The bitcoin cash price has increased by more than 50% this week, reversing an extended decline that had threatened to submerge it into irrelevancy.

Like all cryptocurrencies, bitcoin cash took a beating following the early-September revelation that Chinese regulators had banned initial coin offerings (ICOs) and cryptocurrency exchanges. The bitcoin cash price made fits and starts as it attempted to recover from the downturn, but it demonstrated an inability to mount a sustained advance. From September 21 to October 21, the bitcoin cash price plunged by $200 to near $300, and it appeared unlikely that this support level would hold.

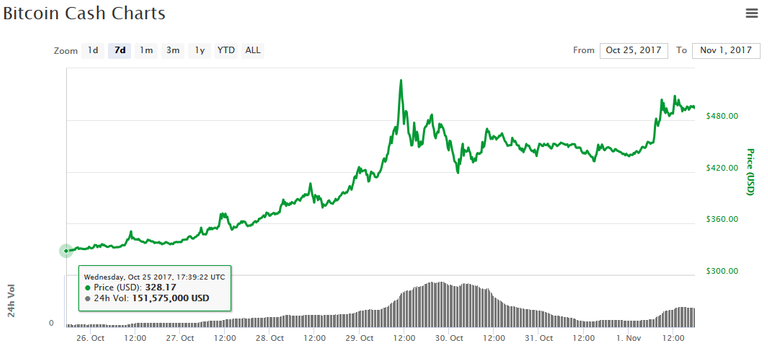

However, during the last week of October, the bitcoin cash price halted this skid and began to claw its way back up the charts. On October 25, bitcoin cash climbed past $350. The next day, it passed the $400 checkpoint and began to soar, briefly spiking above $500 before correcting down to $450 to end the month. However, the bitcoin cash price entered November with a double-digit increase, climbing another 11% to a present value of $496. Even more impressive is the fact that this advance has occurred even as the bitcoin price has posted another all-time high, an occurrence that usually correlates to a decline among altcoins. Bitcoin cash now has a market cap of $8.3 billion, which places it third in the market cap rankings and provides it with a $750 million edge on fourth-place ripple.

bitcoin cash price

BCH Price Chart | Source: CoinMarketCap

More than 65% of all bitcoin cash volume is concentrated on Korean exchanges, and Bithumb boasts more activity than the next 15 highest-volume exchanges combined. Bitcoin cash is also trading about $10 higher on Korean exchanges than it is elsewhere, but this is not unusual (Bitcoin, for instance, is currently priced about $200 higher on Bithumb than Bitfinex).

The bitcoin cash price rally has been fueled by at least three factors. The first, as has been discussed previously, is that bitcoin gold has not performed well during pre-release trading, confirming suspicions that traders and investors are already experiencing “fork fatigue”. Additionally, WikiLeaks Shop added bitcoin cash as a payment option. This is not a major announcement, as the web store already accepts a variety of other cryptocurrencies, but it does provide the cryptocurrency with exposure. The factor that is most directly fueling the rally — at least at the moment — is the announcement of a November 13 hard fork to upgrade bitcoin cash’s difficulty adjustment algorithm (DAA) and hopefully bring some stability to the network’s blocktimes, which have often fluctuated wildly due to miner manipulation.

source : https://www.cryptocoinsnews.com/arkansas-sheriff-mines-bitcoin-cyber-crime-prevention-initiative/

Great post keep up the good work also if you want you can follow me and comment on my post so that you can receive more up votes from me.

Thank you very much for the upvote i just followed you, you can follow me as well @attakye

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.cryptocoinsnews.com/bitcoin-cash-price-climbs-50-in-a-week/