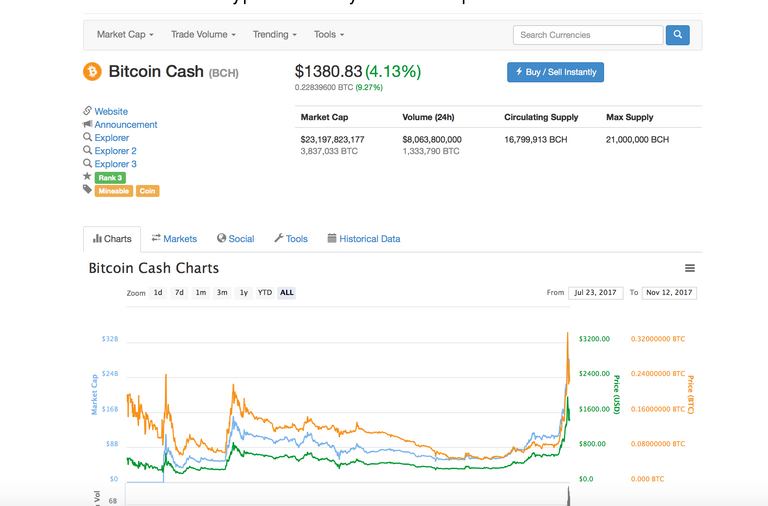

So for anyone who hasn't been living under a rock lately, you would have noticed that Bitcoin cash has been rallying to new heights lately and at one point surpassed Ethereum in terms of market cap and had been valued at about 0.5 BTC. At the same time, Bitcoin seemed to be going into free fall, dropping from its all time high in the $7800 USD range to its lowest in months to $5507.29. This has lead numerous people to question the stability in Bitcoin and whether it could be dethroned by BCH. To understand why this rally has happened in the first place, we have to go back a little bit into the past.

One of the main issues with bitcoin in recent years has always been the scaling issues. As anyone who has used the bitcoin platform in the past few years can attest, the transaction fees and network congestion can be horrendous. This issue has lead to a lot of solutions being thrown around. Now I'm no tech wiz, however I've seen time and time again that the 1 MB block size is too small for the level growth that bitcoin has been seeing. There was the proposed Segwit2x fork which was said to increase the block size by 2 MB and had the approval of over 90% of the mining power at one time, but we've all seen how that worked out and I'll get back to Segwit2x in a bit.

Now a couple months ago when Bitcoin Cash came out as a fork of Bitcoin it was trying to be the version of Bitcoin that Satoshi Nakamoto had envisioned it to be. This is not my opinion but rather the vision of Bitcoin Cash as they want it to be. Bitcoin Cash came without Segwit and boasts an 8 MB block. There is a lot of controversy with whether or not an increase in block size truly solves the scaling issue in the long run and quite frankly I wouldn't be able to tell you. I do believe however, from what I've read, it could be more beneficial than having a 1 MB block. For a few months Bitcoin Cash went quite and no one was talking about it.

In this time Bitcoin was reaching new highs month after month. The time for activating the Segtwit2x fork was nearing and a lot of uncertainty surrounded what would happen to bitcoin if B2X were to take over BTC. It be came very evident however, the closer we got to the fork, that there was likely a chance that B2X would be dead on arrival. More and more mining pools were pulling out of the agreement. People saw this as a direct attack to the decentralized nature of Bitcoin. At the same time Bitcoin was reaching astronomical highs as many people who don't know much about Bitcoin were excited to get their "free" B2X tokens. Once the announcement came out that Segwit2x was canceled, everyone in the community rejoiced that the evil B2X was canceled. Very shortly after the announcement, however, Bitcoin fell almost one thousand dollars. Most people would argue that this was due to people booking in profits now that people wouldn't receive their free B2X coins. I however, believe something more cynical might be going on.

To explain the situation, we must analyze the Bitcoin core team and unravel the politics behind Bitcoin. Now before I continue, I'd like to add a disclaimer that from here on out this just pure speculation based on evidence. Anyhow, one of the main problem people have with Bitcoin Core is that it has been infiltrated by the banks. Three of the members of Bitcoin Core work a company called Blockstream, and Blockstream is company that specializes in blockchain technology. The problem people have with it however, is that it is funded by a group called AXA group. The problem with this is that AXA group's chairman, Henri de Castris is actually a chairman of the Bilderberg Group. For those of you who don't know, the Bilderberg group is an elite group of individuals with numerous conspiracies surrounding their actions. They include the most powerful people in the world. This leads many to believe that the true intentions of Bitcoin are not with its end users but rather with the big bankers and institutional investors. A reddit user explains this whole conspiracy in more detail down below:

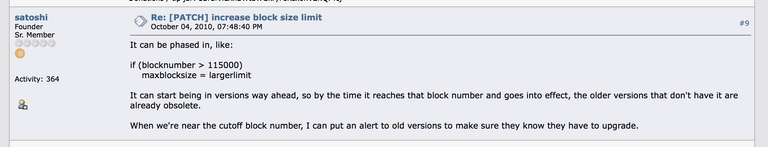

This would make a lot of sense since Bitcoin core has time and time again delayed the implementation of an increase in block size. To my surprise, Satoshi Nakamoto himself actually suggested an increase in block size before he went AWOL.

Here's the whole conversation down below

https://bitcointalk.org/index.php?topic=1347.msg15366#msg15366

Now from a miner's and banker's perspective, it would make perfect sense to keep the 1 MB limit so higher transaction fees could be placed and there's a barrier to entry into the market.

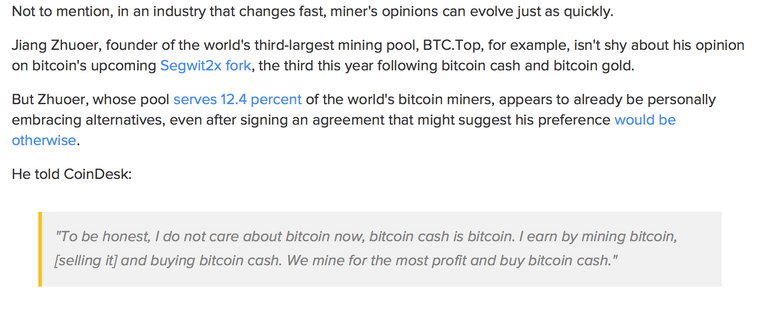

Going back to Segwit2x now, an interesting article came up a few days before the cancelation of the fork. In the article, Jiang Zhuoer, the founder of the third largest mining pool called BTC Top, claimed that he has been stacking up Bitcoin Cash for a while now and claims that BCH is BTC.

https://www.coindesk.com/split-no-split-bitcoin-miners-see-no-certainty-segwit2x-fork/

With more people moving BCH, a snowball effect has lead more and more investors and miners alike to move to BCH, hence the astronomical rise in price action the past couple days. People are not liking the direction Bitcoin is going in and are finally starting to fight back.

Ultimately, only time will tell what happens to Bitcoin and Bitcoin Cash. One thing I do know however, is that a bloody war is about to take place and there will only be true winner. Bitcoin seems to already be centralized, masked as decentralized to the novice investor and causal onlookers. This is truly a battle between the bankers and the people who claim to be with the people. What do you guys think? Who will prevail winner of this battle? Let me know down below.

Congratulations @diomob! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP