room

Trading View - https://www.tradingview.com/u/yarr/

Donations:

LTC - LZUDfi91HEoL589gwBXRQ9WfrFnGYNnot5

Still too early to say that the market is correcting.

This is a good post, followed you so keep them coming.