Content adapted from this Zerohedge.com article : Source

Authored by Charles Hugh Smith via OfTwoMinds blog,

Nations that attempt to limit cryptocurrencies' ability to solve these problems will find that protecting high costs and systemic friction will grind their economies into dust.

There's a great deal of confusion right now about the regulation of cryptocurrencies such as bitcoin. Many observers seem to confuse "regulation" and "banning bitcoin," as if regulation amounts to outlawing bitcoin.

Further confusing things is the regulation of cryptocurrency exchanges, where cryptocurrencies are bought and sold.

In China, for example, cryptocurrencies are not outlawed, but exchanges were shut down until regulators could get a handle on how to deal with the potential for excesses such as fraud, misrepresentation, etc.

A Wild West free-for-all is conducive to scammers, and so some thoughtful regulation that protects users is to be welcomed.

Governments tax income and capital gains. This is how they fund their activities. Clearly, gains reaped from cryptocurrencies are no different from gains reaped from other speculations and investments, so they should be recorded and taxed in the same manner.

Some enthusiasts of cryptocurrencies seem to think that regulations requiring the reporting and taxation of gains made buying and selling cryptocurrencies is tantamount to destroying cryptocurrencies.

I think this view has it backwards: fully legalizing and regulating cryptocurrencies as financial instruments legitimizes them in a much wider circle of potential users, and common-sense regulations are to be encouraged and welcomed, not viewed as threats to cryptocurrencies.

I want to stress that beneath all the speculative frenzy we see in the cryptocurrencies, what will retain value and remain scarce and in demand is whatever solves problems.

Cryptocurrencies have the potential to solve two problems:

1. reducing the cost and friction of financial intermediaries.

2. holding value as the $250 trillion in phantom wealth created in the asset bubbles of the past 12 years vanishes.

These are real problems: financial intermediaries introduce a great amount of friction and cost globally, and even a modest reduction in cost and friction (time, effort, compliance, recording transactions, etc.) would add up very quickly.

The global value of real estate, stocks, bonds and debt-assets such as mortgages and auto loans is around $500 trillion. By my rough estimate, about half of this was created in the past 12 years as central banks inflated enormous bubbles.

A house that was worth $200,000 in 2005 is now worth $500,000, but it provides no additional value as shelter; it is the exact same house with the exact same utility value. So the additional $300,000 of current market value is entirely phantom wealth.

The same can be said of all the other assets whose value has skyrocketed: the underlying assets/collateral haven't changed enough to justify the current valuations.

Once the bubbles in stocks, bonds, housing, commercial real estate and debt-assets start popping, the owners of all that phantom wealth will be desperate to sell what is dropping in value and convert that wealth into assets that are either holding their value or appreciating.

Virtually all of this newly created financial "wealth" is ephemeral. Bitcoin et al. are routinely criticized as being "worthless" due to their digital/ephemeral nature.

But critics rarely if ever examine the equally ephemeral nature of $250 trillion in financial "wealth."

Bitcoin in particular has two features which may be viewed as having value as all these coordinated bubbles pop:

1. The organization and distribution of bitcoin is mathematical. It is not something that can be changed at the whim of a handful of self-serving people in a room (i.e. central bankers).

2. It is limited in quantity.

Some critics claim this can be changed, but that's not the way it works. A group of bitcoin miners can propose a new version of bitcoin that will issue a trillion coins, but if nobody supports their new version, it dies.

In other words, the marketplace of users decides what has value and what doesn't.

Regulations that enable cryptocurrencies to solve the two problems listed above should be welcomed, as these problems are structural and impact everyone in some fashion.

Nations that attempt to limit cryptocurrencies' ability to solve these problems will find that protecting high costs and systemic friction will grind their economies into dust.

I'm offering my new book Money and Work Unchained at a 10% discount ($8.95 for the Kindle ebook and $18 for the print edition) through December, after which the price goes up to retail ($9.95 and $20). [Read the first section for free in PDF format.] 4 _If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com. _

Governments do not want unregulated currencies. They want to know how the money is spent, where and by whom. I believe that soon or later, all crypto-currencies will be the subject of heavy regulation, including imposing taxes as you stated above.

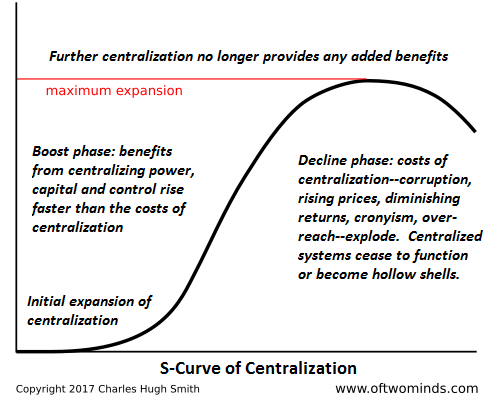

The problem with "regulating" cryptos is that the whole point of the technology itself it to remain outside of centralized control. Cryptos are the antithesis to centralized financial systems!! There's not way to merge the two in any meaningful way.

Exactly @techwizardy.

That is something that the entire governmental and banking system misses (or chooses to ignore). It really is a stupid premise. Regulate the exchanges and people will move to decentralized exchanges. Try to track the path of bitcoin and atomic swaps enter the picture and throw one onto an entirely new chain.

Tech will outpace the government.

Blockchain is after the banksters, governments are also on the list.

I love that line. Once the gov. begins to see their grip on the populace begin to loosen, the stage will be set for a confrontation. I think the statists are starting to see the writing on the wall, and they are starting to seriously consider the long-term implications of non-state cryptocurrencies.

https://www.bloomberg.com/news/articles/2017-12-18/europe-wants-to-regulate-bitcoin-to-clamp-down-on-illegal-risks

Interesting article.

I wonder, in situations like that, what the true motivation is. My belief is the g-men are just hacks for the banksters...just an arm to do their bidding.

So I often conclude the banksters see the threat and the hacks are operating under their orders. I am not sure the "statists" as you call them are aware.

They might fall in the "always the last to know" category.

What has how BTC is issued got to do with how it is regulated? BTC is practically a 'fait accompli' now, with so much 'real' money invested in it.

Regulation is applicable to cattle, and public nose-picking, as well as fiat money. It has nothing to do with centralized financial systems - except that they are but poorly regulated.

Copying/Pasting full texts without adding anything original is frowned upon by the community.

Some tips to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

If you are actually the original author, please do reply to let us know!

Thank You!

More Info: Abuse Guide - 2017.

Really good read I gained some insight into some things I did not know about. I did not necessarily think of the IRS's decision to start to regulate cryptocurrencies by taxing them as capital gains would be a good thing but I can see now that their actions now validate cryptocurrencies even more. Also I really liked the idea of phantom wealth. I had never heard that term before yet will be using it more from now on because it explains our current debacle perfectly right now. I really liked how you explained how bubble money is basically phantom wealth, one question I have towards this is do central banks and owners of debt help push bubbles higher because they gain more money and influence the greater they grow? My thinking behind this is that if they overvalue a home that is worth $200,000 and then it gets sold later at $500,000 but then the bubble bursts the owner of the home is still on the hook for $500,000 that they bought the house for and now they owe more money than it is worth so they are stuck in this debt cycle.

It was already determined for tax purposes that crypto currency is a security meaning it is subject to capital gains just like a house, stock, or bond.

The banksters inflate things so that they can sell at the top and buy at the bottom. With their access to unlimited fiat, they can bubble anything. Of course, they really only start the process then the feeding frenzy takes over.....the stupid money, i.e. general public is the last in..just in time to ride it down. By this time, the banksters are on the sideline ready to jump in and buy things on the cheap.

Many homeowners experienced this exact thing in 2008. The reason this crashed the economy, is that so much new debt had been created that income necessary to pay it didn't exist.

We are in an even worse position now, as the solution undertaken then was to create 5X the number of dollars that then existed, which were given to the banksters - not the debtors, who went bankrupt - and those banksters simply added zeroes to their balances such that they were then solvent.

Once they were solvent, they proceeded to do the EXACT SAME THING and recreate the bubbles.

It will crash in 2018.

Think BTC mooned lately? I am confident that John Macafee's dick is safe, despite his promise to eat it on live TV if BTC didn't reach (some outrageous sum by some too early date). Given the non-inflationary, non-debt basis for BTC, I believe $100k valuation by the end of 2018 is conservative.

As bubbles pop, and BTC moons, those $100T's of phantom dollars will be owned either by extremely stupid people (which, seeing as they own that money, isn't likely) or it will be invested in BTC and other IMMUNE cryptocurrencies by smart investors.

What will $100T influx do to BTC price? How about 5X that? That will be BTC moon.

Today is still before the beginning.

I am not an advisor. I don't know what the hell I am talking about, and am probably insane. If you follow my opinions, which come from an anonymous shitposter on an internet kelp-pickling forum, as investment advice, you are probably insane too. Don't do that!

John Macafee is certifiably insane, also.

Don't be John Macafee!

Edit: oh yeah, those unfortunate homeowners who risk being upside down in their mortgages? If they aren't stupid, when they have enough equity in their homes due to real estate bubble causing valuation to greatly exceed what they owe in their mortgages, they'll take out second mortgages and buy BTC, LTC, or any solid (non-scam) cryptocoin.

Then, they'll be fine.

Absent regulation, security of cryptocurrency will continue to be phantasmal.

Remember Mt. Gox? The BTC stolen in that hack is now worth $15B.

It is the largest theft to have ever occurred.

A critical question to me, is capital gains. Generally, capital gains are only incurred when an asset that has increased in value is sold, whereupon the gain is realized.

If crytpcurrency is money, and can be spent for goods and services directly, how can capital gains be assessed? Can we expect taxing agencies to insist on monitoring every transaction undertaken in the world? Because this is the only way to tax gains in the value of BTC.

I'd appreciate any thoughts on this anyone might be willing to share.

Thanks!

Regulation in the US means putting it under control of the bankers.

Regulating cryptos means treating them as a security and only licensed financial institutions can issue/sell securities. In the hands of the bankers.

Those who commit fraud, there are laws on the books for that. There are a great many ponzi schemes using bitcoin...toss those people in jail. There does not need to be any regulation on Bitcoin to arrest people for running a ponzi scheme.

Besides, cryptocurrencies cannot be regulated. It is outside the control of any one government. Regulate the exchanges and business will move to the de-centralized ones.

I am holding some BTS so I love the idea of regulation (over regulation) by the SEC....move all the business elsewhere.

I think you're being a bit optimistic. The banksters aren't nationalists, aren't tied to a nation. The reach of money exceeds any nation's, including the USA.

Given political will - and money can buy that - it is trivial to regulate BTC. Any exchange can simply be eliminated if it won't play ball. Every employee of every exchange in the world can be 'extraordinarily' renditioned, and spend the rest of their lives drooling in MK Ultra programs in black sites, without exceeding the cost of lunch for just the Rothschild family for one day.

I'm not saying those particular scenarios are likely - they're not. They're not because much more reasonable means exist to compel exchanges, and holders of BTC and other cryptos, to accede to regulaton, even taxation.

We are talking about folks that intentionally profit from crimes against humanity, after all. Think of how many 'nice' ways that can be used to convince YOU PERSONALLY to say 'please, take half my BTC!'

All they have to do is 'accidentally' turn off the power, or the internet - again, a blunt force example, rather than one that requires more than one second to think about and devise.

To those two features you mention about Bitcoin I would add a third: Real ownership.

Bitcoin can't be frozen or seized. If you own it, you own it.

May be that's the best defense against bad laws.

Good laws > No laws > Bad laws

Given the authority, I can indefinitely freeze all BTC, even seize much of it. In fact, I can get folks to demand I seize substantial portions of their BTC holdings.

All I have to do is turn off the power. Even less direct mechanisms abound, although that is the simplest.

It is trivial to seize and freeze BTC, given political will.

Actually @angelicawtfn, bitcoin can be seized if they get you to give them your key which we might see court order people to do OR one is on a centralized exchange.

Authorities around the world have seized bitcoin.

There a lot of advocates of crypto regulation, people who are involved heaviliy in crypto and blockchains want a little bit of regulations. Charlie Lee ( The creator of Litecoin) said it on CNBC, that he thinks regulation in the cryptospace is needed. I also think that some kind of regulation is pretty important. If we want some institutional money to pour in - we have to approve it too.

Majority of the world's wealth lies in the derivative market. Why do stocks when you can control the same amount of the underlying using futures and options? Derivative increases the efficiency of money by allocating risk to the people who are willing to assume them. Wealth can be created from "nothing." All you need to do is to give "nothing" a price.

Except in a crash, as we saw in 2008. Despite their binding contractual nature, they could not be paid, as the money to pay them had vanished in the crash.

Derivatives are a scam, and are only useful as long as the market, as a whole, remains functional. When the market breaks, so do they. Also, they're a bit different than calls and puts. There's more to them than that. They're more like an insurance than futures.

As we frequently see, insurance breaks too easily when disasters strike.

But calls and puts are derivatives as well. If derivatives are scams, then why don't you take part in the other side of the trade? There always two sides to a trade. There's a reason why insurance companies are making a killing.

Because, as I said, the value of derivatives is unrealizable in an existential market crash. The paper position is irrelevant when the market cannot cover them. 2008 proved this, and only the extremity of the 5X inflation of the money supply - merely a temporal reprieve - covered them.

Will we undertake a 50X inflation next? It becomes too obvious a caricature of actual markets to enable acceptance at some point. The monetary flows into cryptos indicate to me we have passed that point.

When the bubbles pop this time, what is left of the phantom fiat will be poured into a real solution, I think, rather than more smoke and mirrors.

YMMV

you can still choose to exercise your derivatives or simply let it expire.

Derivatives that were employed to hedge the risk of the bundled mortgages were not exercisable, despite them being theoretically very valuable when the mortgages defaulted.

They couldn't be, because there was no money to pay them.

It wasn't a matter of choice.

And sell "nothing" as said price.

That is important too.

We have laws to deal with fraud in virtually every nation around the world and none of them require regulation of cryptos to accomplish it.The very nature and original idea of cryptos was to get away from central bankers.a new investor class has sprung up, one where anyone can participate in the new Gold / Silver rush each to his own ability. Its a truly free trade market where prices are decided by simple supply and demand

Big money will never pour in in such an environment. Hedge fund managers and institutional managers cannot afford to pour money in assets, that are that volatile. Also if you look at the ICO's, big chunk of them are total scams, with no idea and will be gone pretty soon.

$350B since Thanksgiving is pretty big money.

And more will continue to roll in regardless of whether cryptos are regulated or not.

You might be right. But I think most of the money in the market lately was for a quick buck, not for the long haul. Just my 2 cents.

Why would they suspect BTC would make them a quick buck? What will happen when bubbles start popping?

$500B is .1% of bubble money.

Think about that.

That could be true...although that type of change, $350B is a lot of dough....the only ones I know who can pile in that much is Wall Street. I believe they are here. For months we heard counts of the number of hedge funds raising money for crypto...I think this is the result of all those funds.....

I believe we will see rotation plays as opposed to the money coming out. Run up bitcoin, dump and go to ETH...dump ETH and to go LTC...then back to BTC...

Although that still could be down the road since most of the money is not in here yet.

I said $1.5T by the end of 2018...it looks like that will be far eclipsed.

Only coinbase was adding 100k + users a day. Not to mention other exchanges and so on. I think it might be both. Let's call it a tie :)

That's great news! So, where's that $15B that was stolen by fraud from Mt. Gox?

Hey, wanted to let you know where to get some free Bitcoin.

It's a Bitcoin lottery and you can win up to $200 every hour, there's also jackpot drawing of $500 every week!

You can also mine BTC and they have a gambling section if that's your kind of thing.

Hope this can help you get a little extra in your wallet.

Good luck!https://freebitco.in/?r=8869745

That's really amazing spam! You managed to even make it applicable to the post.

However, I can see from your reputation that I need not caution you to cease spamming, as shortly your spam will become invisible, and won't impact the rest of us anymore.

Please, keep spamming, so you disappear faster. It'd be a shame if you wised up, confined your advertising to your posts, where your reach would be limited to those who wanted to see such drivel.

Thank you!!!

I love very much a world of cryptocurrency

Every day there will be new, useful and profitable news

Yes it is a very wonderful world

Sometimes I think it is a dream while it is a wonderful fact

Thank you and all who develop and spread this field among people

fuck regulation and taxation

Regulating bitcoin is impossible...

How? All that is necessary is to do what was done to coinbase. Merchants that accept BTC can be the chokepoints, along with exchanges.

How can BTC avoid regulation, even taxation?

Yeh i understand. Thanks.

Thanx you so much dear sir @zer0hedge for sharing this news. & i see your website your website is very helpful.

Hlw my dear @zer0hedge Thanx you so much for sharing this news . i see before & now you always give our very helpful news . i always #resteem & upvote your because i like your post. i pray for you my dear @zer0hedge you always be happy. & have nice day.

Nice Post , Merry Christmas bro @zer0hedge

I heard the news that in China, for example, cryptocurrencies are not outlawed, but exchanges were shut down until regulators could get a handle on how to deal with the potential for excesses such as fraud, misrepresentation, etc.

A Wild West free-for-all is conducive to scammers, and so some thoughtful regulation that protects users is to be welcomed.

Governments tax income and capital gains. This is how they fund their activities. Clearly, gains reaped from cryptocurrencies are no different from gains reaped from other speculations and investments, so they should be recorded and taxed in the same manner.

I am having deja vu....I read this somewhere.

Thanks for your Cryptocurrency news @zer0hedge

You got a 10.05% upvote from @upme requested by: @zer0hedge. Send at least 1.5 SBD to @upme with a post link in the memo field to receive upvote next round. To support our activity, please vote for my master @suggeelson, as a [STEEM Witness](https://steemit.com/~witnesses