Content adapted from this Zerohedge.com article : Source

Days after bankers began pressuring African central banks to allocate their reserves to Bitcoin, researchers from a consulting firm and a pension fund make the case for institutional investments in cryptocurrencies.

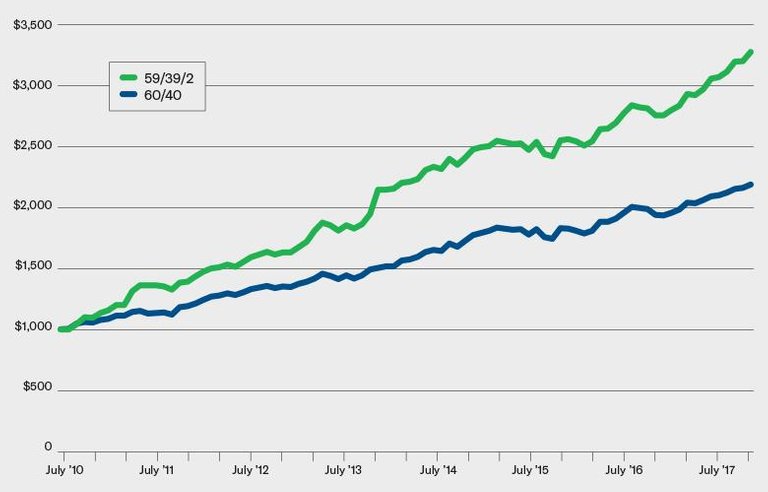

A traditional portfolio of stocks and bonds versus a portfolio with a 2 percent allocation to Bitcoin.

_Authored by Amy Whyte via Institutional Investor,_

Bitcoin is largely unregulated, "very volatile," difficult to hold - and should be included in institutional investors' portfolios, according to a research paper by a hedge fund consultant and pension fund investor.

The case for investing in Bitcoin comes from Jim Kyung-Soo Liew, a finance professor at Johns Hopkins' Carey Business School and chief executive officer of SoKat Consulting, and Levar Hewlett, a quantitative risk management associate at the Maryland State Retirement and Pension System. In a paper posted last month on research database SSRN, the authors pointed to** the cryptocurrency's "unique diversification benefits" and "attractive" risk-return profile.**

"Institutional investors are under-allocated to BTC," Liew and Hewlett wrote in the paper.

Bitcoin — the largest electronic currency with a market value of $253 billion on January 2 according to CoinMarketCap — had a rollercoaster 2017, soaring above $19,000 per coin before plummeting below $14,000 in a year-end rout. In December, two U.S. exchanges began trading Bitcoin futures, offering regulated trading options to investors.

According to Liew and Hewlett, the historical returns of Bitcoin have compensated for the "high degree of volatility," yielding a higher Sharpe ratio than any standard asset class. They also found the cryptocurrency to be "surprisingly interesting from a diversification perspective," as it's uncorrelated to other investments.

"Are we proposing that institutional investors should allocate 100 percent to BTC, to the exclusion of other investments? From a mean-variance framework, the answer is a resounding no," they wrote. The optimal allocation, according to Liew and Hewlett, was 1.3 percent over the period between August 2010 and October 2017.

"For those CIOs who are lagging behind industry peers and need to add riskier, and thus more rewarding, investments to their portfolio, cryptocurrencies are an investment worth considering," the authors said in the paper.

The pair went on to recommend that institutional investors educate their staffs about blockchain and electronic currencies, while noting the underlying risks. They suggested a diversified exposure to digital currencies to protect against a Bitcoin crash, pointing to Ethereum and Litecoin as possible holdings.

"We believe in the long run that the early institutional adopters will benefit," Liew and Hewlett said.

The cryptocurrencies are the future and that´s not only a way to promote this coins and projects, its the ACTUAL future and people will have to adapt to it...

Having said that, you should obviouly invest 2% or even more of your portfolio, because the risk is high, but the potencial reward makes you Millions!!

Bitcoin is famous, but it is only the beggining.

I agree with you @diogosantos.

There is no reason why a portion of someone's portfolio cannot be in crypto...even if it is a small percents.

And that is why I believe they will continue to explode. Gold is not a mainstream investment yet it is a portion of the portfolio of many...and it is a $8T market.

There is a lot of upside to this.

Such a good strategy to use as an investment opportunity, especially if you have a level head and do not get emotional with your actions. Pension and Hedge funds that already have large sums of liquid could allocate even a small percentage of their portfolio here and see staggering profits... thousand percent growth in a matter of weeks, as per my first crypto investments !! lol The fact of the matter is that you could get away with this using the 'don't pull all your eggs in one basket' approach from grade school.

Im sure it has paid off in both the short and long haul for all of the pension funds taking this strategy and running away with cash to make it rain on them titties boiiii hahahhaha

Good shit man straight digging these posts you been puttin out keep it up forreal!! Respect from @conradsuperb

People in the financial sector actually advising investment in cryptocurrency? There's something new...

Did they really say the optimal allocation was 1.3%?? That seems a bit low if they actually think it's a good investment, especially considering recent gains. I'd think they would shoot for 5-10% if they want to actually get rewarded for the risk.

I think it is low @jakeybrown but it is better for them to be prudent. The financial planners do not need to be telling people to go all in with their investment portfolios...especially since most people cannot handle the volatility that comes with cryptocurrencies. Up 30%, down 40%, up 35%...etc..

That's true, that friend I was talking about in one of your earlier posts said he had a client with about 5% in crypto, I just feel like 1% is nothing for most average income people

They would be smart to get in on cryptocurrencies.

Another year like 2017 and investors will be screaming at the top of their lungs to be able to get into this market.

Of course, we are seeing Wall Street control the show. It is "too risky" for the masses..until they deem it safe. By that time, the ship sailed, the banksters loaded up, and will dump the assets causing a market crash.

That is how they operate. The government is fully involved in this too....regulation means favoring the banks.

In the field of crypro world ..every thing should be possible compared to the any other investments..lets see the price of the bitcoin in 3 months back its euals to 4k usd but now it is 17 k usd if we are bought a 1 btc at that time now we get a profit of 1000 % its not impossiblw in any other invwstments ..in the same way same thing was happend to the ripple coins also 1 month back the cost of ripple is 0.2 usd now it is around 4 usd...and in coin markwt chart the position is up to 2nd ..these type of growths are not possible in any other investments ..so that is thw reason all the counries governmenrs are look into the crypto and some of them are plan to give a security to the coins and want to collect taxes from that....@zer0hedge

I'm sorry if this is spreading a bit of FUD, but doesn't all this seem a bit too good to be true? In the crypto world, you can easily get a 10X gain in a year. If you invest $10,000 today, in three years, you will be at $10,000,000 assuming the market doesn't crash (it won't) and you make 10X every year (you can easily do more).

If there's one thing I learned trying to earn some extra money on the internet, everything that sounds too good to be true is too good to be true.

To do what you say, you need to invest in the right tokens, obviously.

So not it isnt too good to be true since many of these blockchains are going to obliterate the traditional companies operating in those industries. That is the real key.

Anything the Internet touches in terms of an industry, it disrupts the existing players AND creates abundance. The Internet decided to come to money.

Copying/Pasting full texts of articles from known internet personalities without their consent, and without adding anything original is frowned upon by the community.

www.zerohedge.com has confirmed that they have not given any permission for their content to be reused for profit.

Some tips to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

If you are actually the original author, please do reply to let us know!

Thank You!

More Info: Abuse Guide - 2017.

Pension funds did heavily invest in mortgage backed securities and what has happened will be remembered for a long time. They are more careful nowadays and prefer to invest in less volatile instruments.

Bitcoin is definitely here to stay and we´ll see a further rise in value for sure as new money floods the market. The current market cap is still very low compared to other assets and it´s difficult to enter the market as well these days. So fasten your seat belts & get ready for the next run ;)

I wouldn't be keen on my pension investing in any crypocurrency untill they figure out how to stop someone from inside the pension fund running off with the passwords and money. Counterparty risk is still the biggest problem to institutional investment.

I know that according to Liew and Hewlett, the historical returns of Bitcoin have compensated for the "high degree of volatility," yielding a higher Sharpe ratio than any standard asset class. They also found the cryptocurrency to be "surprisingly interesting from a diversification perspective," as it's uncorrelated to other investments.

Very well written post!I personnaly belive that now should be the time to buy and hold for 6-8 months as cryptocurrencies are in the proccess of being adopted to the big market as more and more people are inrmterested in investing. Therefore, the next few months will be crucial and bring in huge profits for holders especially in July 2018 as Goldman Sachs is adding cryptocurrencies to their investments !! Billions of dollars are coming real soon and real fast!

ETFs will pave the way for that money to flow in!

What I don't like is that Bitcoins long term usage seems to be a store of value rather than a medium of exchange!

I like this fact!

Congratulation

Today one year ago you joined SteemItThank you, for making SteemIt great and Steem on for more years to come!

(You are being celebrated here)

Check this https://steemit.com/bitcoin/@martymcfly17/mark-zuckerberg-announces-that-facebook-is-exploring-how-to-use-cryptocurrencies

Good post!!! Thank you :))

institutional investors and pension funds are chomping at the bit to get in.

I hope Africa gets ready for the blockchain soon but i don't they are the concept is fairly new to the bankers .

I disagree, pensions should not invest in anything.

Good post

Thanks for Cryptocurrency news I appreciate it @zer0hedge

When your completely insolvent to begin with ... then WTF ... roll the bones.

I wouldnt mind if the pension fund I use invested in cryptos. Seams more "safe" than the other stuff they invest in. Very good point!