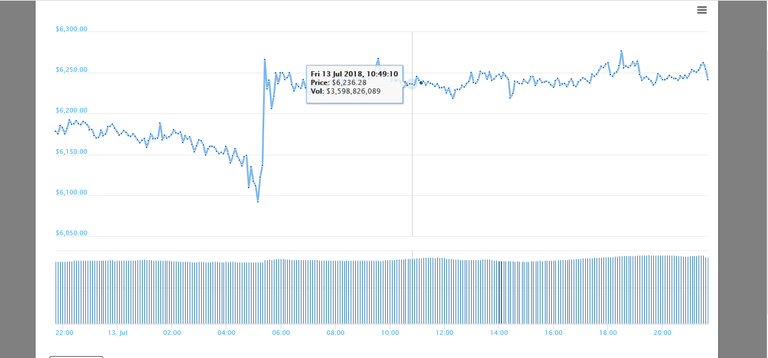

Over the past 12 hours, the bitcoin price has defended a fall below the $6,000 mark, after falling to approximate $6,000 on July 12.

Lack of Momentum and Volume

The slight increase in the price of bitcoin from $6,070 to $6,250 has allowed the dominant cryptocurrency to break out of a descending trendline since July 10, setting up a corrective rally in the short-term. The Relative Strength Index (RSI) of bitcoin has also demonstrated a bullish trend for bitcoin in the upcoming days, increasing the probability of bitcoin’s recovery to $6,400.

However, the lack of volume of bitcoin still remains as the issue for the crypto market and other digital assets like ether, Ripple, and Bitcoin Cash, because in a downtrend, both major and minor digital assets tend to rely on the price trend of bitcoin.

Currently, as of July 13, the daily volume of bitcoin remains at around $3.5 billion globally, and $163 million on Binance, the world’s largest crypto-only exchange. In comparison, in early July, the volume of bitcoin surpassed the $5 billion market and remained above $300 million on Binance against Tether (USDT).

Hence, even though the RSI, MACD, and descending trend lines of bitcoin demonstrate a bullish movement for BTC in the upcoming days, the lack of volume of BTC will likely prevent the market from initiating a proper corrective rally in the short-term.

Based on the trend of bitcoin over the past 48 hours, it is unlikely that BTC initiates a corrective rally to its previous support level at $6,700. A more likely scenario is, BTC falling to the lower end of $6,000, experiencing severely oversold conditions with the RSI below 30, and rebounding by several percent.

✅ @yuvi8899, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Thank you in advance!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.ccn.com/bitcoin-price-avoids-decline-to-6000-but-crypto-market-still-in-downtrend/