I can prove what the maximum possible profits from Bitconnect's trading Bot!

Because Bitconnect is traded on a blockchain, coinmarketcap.com can record the price and volume moves each day, which will let us calculate the maximum profits the Trading Bot could be making.

First, let me explain what volume is for those that don't fully know.

Let's say I own five CharlieCoin (CC), and you want to buy some. So, we both make a transaction via a marketplace using something like Gemini.com or Kraken.com. I sell you 5 CC at the price of $10 each for a total of $50. Later in the day I decide I parted with my CC too eagerly and want to buy at least one of them back. You sell me 1 CC for $60. Then later I buy two more from someone else for $40 each and a transaction total of $80. Now there are 3 transaction worth $50 and $60 and $80, and a total of 8 CC were traded (5+1+2). The volume is just the sum of the total transactions that took place and can be represented in $ or shares or coins.

- 5 CC @ $10 each for a total of $50

- 1 CC @ $60 each for a total of $60

- 2 CC @ $40 each for a total of $80

- Total Volume is 8 CC or $190.

So how can we use this to prove the maximum profit the bot is earning each day?

Let's go back to the simple example to explain the concept. Let's pretend that the data below was published on coinmarketcap.com for the last 24 hours:

- 24 Hr Volume of $425

- CharlieCoin's low price was $10

- CharlieCoin's high price was $75

- Buying 5 CC @ $10 each for a total of $50

- Selling 5 CC @ $75 each for a total of $375

- Total Volume is 10 CC or $425

- Max profit is $375 - $50 = $325.

How much money could Trading Bot make from perfect day trading?

I went to coinmarketcap.com and exported the daily historical prices for Bitconnect Tokens and for Bitcoin. Virtually the only way to acquire Bitconnect Tokens is by using Bitcoin. There are other ways to acquire it, but those account for less than 1% of all transactions according to coinmarketcap.com and can be neglected for this calculation.

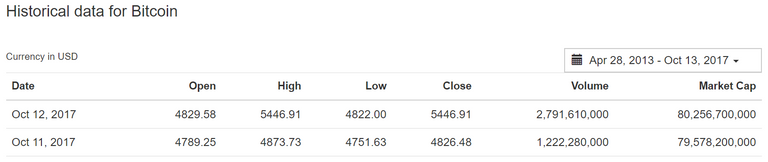

The data looks like the images below - just many more lines of it. Other than the dates all units are USD.

[caption id="attachment_1986" align="alignnone" width="1625"] Figure 1 Shows a snippet of the data that I exported for Bitconnect, priced in USD.[/caption]

Figure 1 Shows a snippet of the data that I exported for Bitconnect, priced in USD.[/caption]

[caption id="attachment_1985" align="alignnone" width="1631"] Figure 2 Shows a snippet of the data that I exported for Bitcoin, priced in USD.[/caption]

Figure 2 Shows a snippet of the data that I exported for Bitcoin, priced in USD.[/caption]

From these charts we cannot figure out the exact low and high price of the BCC/BTC ratio because the high and low prices of the two different coins don't typically fall at the exact same time. However, we can take the high of Bitcoin and the low of Bitconnect to find the lowest the BCC/BTC ratio could have been. So, for Oct. 12th that would have been $166.23/$5,446.91 = 0.03051822 BCC/BTC. In a similar fasion for October 12th the highest the BCC/BTC ratio could have been was $188.09/$4,822.00 = 0.039006636. That is a price change from low to high of (0.039006636-0.03051822)/0.03051822 * 100% = 27.8%! Now these exact ratio likely did not ever occur because the price of Bitcoin likely did not hit its high for the day exactly when Bitconnect hit its low etc.. In fact if we look at the daily chart available on coinmarketcap.com it will show us that the min and max of the ratio for that particular day was 0.0345370 and 0.03516540. That is a peak to valley price rise of 18.2%, which is less than the 27.8% that we calculated earlier. This is good because I don't want to short change the Bitconnect bot when I calculate the max profits possible. I think giving a price change of 50% higher than what actually occurred is rather generous. Also, since I see no way to export the high and low BCC/BTC ratio, I would rather estimate the max and min BCC/BTC ratio instead of reading it from the chart for each and every day. If you want to please do that and send it to me. I don't have the time and don't need it to prove my point, but I want that data if you get it!

Next using the volume of BCC/BTC, we can calculate the max daily profit. So, on the 12th of October we can see that the volume is $15,616,200 for BCC. Again, since BCC can only be acquired by BTC. Again, that is virtually synonymous with say it is the volume of BCC/BTC since BCC/BTC accounts for over 99% of all BCC transactions. Instead of using the 18.2% rise to calculate the Bot's max profits we will be generous to the Bot and use 27.8%. Now the question is, "how much money could the Bot have used at the start of the trade and at the end of the trade sold for a 27.8% profit, without having those two transactions surpase the daily volume of BCC/BTC?" I will spare you the details here though I will make them available later, but basic algebra tells us:

- $8,760,976.12 = $6,855,223.88 * (1+0.278)

- and $8,760,976.12 + $6,855,223.88 = $15,616,200 which is our total volume!

- So the max total profit is $8,760,976.12 - $6,855,223.88 = $1,905,752 on October 12th.

What is the total a perfect Bot could have earned since the BCC/BTC started trading?

$68,432,921.61 from January 20th, 2017 to October 12th, 2017! That is a lot of profit, but does that tell us anything? Yes, it most certainly does!

At the close of October 12th, 2017 Bitconnect had a total market cap of $1.183 Billion dollars and we said the max earnings on that day was $1,905,752. That means the profits were only about 0.16% of the total marketcap - if their bot made the perfect trades. If we calculate this for every day we find that the average max profit is 0.185% of the total market cap on that day. As you know 0.185% is much lower than the approximately 0.89-1% they pay each day.

Now you may know where I am going with this, but before we get there I need to remove one more thing I am sure people will try to say, "That is the % profit of the entire market cap not the total loan value, which is the value they pay interest on!" It is true, I know of no way to look up the total loan value. Please, if you know how, do tell! However, if only 21% of the market cap was lent to a perfect trading bot, that was able to buy at prices lower than existed through the day, and sell at prices higher than existed during the day, the Bot would just break even after the payouts.

What I think is really happening...

Let me paint a scenario for you. Say I want to make a new crypto currencies called CharlieCoin - the fake coin I chose earlier. I limit the total supply in the future to 28 million coins, and I do a pre-mine so that I have 5 million coins. I set the rules to have Proof of Stake. As time goes on I get more of the 28 million coins just buy holding my 5 million.

Unfortunately, I don't know any way to really make my coin better than Bitcoin. Instead I tell people that I have this great trading Bot that I can use and pay them 365% interest a year if they buy my coin from me and lend it back to me. The first person I talk to asks, "why do you need me to buy the coin from you and lend it back to you? You already own the coin don't you?" At that point I decide to move on to the next person who doesn't ask that question.

I find enough people who don't ask that question and just buy my coin, and call anyone who does ask that question a hater. As more people buy the coin they push up the price. All of the sudden the 5,000,000 coins I have that were worth nothing become worth $0.10 then $1 then $100 then $200... you get the idea. As this happens I become richer and richer. More people hear about my offer and more people begin to add money. How could a coin with the market cap in the billions be a scam? I even add in a little extra incentives to get more people to lend me the coin.

We all know how exponential growth works - really fast! Before you know it, I have run out of people who don't ask the question, "why do you need me to buy your coin from you and lend it back to you." All of the sudden my coins stop going up in price. My trading Bot - that either doesn't exist or doesn't earn enough - can't pay back the 365% interest a year (1% a day payout) on all the coins that people lent to me. As this happens I start to sell my 5,000,000 coins to pay the people back. As I do this the price starts dropping. More people sell the coin. Fewer people start investing. I realize that I can either sell the rest of my coins now and not pay the lenders back, or I can continue to sell my coins over time to pay people back as needed and eventually I will run out of coins. Either way it comes to an end. The question isn't whether the creators of Bitconnect are scammers or not. I have my own very strong opinion on that, but the real question we need to answer is, "Can Bitconnect sustain itself?" The clear and obvious answer is no. If you read this an even think Bitconnect might not be sustainable I encourage you to share this idea with people who are invested or are thinking about investing.

Thank you for reading. I hope you have enjoyed it and learned something. If you would like to take a look at the Excel sheet I used to produce these results just click the link. Bitconnect Proof rev 3 (public)

As some of you know, I do actively trade the markets of cyrpto currencies and stocks. If you would like to find more information like this I encourage you to follow my blog, twitter, steemit, or Collective2.

Congratulations @charlestines.com! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP