TL;DR the BTCP White Paper

The crypto community is waiting with bated breath, anxiously refreshing Bittrex on twitter, harassing Rhett Creighton any way they can, for news on the upcoming hard fork of BTC and ZCL — Bitcoin Private. The team behind BTCP is striving to create a new currency that is faster, better aligned and, as the name implies, private.

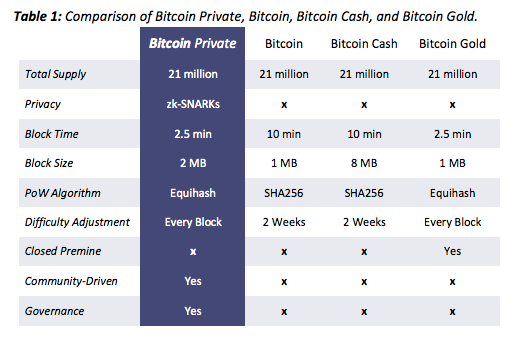

The BTCP white paper focuses primarily on the shortcomings of other significant blockchains and how BTCP improves on those issues. BTCP features a larger 2MB fixed block size compared to Bitcoin’s 1MB, and a 2.5 minute block time compared to BTC’s 10 minute time. These features are the same as Zcash and Zclassic. BTCP uses Equihash, the premier ASIC resistant proof-of-work algorithm. The snapshot, or the exact time when you must hold BTC or ZCL in order to receive BTCP in the fork, will happen at 5pm UTC on February 28, 2018. Currently BTCP has exchange support on Trade Satoshi but Bittrex is expected to announce support at some point.

The Bitcoin Private team is is calling the fork a “fork-merge,” because everyone holding 1 Zclassic or 1 Bitcoin at the time of the snapshot will receive 1 BTCP. This is a unique method, combining the UTXOs (unspent transaction outputs, in this case any BTC or ZCL that is held), but actual blockchain being forked is Zclassic. The total supply of BTCP is 21 million, and at the time of the fork almost 20.4 million of those will already exist from the initial distribution. The BTCP team claims this will make them the “least inflationary coin ever produced,” according to their white paper.

For miners, the team took lessons from both Zcash and Zclassic. BTCP has no “founder tax,” an unpopular feature of Zcash, but does include a system to incentivize developers, which was neglected in Zclassic. They facilitated this by creating a “voluntary miner pool,” which would reward Zclassic miners for contributing to a fund by offering them a >1:1 proportion of BTCP to their ZCL contribution after the fork. The reward for mining at the first block will be 0.7815 BTCP. After about 66,000 blocks the reward will be cut in half, and will continue halving every 840,000 blocks.

The claim to increasing privacy comes from the implementation of a zero-knowledge proof algorithm called zk-SNARKs. Transactions can be either transparent, visible on the blockchain, or shielded, where they verifiable but not able to be tracked by outside parties.

BTCP — Third Time’s a Charm?

Practically, and when considered in a vacuum, Bitcoin Private is solid. The white paper is well considered and well reasoned and addresses some major and important problems in the cryptocurrency space. However, when compared with its true predecessors, Zcash and Zclassic, Bitcoin Private not much more than a small shift and better branding.

Zcash was a fork of Bitcoin that made some important improvements, such as the inclusion of Equihash, which without going into too much detail, improves the strength of the claim of decentralization. Zcash also included what is effectively the cornerstone of Bitcoin Private, the application of zk-SKARKs. Zcash faced criticism over the exorbitant founders tax on all mining, which led to an almost comically fast fork into Zclassic, which was technologically similar to Zcash but excluded the founders tax, which had the unintended consequence of neglecting developer incentives. Bitcoin Private is effectively the same as Zclassic but attempts to fix some of the developer incentive issues, by creating a pre-fork, voluntary donation pool.

The white paper tends to obscure the similarity to Zclassic and Zcash by comparing BTCP to Bitcoin, Bitcoin Cash and Bitcoin Gold (See table on page 3 for example). I like to believe that this focus was intended to emphasize the improvements that BTCP makes over these other Bitcoin forks, but it also speaks to a larger trend in the space. For such a promising technology like blockchain there is an incredible amount of snake oil being sold. At this point so early in the exploration of the space, maybe that’s fine. But eventually, supporters will get smart enough to know that we aren’t really adding value. And, frankly, if your white paper needs to be a little shady that doesn’t bode well for your ability to execute.

Bitcoin Private claims to be focused on their community in a way that Zcash and Zclassic didn’t pull off well. Zcash was a sincerely novel project in a lot of ways, so we can assume that they thought they would need the money from the pre-mine and the 20% founders tax. Zclassic reversed those, but didn’t make any moves to actively reward developers so they lagged on improvements. Bitcoin Private’s actual largest change was in the way they looked to solve these problems, but it is unclear whether or not they hit the mark. Their community focus includes a treasury fund to incentivize developers and a community developer program. The treasury fund is governed by primarily by the Bitcoin Private team, hardly and arms-length transaction, and has no stated plans to transfer that management to the community. The developer program as described is open to anyone but requires a successful application to the program and so is still tightly controlled. This isn’t to say the approach won’t be effective, but that the amount of input allowed from the community may be overstated.

The structure of the BTCP block reward is a risk that will ultimately depend on the value of the coin. This is true of every coin, of course, but by starting with such a small reward, if the price drops immediately after the fork, miners could lose confidence and stop mining. Inevitably some miners will stay because the difficulty is adjusted based on the number of miners, but having only a small number of miners will reduce hash power impacting the security and speed of transactions. Again, this is a risk with every fork, but by starting with such a small reward the BTCP team could be putting additional pressure on an already difficult balancing act.

Finally, and arguably most importantly, the claims of privacy through Bitcoin Private are imperfect. Between two shielded wallets the privacy components are excellent. However, because there are very few decentralized exchanges, BTCP transactions made on an exchange will not be truly private. Centralized exchanges, though they typically send transactions in bulk, have to keep records to comply with governmental regulations. True peer-to-peer transactions are limited at this stage and because most transactions include at least one side operating through an exchange, the feasible impact of the privacy assurances are limited. This does, however, position BTCP perfectly for the future implementation of decentralized exchanges, though again not in a way that Zcash and Zclassic are not already positioned.

Overall, Bitcoin Private is fine. It includes some minor improvements over Zclassic, but nothing groundbreaking. It is being implemented by an experienced team, so I have confidence in their ability to implement the project as promised. In some ways it feels like a “third time’s the charm,” approach — but that isn’t necessarily a statement on its potential for success. I don’t have any significant problem with BTCP, but it also isn’t particularly exciting. BTCP feels symptomatic of this period in crypto overall, which is idling, experimenting and waiting for the tools that enable wider adoption.