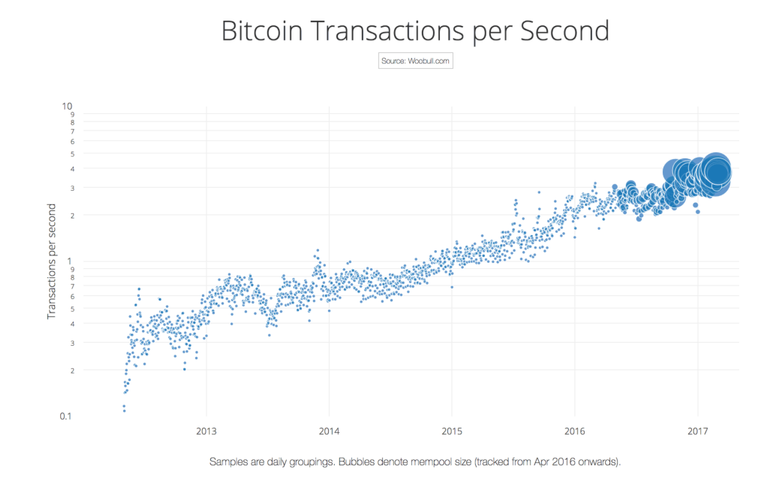

Bitcoins has pass through the roof with the past several years, rising form $200 to $1000 in november 2013 alone. This is obviously an speculated bubble and like all bubbles it will pop!. Anybody with any economical sense at all can see that. optimists like to compare the current bitcoin to the dot-com bubble of the late 90s. After all com bubble may have burst but internet survived it going to do the same thing right on the surface that sounds like the reasonable comparison however there is a variable in this equation almost no one is talking about.

Bitcoin has a fundamental design flaw and fixing that design flaw require in completely changing the way bitcoin network operates. In the current form bitcoin system is able to facilitate transactions without a centralized database by requiring each client of the network to download a copy of the block chain.

Whats the Block chain?

Block chain is the record of every transaction ever made using bitcoin from 2009 till present.

With every transaction this file gets bigger. At first the file size was negligible, it stayed below 1 GB until mid 2012. However with increase interest in the currency the size of the Block chain grow exponentially.

By September of 2012, it had jumped to 2 GB. By September 2013 just one year later the file was over 9 GB and by the end of November it had passed 11 GB.

On the official Bitcoin website they actually admit that it will require 14 terabyte of hard-drive space every 85 days in order to handle as many transaction as Visa

If the interest in the currency continues to increase in a number of transactions continues to go at it current rate, Block chain will easily reach 50 GB within a year and 250 GB within 2 years.

Now the specific amount of time it will take the Block chain to reach a particular size is beside the point. What its come down to is this:

in its current form bitcoin is not scalable, the way the system is designed right now the Block chain will eventually reach several tera-bytes in size.

ofcourse, the average user will be unable to participate long before the happens. somewhere along the way bitcoins will have to restricted to allow individuals to use the network without downloading the entire block chain. this is no simple task and making the shift will involve introducing a degree of centralization into the mix an example proposal to address this issue would be to use what some have referred to as super nodes as intermediaries.

Super Nodes

Super Nodes would handle the Block chain for you and you would communicate with the super node to deposit or to spend bitcoins. so essentially Bitcoins Banks. Now this is arguably better then the traditional banking system because Bitcoin Banks wouldn't be able to engage in fractional reserve lending and some have tried to make the case the anyone could theatrically start a Bitcoin super node however, given the fact that the Block chain is designed to keep crawling and growing.

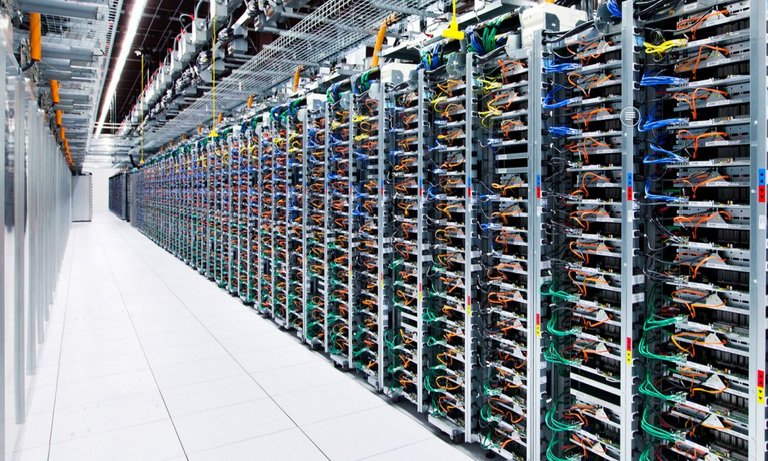

The Super Node operation would eventually require massive arrays of servers and storage space with industrial grade electrical and internet connections. This is not the kind of thing you run in your garage. This would be more like modern day server companies and such facilities would be easy bring under regulatory control. Once that happens Bitcoin will no longer be outside the system as it is now.

Maybe that wouldn't be such a big deal if it weren't for the fact that one of the major reasons that people are buying bitcoin is to bypass the system that means it's value cannot saperated form its form.

We know that this form is going to change we know that Bitcoin is going to have resurrected but no one knows how the bitcoin of the future will work not even the developer themselves because by their own admission they haven't decided decided on the solution. Whats the take away here?

Dont Treat Bitcoin as a Stable Long Term Investment.

because it is not!. A short-term if you own alot of bitcoin you probably feeling really wealthy right now. Good for you :)

Just make sure you are treating it like a day trade in a stock market who is holding a very volatile commodity. You sell at the right time you might make alot of money however, those who get blinded by their ideological attachement to the currency are likely to lose their shirts.

Interesting thoughts. But I think some of the scaling issues will be solved with the lightning network where a lot of the transactions will happen off-chain. But yes this crazy rise in price feels a bit too good to be true

thats exactly my point,

Bitcoin markets and developer will face this biggest challenge soon and that moment will decide the future of these cryptocurrencies..