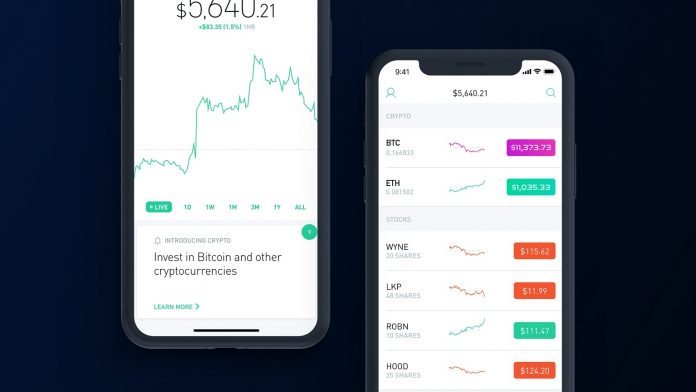

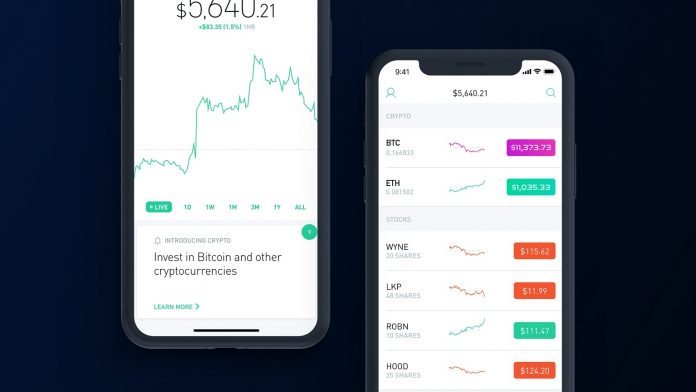

In just three years, Robinhood Financial LLC has exploded. It gained traction as a free stock trading smartphone application (app). At the start of this year, they announced incorporation of bitcoin and ether trading, using free trades as a loss leader to gain customers. The model seems to be working, as the Wall Street Journal is reporting the startup will soon be valued over 5 billion USD.

Robinhood Booms with Crypto

It’s a daring business model. Sell trades to market makers, collect interest on users’ escrowed cash, and essentially give away free trades of stocks and cryptocurrencies. Then, hope a significant number of users opt for deluxe services, such as the ability to borrow or to trade after formal hours for a nominal subscription fee.

News.Bitcoin.com reported two months ago how Cofounder Vlad Tenev explained, “Cryptocurrencies have become the first foray into investing and financial services to a large number of people. Now it’s become more and more clear [that bitcoin is an] investing asset. We will connect to many exchanges, up to a dozen or more, over the next several months. We want to break even on this business, not to profit from it. We view this as an opportunity to expand our customer base and give our customers more access to functionality.”

Since Embracing Bitcoin, Robinhood App Value Jumps to $5.6 Billion