Ahoy mates!

Today I’m sharing with you my weekly update on bitcoin. This time we dive into the depths of Kraken where no pirate has gone before and some dare to oppose the monster itself! So prepare for the bullish case for bitcoin!

When the whole market is full of pessimism, and people are looking at the same bearish targets, this indicates only one thing to me. As this legendary investor put it:

The market is showing a strong bearish sentiment and what usually happens during that is the people are stuck with bearish thinking or are only seeing bearish patterns. This is also the time when people are not finding it as attractive an investment either.

This article is mainly focused on what whales don’t want you to see and also we will be focusing on the larger picture so it’s easier to understand where Bitcoin is heading next.

The Market Psychology

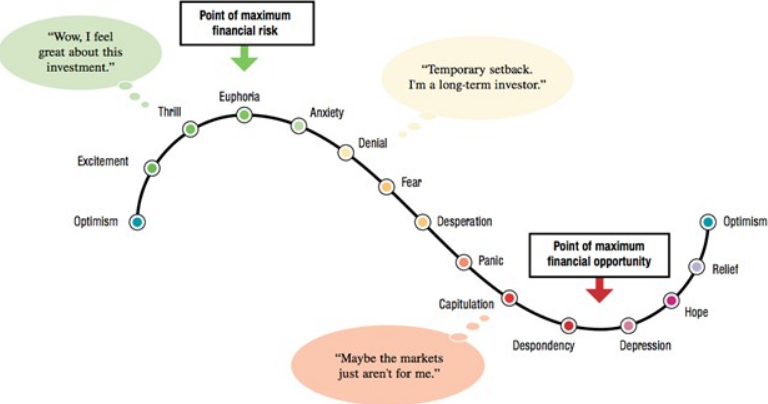

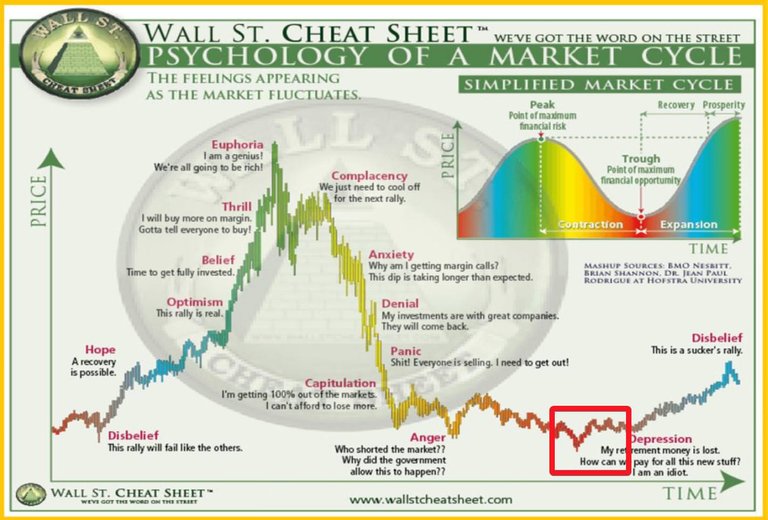

Let’s begin with the market psychology. Emotions are strong, especially in the crypto markets, and people are not afraid of showing it. This is good for us so that we can analyze this kind of behavior and see how it correlates with the price action.

This is the time when it’s nearly impossible to scroll through twitter feed, enter into a discord chat, or check news, without being exposed to the overwhelming amount of depressing information about cryptocurrencies.

But even if the vast world of cryptocurrencies is not going away, this kind of information that can make you feel like it.

Information like this is valuable to us. Why?

When you look at the images down below they reflect how emotions are correlated with the price movement. When this is compared to the Bitcoin Chart, you can start noticing similarities with the emotions people are having and where the price is now.

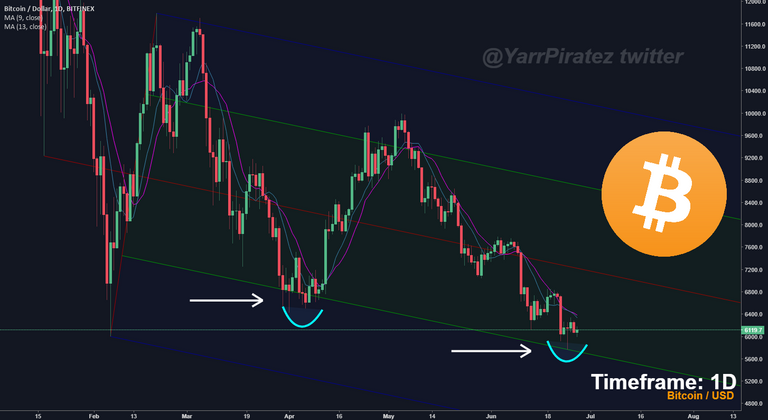

Bitcoin Chart for Comparison on Daily Timeframe

Wall Street Cheat Sheet

As you compare charts you may start seeing that we are getting close to the part where the financial risk is minimal and upside potential is maximal.

Let’s continue with the article. Next stop is…

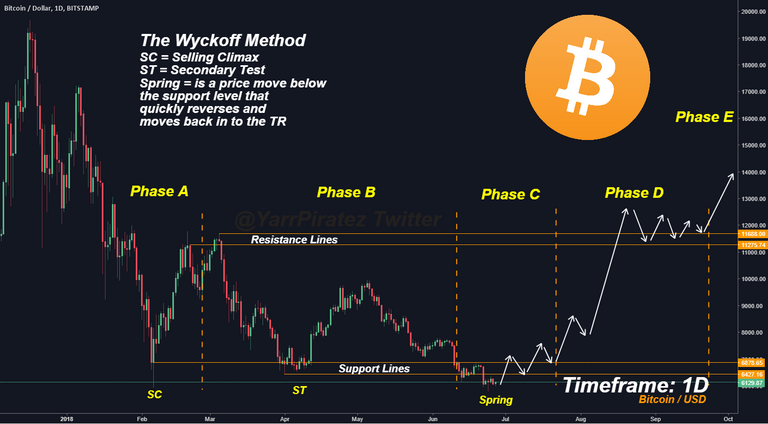

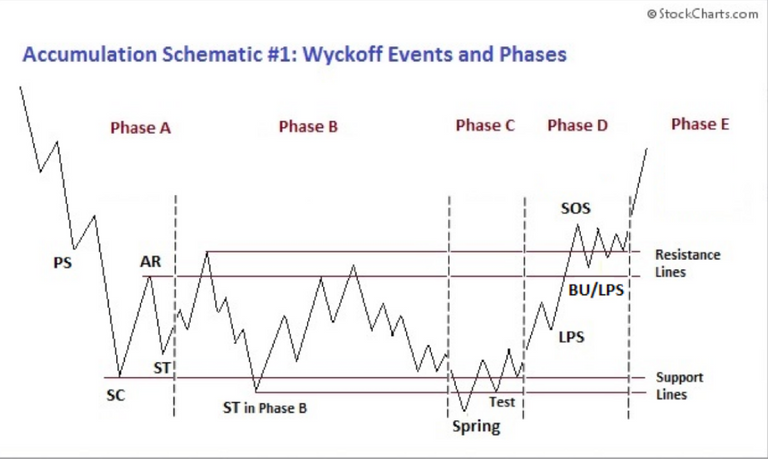

The Wyckoff Method

This is based on Richard Wyckoff’s powerful theory which provides guidelines for determining events happening in the trading range. The events can be found in the famous schematic which exposes it fully.

Accumulation Schematic #1: Wyckoff events and Phases

You can find more information about The Wyckoff Method at here

and read more about 'How to Trade a Selling Climax with Cryptocurrency?'- at here.

The Bottom of The Market Structure

The weekly chart of bitcoin is showing a fascinating piece of information that it has hit the bottom structure of the market (meets major support) and seven past candles have been grinding against the downtrend line. When a price is able to grind against a long term downtrend line like this, it tells us that it hasn’t seen any significant drops during those weeks. If that were the case, where it would have significant drops, the downtrend line and the price would have distance between them. This is a great signal of sellers (bears) losing strength and not being able to push it lower.

This week’s candle determines the direction of the market and this is an ideal zone to watch for reversal patterns.

Descending Channel

In this scenario I used the pitchfork tool to generate a descending channel. It highlights perfectly that it meets descending support for the second time, retests it. If it does manage hold, it could lead to an uptrend only if enough buyers take action in this spot.

Bullish Divergence + Diamond Bottom

Bullish Divergence is a lead indicator for revealing tops and bottoms of the markets. This is a commonly known reversal pattern and breaking above of the resistance area would be a good indicator that the price is wanting to push higher. Bullish Divergence is accompanied with a Diamond Bottom which is a known Reversal Pattern as well. When a price is starting to break out from the Diamond Bottom it’s usually followed by expanded volume. This gives validity to breakout. Bitcoin also needs to break above the neckline area and stay above it as well. Rejection could lead to new lows and that’s why it’s good to have confirmed signals before entering into a trade.

Conclusion

As seen in this article, the cycle charts are highlighting that we are not that far away from the recovery phase and shows that the risk/reward ratio is getting really good.

Keep in mind that even the whole market would be bearish, there are still things to take into consideration and observe. Don’t be fooled by the prevailing sentiment but try to come up with fresh ideas that has confirmation and then you will be a few steps ahead of others.

Thinking out of the box is essential when it comes to cryptocurrencies and, generally speaking, contrarians (The ones that haven’t gone along with the herd) have been the most successful investors and traders of all time.

Being around people who are overly biased, stuck with bearish mind set, can have harmful influence towards others and it can be hard to break from that cycle. It is better to keep neutral stance and see what opportunities the market brings. Do not try to force any setups.

Please, if any question come to your mind don’t hesitate to ask! I try my best to respond ASAP!

If you need help with trading, finding information or courses let me know and I’d be more than happy to help you!

Here's motivational quote to the end:

Please, if any question comes to your mind don’t hesitate to ask! I try my best to respond ASAP!

If you need help with trading, finding information or courses let me know and I’d be more than happy to help you!

DISCLAIMER:

Please be aware this is not financial advice. You are responsible for your trading and investing decisions. It is highly recommended to do your own research before investing anything.

My list of trading tutorials

- Lesson 1 - Beginner's Guide: How to use Moving Averages to Day Trade?

- Lesson 2 - How to Trade a Selling Climax with Cryptocurrency?

Please consider upvoting if it has helped

More coming soon!

- Twitter - http://twitter.com/YarrPiratez

- Telegram - http://t.me/YarrPiratez Crypto Signals & News

- Telegram - http://t.me/YarrChat Coin Chat Room

- Trading View - https://www.tradingview.com/u/yarr/

- Trade altcoins – https://www.binance.com/?ref=10803871

This is solid analysis, keep it up!