International diversification gives you freedoms that can not be outdone. One major part of your Plan B should include holding multiple passports and offshore assets. It frees you from absolute dependence on any one country.

In short, international diversification minimizes the State’s power to coerce you. Bitcoin is an important part of this strategy. It’s an inherently international asset. Bitcoin has incredible value as an international transfer mechanism. You can take any amount in and out of any country. You don’t need permission from any government. You can send it across any border—or any number of borders—as often as you want. And there’s nothing anyone can do about it. I’ve seen this firsthand in Panama and Mexico, where bitcoin helps people get around capital controls. (Governments use capital controls to trap money within their borders so they have more to steal.)

Bitcoin helps people bypass these restrictions. That’s because governments can’t freeze, seize, or block the transactions.

This is why bitcoin is such a disruptive and exciting technology, and why bitcoin should be a critical tool in your international diversification toolkit. Bitcoin’s use is set to explode… and it could make you a fortune.

Compare Netscape to Bitcoin and see what I mean read below:

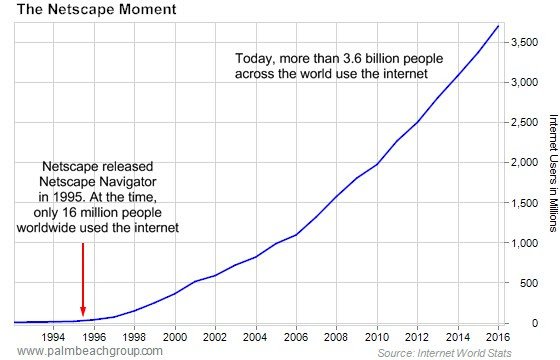

On August 9, 1995, the internet had its “mainstream” moment.

That’s when Netscape held its initial public offering (IPO) and released its web browser, Netscape Navigator, to the world.

At that point, the internet had already been around for 15 years.

Yet despite being one of the greatest inventions in history, the world was slow to adopt. In 1995, only 0.3% of the world’s population used the internet.

The internet needed a catalyst. And looking back, it was Netscape.

The numbers back it up.

Bitcoin Is Like the Internet in 1995

Today, there’s an estimated 15 million–35 million bitcoin users. We’ll split it in the middle and call it 25 million.

That’s 0.3% of the population… similar to the number of internet users before its Netscape moment.

Like the internet in 1995, bitcoin continues to gain popularity.

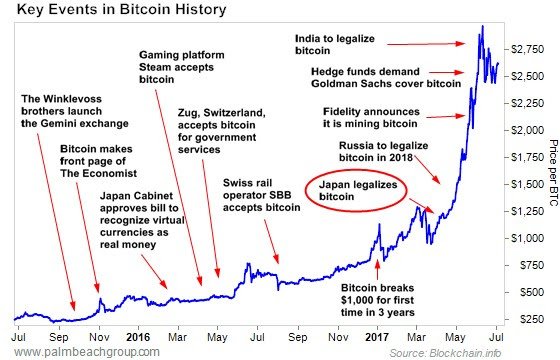

The chart below highlights the key events of the last two years.

one event stands out as bitcoin’s Netscape moment. That’s when Japan legalized bitcoin.

• 260,000 stores in Japan are rolling out bitcoin as a payment method.

• Stores at famed electronics marketplace Akihabara have started accepting bitcoin.

• Japan is setting up a bitcoin “testing hub” for fintech companies.

• Leading Japanese bitcoin exchanges have unveiled plans to accelerate adoption.

It’s all leading to increased usage of bitcoin in Japan.

Volume on LocalBitcoins has accelerated since the law went into effect. And it had its highest volume week of the year the last week of June, topping 4.7 million yen (about $42,000).

How to Profit From the “Bitcoin Moment”

I think we’ll look back at Japan’s legalization of bitcoin as its Netscape moment.

Every day, millions of people are working on bitcoin to make it better. And its acceptance will only rise from here.

And just recently, South Korea announced it will regulate and legalize bitcoin. The trend that started in Japan continues unabated.

The best way to profit from this trend is simply to buy bitcoin.

I agree to the point that Bitcoin is the internet of the 90's. The only difference is that Bitcoin is limited & people are trying to hoard it as much as they can so that they can earn profit from it.

Bitcoin doesn't have any intrinsic value like copper or gold

Where as Internet is unlimited.

Yes. This is ONLY the beginning for cryptocurrency!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.onenewspage.com/n/Markets/75ec25rgu/Bitcoin-Is-Like-The-Internet-In-1995.htm