Hello traders!

This will be my first post in Steemit and I want to share with you guys my Moving Average Trading Strategy that can be used with 15min, 30min and 60min timeframes.

This is my experience how do I trade and learning a strategy takes time and effort, also it is recommended to do your own research before investing or trading.

Before you can actually use this technique you must know what is a moving average.

Quoted from investopedia:

"A moving average (MA) is a widely used indicator in technical analysis that helps smooth out price action by filtering out the “noise” from random price fluctuations. It is a trend-following, or lagging, indicator because it is based on past prices.

The two basic and commonly used moving averages are the simple moving average (SMA), which is the simple average of a security over a defined number of time periods, and the exponential moving average (EMA), which gives greater weight to more recent prices. The most common applications of moving averages are to identify the trend direction and to determine support and resistance levels. While moving averages are useful enough on their own, they also form the basis for other technical indicators such as the Moving Average Convergence Divergence (MACD)."

In simple words it is a trend-following and lagging indicator which is based in the past history.

INFORMATION

(You can skip this part if you know how to setup tradingview)

List of things that are required:

- Trading View account (Tradingview)

- Time to practice this strategy and basic knowledge of moving averages

- An exchange account (Binance for example)

- It is a necessity to do your own research before investing anything!

Steps to begin with:

- Sign in to your tradingview account

- Click chart

- Pick a coin that you want to trade

- Make sure you use "Candles"

- Pick one of the timeframes 15m, 30m, 45m or 60m

- Go to "indicators" and search for "moving average exponential".

After you have made sure you have clicked 4x times "moving average exponential", then it's time to add some values in to them.

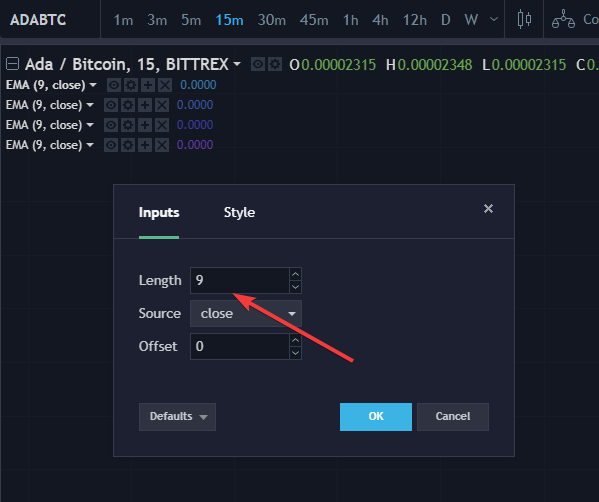

Click "settings" icon and it opens a window which looks like this.

Change numbers until you have changed all 9's to the following numbers 8, 13, 21, and 55.

TRADING

I use exponential moving averages of 8, 13, 21, and 55.

This is super simple trading strategy and it takes effort before you are able to use it properly.

The general strategy is that when all the moving averages cross each other, it is time to go LONG with the 55 moving average staying BELOW. Sell when moving averages cross again, leaving the 55 moving average ABOVE.

Let's take a look on LTC/USD

Another example on NEO/USD

Keep in mind that there is a chance that a price will touch the 55 moving average couple of times without BREAKING it. That's why it is important to be alerted when to sell.

How do you know when a price reached it's top? To be honest with you that nobody really knows where the actual top is going to be. These tools are helping us to find the closest point but not the actual one.

Advanced version

Once you have given yourself enough of time to master previous trading strategy, then it's time to add one more indicator to it.

This indicator is called MACD (Moving Average Convergence Divergence).

MACD belongs to same family tree than moving averages. It is a momentum indicator.

When MACD is added, this trading strategy can be used with bigger timeframes.

You can think MACD as an assistant who brings you coffee every morning, so you get enough of energy to survive till end of the day. MACD isn't any different from that, it gives us something what we need to ride the wave and sell near to the top. That something is called confirmation. It is necessary to have as many confirmations as possible so we can make it till end of the day.

NEO/USD example on 45min timeframe

As you may have noticed that, it did indicate to sell near to the top. Isn't that awesome?

I hope this helped you to get overall view on my trading strategy that I use. This isn't quite far from my setup that I use daily but it's close enough!

Please, if any question comes to your mind don't hesitate to ask! I try my best to respond ASAP! :)

If you need help with trading, finding information or courses let me know and I'd be more than happy to help you!

Twitter - http://twitter.com/YarrPiratez

Telegram - http://t.me/YarrPiratez

Trading View -

https://www.tradingview.com/u/yarr/

Donations:

LTC - LZUDfi91HEoL589gwBXRQ9WfrFnGYNnot5

Great post. Very straight forward. We use the same averages, and glad you pointed out that no one knows the top!

Very good beginner guide to MA's, thank you and good luck!

Thanks for the article. I appreciate the time and your expertise.