When you are planning to invest in Bitcoin Cash I advise you to do at least a lot of research first AND USE MULTIPLE SOURCES! The reason that I advise to use multiple sources for your research is that the first search results for ‘Bitcoin’ in Google will lead you to bitcoin,com.

This site is owned by Roger Ver and here you will read only his side of the story. This is also the case with the Bitcoin Twitter account and the r/BTC Reddit. Try to read also sites like bitcoin.org and check out content of Andreas Antonopolus and Trace Mayer. Now I will dig in the problems that I have with Bitcoin Cash. Since Bitcoin Cash is not Bitcoin I will call it Bcash from now to avoid confusion.

I wrote on this subject before:

Already before the Bcash hardfork I wrote about the fact that Roger Ver and Jihan Wu could manipulate the price to give false market signals THIS post under point 5

The ‘true vision of Satoshi’ story

Bcash proponents (bitcoin,com e.g.) say that Bcash is the real Bitcoin and the real vision of Satoshi. When you understand the technology and know the history of Bitcoin you will understand that this is a total lie.

Bcash forked off from Bitcoin without consensus (only around 5%) trough a hard fork. The original purpose of a hardfork is to upgrade the network with full or almost full consensus. After a hard fork the new code is not compatible with the old code anymore and a split will happen if full consensus is not met.

Bitcoin was upgraded with Segwit the same day trough a soft fork with full consensus. A soft fork means that the old code is still compatible with the new code, so post fork Bitcoin can still be handled with pre fork software and reverse. This means that Bitcoin was technically still Bitcoin and Bcash not anymore.

When Satoshi disappeared he handed over the development of his project to the already active devs and the community. This means his VISION was that Bitcoin should evolve through the decentralized consensus mechanism that is driven by the community. This is exactly how Bitcoin became what it is today so Bitcoin IS Satoshi’s vision, and Bcash is not. Bcash is not more than a failed upgrade.

Bcash will become more centralized over time

There is a reason that the core devs (the best in the world) not wanted to simply increase the block size to raise the transaction capacity of the network. When blocks get bigger the requirements to run a full node will increase and this will eventually lead to centralization. There is no financial reward to run a full node, so the more expensive it becomes the less people will run one and eventually only big corporations or other powerful entities are able to run one. This heavily undermines the decentralization.

Bigger blocks will also lead to miner centralization. When a new block is found the miner that found it can immediately start with the next block while the other miners have to wait till they receive the latest block. The bigger the block size the longer the propagation time and the longer the other miners have to wait for the latest block.

This means that a big miner that find blocks more often than other miners will have a bigger chance to find even more blocks because their competitors have to wait till they receive the last block more often. This leads to an advantage for bigger miners and promotes centralization. Also attacks like selfish mining are easier to perform when the propagation time is longer.

Block space scarcity led to efficiency

Bitcoin has gone through a hard time when the fees were unreasonable high, but this scarcity of block space has led to huge efficiency improvements. When fees are expensive everyone involved will search for solutions to pay less. Payouts can be done monthly instead of weekly and exchanges can batch transactions and implement Segwit to save hugely on fees.

Long periods of high fees can certainly damage the reputation of the network, but some scarcity is good to increase efficiency. Bcash hardly get the big blocks full so many unnecessary transactions will be send. Segwit increases the capacity of a 1 MB block till 2.1 MB, if efficiency solutions like batching can 4 fold the amount of transactions to be send a 1MB Bitcoin block can contain more transactions than a 8 MB Bcash block!

Big blocks are the selling point of Bcash, but they get hardly 100 KB of the 8 MB full LOL

Litecoin is doing way better, Segwit adoption is rising and Lightning is coming

Bcash has only one selling point and that is cheap and fast transactions. Short term Bcash will face a lot of strong competition and will probably be made obsolete in the long run. For cheap and fast transactions Litecoin is way better and the fundamentals are WAY better too while Bcash is priced higher. READ HERE MY POST ABOUT LITECOIN AND THE FLAPPENING.

Also Bitcoin transactions are cheap again and accelerating Segwit adoption makes it likely that it will remain to be cheap. The biggest treat for Bcash is Lightning Network that will be consumer ready soon. LN will deliver instant transactions almost for free! This makes Bcash transactions that takes 10 minutes look extremely slow. Because Bcash rejected Segwit they will not be able to build a secure Lightning Network anytime soon.

There are some HUGE risks for Bcash on the horizon!

Bcash has only 10% hash rate and the same mining algorithm

Bcash is using the same mining algorithm as Bitcoin, but has only 10% of the hash rate. This brings a HUGE risk for every Bcash holder. When 10 percent of the Bitcoin miners (is not much, many single pools are bigger) decide to work together they can double spend Bcash coins and earn millions while the costs to do so is lower!

The next halving will be a big deal!

In 2020 the next halving will take place in Bitcoin and Bcash as well. This halving the miner reward will go down from 12,5 coins per block to 6,25. Because Bcash had a period of hyper inflation because of the flawed EDA the halving in Bcash will take place some earlier.

Miners follow the money. When the halving in Bcash takes place while the halving in Bitcoin still have to come mining Bcash will become very unprofitable compare to Bitcoin. Miners will instantly shift to Bitcoin and it will take way longer for Bcash blocks to be found and an attack as described above will be way easier. When this leads to panic and a selloff even more miners can disappear from the Bcash network and go to Bitcoin. Bcash will be extremely slow and vulnerable for a while.

Don’t use anything from bitcoin,com

Bitcoin,com, the site of Roger Ver is misleading people and trying to sell them Bcash instead of Bitcoin. Even worse is that they deliver unreliable products:

Bitcoin,com wallet

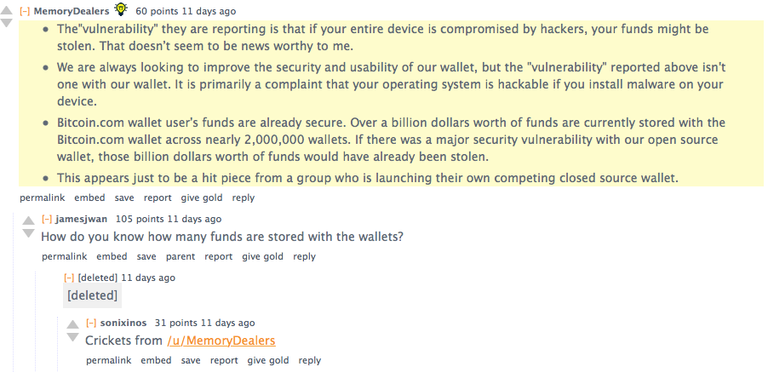

This wallet is a joke, you are not even able to create private keys offline (what is very important for security). Furthermore Roger said in a post that he knows how many funds are totally stored on this wallet and this indicates that he is spying on people or that he is lying.

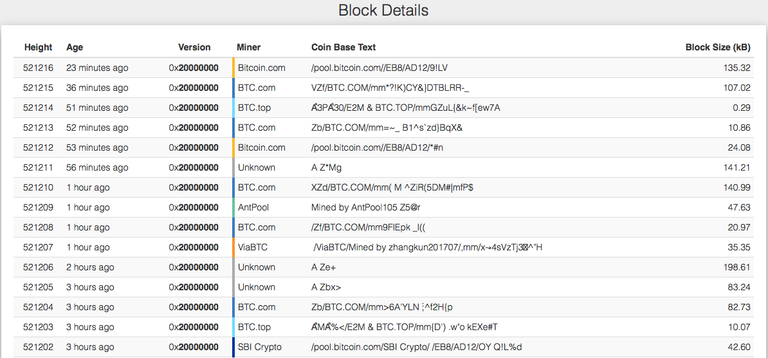

Bitcoin,com mining pool

Roger is always crying about high fees in Bitcoin, but his own pool is not including transactions of less than 10 Satoshi per byte in the blocks they mine. Here some proof This means that this mining pool is mining blocks that are not full (what makes Bitcoin slower) and people using his pool are missing out on fees that are under 10 S/B and could have been included in the block. Stop mining for bitcoin,com immediately, it is harming the Bitcoin network and costing you money.

Mine for this guy and you will miss out on the low fees and harm the Bitcoin network!

Jihan Wu is not all in anymore under pressure of upcoming competition

The Bcash price is only driven on market manipulation and promotion by Roger Ver and Jihan Wu. Jihan Wu is the owner of Bitmain, the biggest miner and mining hardware manufacturer of China. Jihan did all sorts of things to harm Bitcoin and pump Bcash like only accepting Bcash for the miners he sells and mining only transactions above 5 Satoshi per byte (same story as bitcoin,com).

Jihan Wu was able to enjoy a monopoly position over the last years, but that is finally coming to an end now multiple new hardware manufacturers are coming up and mining is re-decentralizing geographically. The monopoly position allowed him to misbehave without consequences, but it looks like the upcoming competition has started to influence his behavior already. He is now also accepting USD instead of only Bcash and since today he is mining transactions with low fees again. When Jihan is quitting his Bcash play Roger will stand alone and Bcash will lose even more momentum.

Dump on the peaks

I got Bcash after the fork and was planning to hold it first. After the recent attacks I really started to hate Bcash and dumped it around every pump and dump scheme to get a good price. I think it is smart to dump all your Bcash, but more pump and dump schemes are not unthinkable, so it could be done at these moments.

Disclaimer:

This is no trading or investing advise, just my view on the markets

Always keep your bitcoins secure:

https://shop.trezor.io?a=bitcoinscout.nl

Like this post? UPVOTE!

Anything to add? LEAVE A COMMENT BELOW!

Roger Ver actually had a copy of your private keys.

Shouldn't surprise me, but source??

@michiel Couldn't believe my eyes reading this. This is when you see a post that crystallizes your thoughts and knowledge into a carefully crafted piece, the way you can never do anytime soon.

See, you are right. It was a misleading from day one.

Out of 10 in my group, i and my fiance are the only that decided against investing in Bcash. It isn't satoshi's real dream and idea in any way. Branding it that way triggered my turn-off button in the first place because it hurled me into research and nothing corresponded.

If he know the exact wallet created then his spying on them. And since he own the wallet where no one can create an offline wallet then there's something happened in the background.

This photo is the real big big red flag

So a leader like him can't do something like that, great job @michiel you show us many reasons to sell bch and buy another coin as litecoin :). Regards

Nice index finger

Yes, so upset when his coin is called Bcash while calling Bitcoin Bitcoin Segwit, Bitcoin Core or Cripple coin. It clearly shows that he tries to steal the Bitcoin brand.

The sad thing, no matter which side you are on re; BCT vs BCH is that it has divided the community and caused confusion for new investors.

Yes this is bothering me too. Bitcoin is already complicated to understand it and this makes it way worse

thanks

good information

Thanks!

A great article, thank you.

I'm a believer in LTC ...

Thanks, I am a big believer in BTC, but bullish on LTC too

This is a good warning. People should really investigate first before investing into anything to avoid potential loss of funds. It's always best also to dump of course on peaks to maximize profit. Thanks @michiel. Kudos!

Thank you! Yes i'm really afraid that newbies land on bitcoin,com first, buy Bcash and get rekt.

This is very beneficial for us small fish@michiel Thank you very much for the information,

Do your own research and do it good. Crypto is still wild west and there is a lot of misinformation and manipulation going on.

Thanks you very much for your vote,

I will remember it

there must be communication to avoid such confusion among new investors. but who cares in these businesses there are no friends or companions

Yes, it is a shame that the domain name BITCOIN,com is used to pump an altcoin. Very misleading for newbies. As with r/btc

oh yes dude btc is king it will go up very soon

Agreed!

Is there a space for both flavours of Bitcoin to exist and prosper?

No. Bitcoin Cash has no brand and will disappear within 2-4 years as no need for Bitcoin Cash now as it is cheaper to send bitcoin than bitcoin cash as segwit and lightning fast payments now .06 c to send bitcoin. excellent pump and dump and twitter marketing etc by bitcoin cash but no it will not survive its central control, most nodes of bitcoin cash are in Japan (where roger ver bcash owner lives) you can see the map just google it

Maybe, but since they use the same mining algorithm they can destabilize each other, so I think in the long run only one will prevail.

most probably that one is bitcoin !

thanks for informing. btc is becoming more and more complicated day by day

Yes it is, and this will not speed up adoption, hope Bcash dies soon and we can go on with positive things

I wish your words become true very soon :)

Lots of concerning info.. think I'll turn some BCash into Smartcash..

@michiel agreed, a lot of market manipulation by individuals and groups who are doing buying and dumping coins. Always plan a short-term, long-term and exit strategy when buying coins!

bitcoin cash is where it is today because of a campaign based on misinformation although I don't believe in the tactics used they have been successful it will be interesting to see where it is a few years as it's just a old copy now as the original bitcoin is innovating quite nicely with segwit and lightning.

More B.S misinformation and propaganda from Core proponents.

Come with arguments

I really like Roger Ver. I like his politics and he comes off as a very genuine person. The negative attacks on him are misleading and I suggest anyone who is not familiar with Roger watch one of his interviews on YouTube or elsewhere. As far as the coins go, Bitcoin Cash aims to make Bitcoin usable as a currency while Bitcoin Core makes excuses for slow and expensive transfer fees by claiming Bitcoin is "like gold" and not supposed to be used as currency. Bitcoin Cash may not be perfect, but I feel much more confident in Bitcoin Cash's development than I do Bitcoin Core, which seems to spend more of their time attacking Roger than addressing their own problems.

Corrections and bear markets are as normal as slow growth periods and "bull markets", where trending positive and up is normal.

Just like bull markets, bear markets comes with its unique features, advantages and disadvantages for us traders. We focus mainly on the following two actions:

https://www.ccn.com/venezuela-airlines-to-accept-petro-and-other-cryptocurrencies-as-payment-for-tickets/

follow me

It may be hard for the investors to invest in either Bitcoin or Bcash because of the doubt people having in such a situation. With increasing demand of more powerful hardware and increasing cost of electricity to mine bigger blocks, I think mining will become unprofitable for most of the miners. I agree with you that the growing size of the blocks will lead to the centralization of mining as only big players can afford the requisite resources to mine such big blocks. However, I am optimistic that this may also lead to the manufacturing of more powerful yet low power consuming machines. However, future is uncertain. After reading your article, I have become skeptic about Bcash. Thank you for this very useful and knowledgeable information.

Thanks for the tip, it's hard to find decent information on Bitcoin Cash.

Just doesn't seem to be very objective.

Bitcoin doesn't pay mining fees to nodes?

Or do they just pay block owner only?

Thanks for the post and information. I just recently did a brief perspective on BitcoinCash as well and I enjoyed getting more information to filter through to understand the potential future of BCH. I initially really enjoyed mining it (due to its low difficulty level at the fork) and was able to stack a bunch. I also really enjoyed the minimal transaction fees with it as well! It seemed like it barely charged any transaction fees compared to a time when Bitcoin's fees were seemingly skyrocketing. I don't mine it anymore because I recently sold my Bitcoin mining rigs and have focused on mining other cryptos right now. Look at the charts...I really wonder what will happen with it in the coming few months and year!

Great information! Thanks!

Bcash is a $17,500,000,000 shitcoin. Let that sink in for a minute.

nice article

what do you thinkk of this

https://steemit.com/dogecoin/@aro.steem/dogecoin-to-the-moon

funny how cash had a few explosions but btc gold is so passive

click here.Congratulations @michiel, this post is the forth most rewarded post (based on pending payouts) in the last 12 hours written by a Superuser account holder (accounts that hold between 1 and 10 Mega Vests). The total number of posts by Superuser account holders during this period was 1568 and the total pending payments to posts in this category was $8516.50. To see the full list of highest paid posts across all accounts categories,

If you do not wish to receive these messages in future, please reply stop to this comment.

Yes, Very smart tips, may be a consideration in investing. thank you @michiel.

The banks have chosen the core devs as their attack vector on bitcoin to cripple it as an actual currency. Bitcoin cash is closer to the original intent of circumventing central banks’ money control. This post is just parroting the narrative that bch is owned by “villains”, Jihan and Roger, for their “evil” motives, which is not really the case. There is a community that has come to the realization that bitcoin has been hijacked, and thus supports BCH.

Great post #flappening

I will definately do a video post on BCASG, I am not a fan of it at all!!!