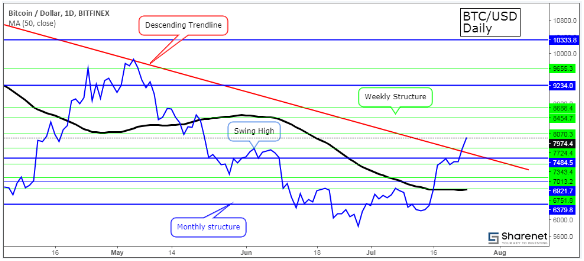

Interpretation of charts: The charts below are detailed with monthly and weekly structural levels. These levels are the closing prices of either the monthly (blue line) or weekly (green line) candles. Furthermore, levels which are not areas where price action has formed a reversal are excluded. Thus, the structural levels defined on the chart are potential areas of both support and resistance. Monthly structure carries more weight than weekly.

1 Day Chart

Bitcoin has proceeded with the solid rally that it has been on for as long as week. Value activity got through both the past swing high and the plummeting trendline on the day by day outline. This is a key specialized point of reference, as we are currently entering an example of new higher highs. In any case, the day by day flame has not yet shut and in that capacity I will save judgment on this move until tomorrow.

That being stated, zones of obstruction are characterized on the diagram as basic levels. I would expect the main zone of protection from be $8070.

The moving midpoints are stacked bullishly on the every day time period, yet with a specific end goal to put more noteworthy accentuation on the rally, I might want to see the development of a higher low on the 50-day moving normal.

4-hour graph

On the fleeting diagram, we can perceive how Bitcoin has broken out of the combination go that it was exchanging yesterday, pushing through the dropping trendline and additionally the overhead opposition of $7716. In any case, the present flame on which the breakout is shaping has not yet shut at the season of composing, so it stays to be checked whether cost can close over the plunging trendline. This is a key level that numerous brokers have been viewing. I would anticipate that the bulls will enter the market in constrain soon. Secure your drawback of this exchange with a stop misfortune at $7715.

The worries that I have had for as far back as couple of months have now been met, should we not see an inversion happen at or above $6550, at that point we could be in for a profound bear advertise, conceivably testing the $4900 level. The way things are as of now, cost is exchanging beneath the 50-week moving normal. The following major bearish turning point would be the hybrid of the EMA8 and EMA20 with the MA50 on the week by week outline. This has happened toward the finish of June. Should the inversion that we are as of now observing on the 4 hour and every day graphs not frame new highs, at that point the bears may drive cost to $4900.