Content adapted from this Zerohedge.com article : Source

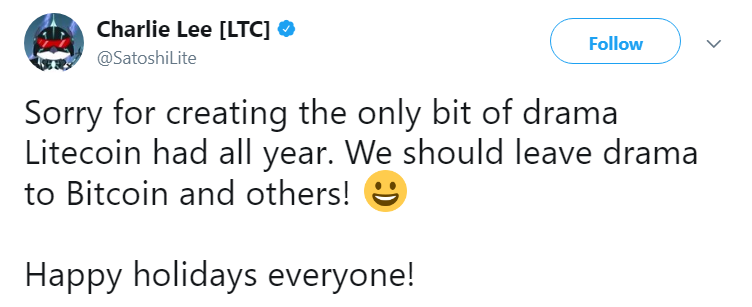

The news broke yesterday morning that Litecoin developer and outspoken founder, Charlie Lee, sold or donated all of his liquid Litecoin holdings. This prompted a big sell-off in the cryptocurrency markets, putting on pause the bounce off of the previous night's bottom below $16000 for Bitcoin.

This comes in the wake of Coinbase adding Bitcoin Cash (BCH) to its stable of coins available for purchase, which also sent shockwaves through the markets.

In his post on reddit, Lee explained that he felt his ownership stake was actually a burden on Litecoin's development as a real-world medium of exchange:

And whenever I tweet about Litecoin price or even just good or bads news, I get accused of doing it for personal benefit. Some people even think I short LTC! So in a sense, it is conflict of interest for me to hold LTC and tweet about it because I have so much influence. I have always refrained from buying/selling LTC before or after my major tweets, but this is something only I know. And there will always be a doubt on whether any of my actions were to further my own personal wealth above the success of Litecoin and crypto-currency in general.

The market reacted negatively to the news but only for a short time. Litecoin under Lee's direction has been setting itself up as the day-to-day cryptocurrency. One that is easy to use, cheap, fast and easy to pay with.

But, as a commenter on the Zerohedge article on this event pointed out, quite astutely:

It was requested from Facebook to do it so that he can't be accused of personal interest, decision bias with regards to the LTC ecosystem development.** Facebook is preparing the big announcement that they will introduce support for Litecoin as payment channel.**

"Digital currency exchange startup Coinbase has announced the appointment of a Facebook executive to its board of directors. In joining the board, David Marcus, vice president of messaging products at Facebook, will bring years of experience in building large-scale mobile products, according to a Coinbase statement posted yesterday."

The article he quoted is this one from Coindesk.

And Litecoin, among the major cryptocurrencies, is uniquely positioned to be that currency for Facebook's digital payment platform as it fills out its road-map into 2018.

It doesn't hurt Litecoin either that with the start of trading of rival Bitcoin Cash on GDAX and buying through Coinbase that there is now potential insider trading (GASP! NO! REALLY!) around it and that trades may have to be reversed (somehow).

Market manipulation and fraud is going to be a big deal in this space going forward. The temptation to cash in and scam people is simply too high not to try and game the system to individuals' advantage.

Lee selling his coins and publicly calling out Satoshi Nakamoto to do the same and end the potential for a whale dumping his stash and bombing the market is another sign that the Litecoin Foundation is looking to go mainstream and take cryptocurrencies out of the 'hookers, drugs and guns' market and into the 'Coke and Starbucks" one.

Creating the Future

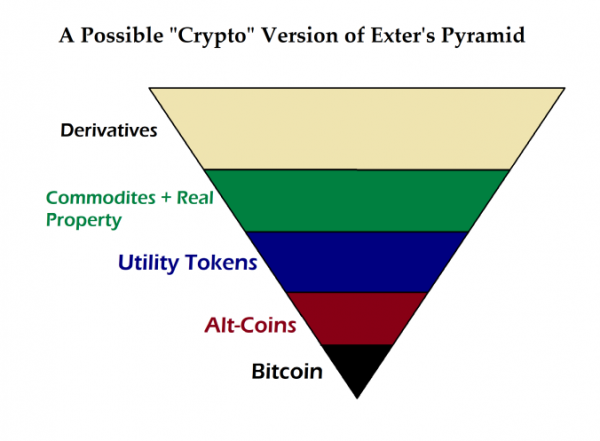

In a previous post I talked about the differentiation and segmentation occurring in the crypto-space. Bitcoin Cash with its big blocks, low fees and quick settlement times is a direct competitor to Litecoin as mediums of exchange.

Litecoin has the added payment processing layer to facilitate point-of-sale convenience while retaining proof-of-work security.

Neither, in my opinion are setting themselves up to be a reserve or foundation asset in the cryptocurrency monetary system. That's Bitcoin's roll. And as the money flowing into the space begins to see just how inadequate and illiquid Bitcoin is they will move into coins that are both good stores of value and retain their nimbleness and liquidity.

In fact, I expect to see at least a dozen of the current coins on the market rising to the occasion to keep the market liquid and flowing. Litecoin is just one of them.

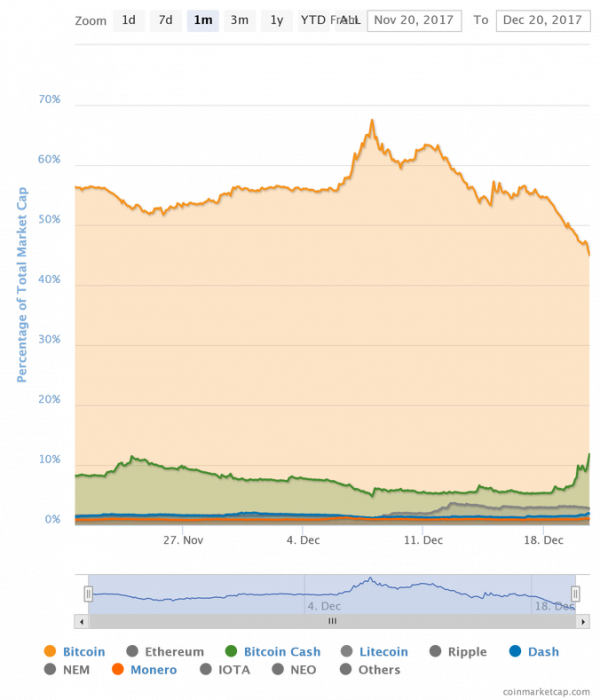

But we are so far from that image above, the market in cryptos today is the exact opposite. Bitcoin sits at the bottom, as a massive, illiquid reserve asset. And it's value will be converted into other coins that are capable of actually processing payments for services rendered.

In just the past four days since Bitcoin peaked near $20,000 its share of the total cryptocurrency market has plunged from over 67% to around 45% today.

Litecoin, for the first time has broken above 2% as are others, like DASH and Monero. It's clear that the cryptocurrency market is undergoing a reorganization of capital during this phase of the bull market. And I wouldn't be surprised to see it continue, even if there is a significant correction on the horizon.

I don't think a major player of any company would ever get away with publicly announcing that they will be dumping their company's shares and recommend everyone else should do the same. Then right afterwards the stock tanks.

Wouldn't that cause a reaction with certain regulators???? Like Jail Time!

By the way the futures market bet on Bitcoin, Ethereum, and Litecoin to go down. This all looked like a well orchestrated event.

The problem is that since these cryptocurrencies are not government regulated and governments tend to hate cryptocurrency. No one is going to do anything about this. These big fish will continue to manipulate the market and steal money from less experienced people, because they will make tons of money and never need to worry about seeing the inside of a jail cell.

Copying/Pasting full texts of articles from known internet personalities without their consent, and without adding anything original is frowned upon by the community.

Some tips to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

If you are actually the original author, please do reply to let us know!

Thank You!

More Info: Abuse Guide - 2017.

I never completely understood derivatives and comodities. I feel like I need a second degree in economics for that :))

derivative just means "BASED ON" ---- the Bitcoin Futures are a derivative as there is no Bitcoin backing it, it is settled in US $..... A Future is a "BET" (think Las Vegas) on what you believe the price will do in the future. COMMODITIES are physical goods(normally) that people compete over by offering a price.

Okay so derivatives and futures are the same or derivatives include futures but not only?

If the FUTURES "settels" with the underlying commodity its NOT a derivative.

for instance if you mine gold and you want to LOCK in your sales price, you sell a FUTURES contract for the date you want to sell it,,, when the Futures Contrace expires you DELIVER the GOLD

But a Bitcoin Future is a DERIVATIVE because when you settle the contract you dont pay Bitcoin,, it settles in US Dollars. --- so the Contract price is "DERIVED" from Bitcoin - hence its a Derivative.

In the past Futures were almost never derivatives, they were a way for compoanies to FIX their costs so they could do good accounting.

DERIVATIVE markets don't need an underlying commodity,,,, for example the GOLD derivatives markets have a value of some 10-100 times the amount of GOLD that exists in the world,,,, its just "Paper Gold" or better said,,, just a bunch of people "BETTING" on what the price of GOLD with be.

DERIVATIVES - means Las Vegas on Wall St.

FUTURES - means FIXING your COSTS or PURCHASE PRICE

Wow, thanks a lot for the detailed information, I really feel more confident about it!

Derivative markets can be:

Futures

Options - (options are used as INSURANCE POLICIES or "hedges" on one's bets)

INDEX funds (that derive their value from the underlying stocks)

etc.

Exter pyramid (inverted) for cryptocurrencies is nice intellectual idea, but not really anchored in reality, IMO. In this subject we always need to refer to: what function does money play (3: store of value, transactional and reference). There should be all three functions covered for entity at the bottom of the pyramid. And this bottom entity is destined to collect value flowing downward. As we know, Bitcoin is transaction medium, firstly.

Nice and creative conception, though.

Today I had transaction experience with LTC,BCC, ETH and XVG.

LTC and BCC cost me around 3 $ , ETH cost me 8$ and XVG - 0.02$

The speed: XVG around 5 min, BCC - 10min, ETH - 15-20min, LTC - over 30min.

With transaction speed like this I really dont see the usecases for LTC and BCC with their "faster" transactions, there are altcoins liek XVG that are far superior in transaction speed and cost.

You have the typical noob mentality when it comes to new altcoins that don’t have a lot of users. Your experience also does not account for coin security. Any transaction on a centralized system will be even FASTER than ALL of the coins you mentioned. So that would be even better! According to that line of thinking.

I am not making a comparison, like a real comparison. I am sharing experience from yesterday. Thank you for your comment - I am indeed a noob in the crypto-world and I don't claim otherwise. As I said, sharing experience is what we need in this community. I guess you don't have much experience with international transactions, so please don't lecture me about centralized payments. Take care, my friend ! I will be very happy if the next time you go softer on "n00bs" like me. Thank you !

STEEM cost you $0.

That is correct @ze0hedge , as I said I am not comparing or searching for the fastest currency. I was just sharing experience. Thank you for tuning in in the disuccsion. Keep up the great work :)

I am not sure the sell off yesterday was due to Lee selling his stake in LTC.

In fact he did that Tuesday I believe with news coming out on Wed or perhaps Thurs.

I can agree that altcoins will close the gap with BTC although I dont think BTC will be knocked down. In the end, there is going to be a multitude of coins that become "money". It is just a matter of where you are.

The FB news is great for LTC though. That said, LTC is better than BTC but still have nowhere near the horsepower of STEEM or BTS.

I am not sure LTC can handle the FB traffic.

This Facebook and Litecoin scenario adds a little spice to the ecosystem, if Facebook adds it as a payment method, we could possible see Litecoin catching up to its big brother... There is alot of catalyst in the market, one of them has to be Amazon, if Bitcoin can get its house in order I believe this would only be a matter of time but for now it won't be a reliable payment service as Amazon delivery would beat Bitcoin confirmation (lol).... We definitely have to see what 2018 brings in store

I agree with you 100%!

I'm a firm believer in litecoin and I see it going all the way by February.

I think people are going to be very suprised how fast it's going to shoot up.

nice sharing @zer0hedge

What makes you like Litecoin so much and my other question is why by February ?

Btc has formed a base at 10k now and niw its time to see 25k in 1st quarter 2018. LTC 500 soon.

Only 25k ??? I don't like to hold bitcoin,,, I like the alternative Privacy Coins instead (for a strictly "money" coin) like XVG or monero or zcoin.

But for me the purpose is to be promoting tokens of actual decentralized companies that will change the world:

VeChain - supply chain tracking

EOS and ETH - development platforms (as is STEEEM)

COB - FREE crypto and fiat exchange (gonna kill all brokers)

Totally agree. There are so many new coins that really have massive potential. I really want to see projects that can change the status quo and will benefit the masses in the long-term !

Nice buyline !!!!

""""It is never crowded along the Extra Mile"""""

followed my new friend !

We have seen what have happened to coins that have been added to coinbase. I can only imagine what would happen if a coin were added to Facebook or any other social media platform.

Litecoin has been good to me, I got a bunch at 50 dollars. I never heard about the facebook accepting it, great news

Great post.

Please do not spam...

If I say that I liked the publication, is it spam?

Its potential "spam" if your not adding anything of value to the discussion,,, like I'm teaching you now what a "bad comment form" is.

Yes and no. If you just comment rarely like this it does't necessary mean that it is a spam. But if you keep writing short comments that do not show that you actually read the post, people will think that you are spamming them. It is because many have done this before and the platform is saturated. Spam comments are most of the times very short, not saying much about the post itself and with the only purpose of catching a few upvotes. If you write this kind of comments people will be confused and some of them may tend to flag your comments, which is not very good for your account. As an advice, I just don't encourage you to write such comments, but you can do as you want, of course :)

Thanks for explaining friend. and I'm sorry for the spam

No problem, you don't have to say sorry, I was spamming too in my early days here, and I discovered why it is not okay when I had already over 41 reputation, so you are pretty fast right now. I am glad I can help!

i feel sorry for him when he tweeted

ROTFLMAO

recently i like litecoin....

i withdraw from steem dollar to litecoin

thnx for share this news

Thanks for the Cryptocurrency news @zer0hedge

I see Litecoin as uniquely positioned to become the number 2 market cap coin.

They are all just right now turning their coins into cash for future and do not telling anyone why is doing like so, In my point of view they are do not want show loss and before loss will rise, they will cash them all. Like others are doing in background.

This is true that Market manipulation and fraud is going to be a big deal in this space going forward. The temptation to cash in and scam people is simply too high not to try and game the system to individuals' advantage.

Lee selling his coins and publicly calling out Satoshi Nakamoto to do the same and end the potential for a whale dumping his stash and bombing the market is another sign that the Litecoin Foundation is looking to go mainstream and take cryptocurrencies out of the 'hookers, drugs and guns' market and into the 'Coke and Starbucks" one.